The biotechnology sector is an outlier in the days of Covid-19. Here is an interesting trade from Jay Soloff.

The biotech sector remains a minefield for those making big bets on the next great Covid-19 treatment or vaccine headline. Yet, as I’ve noted for months, there is a better way to play the sector, which is via companies whose roles in the daily grind of drug manufacturing and research will remain crucial regardless of the ups and downs of any particular acute developments.

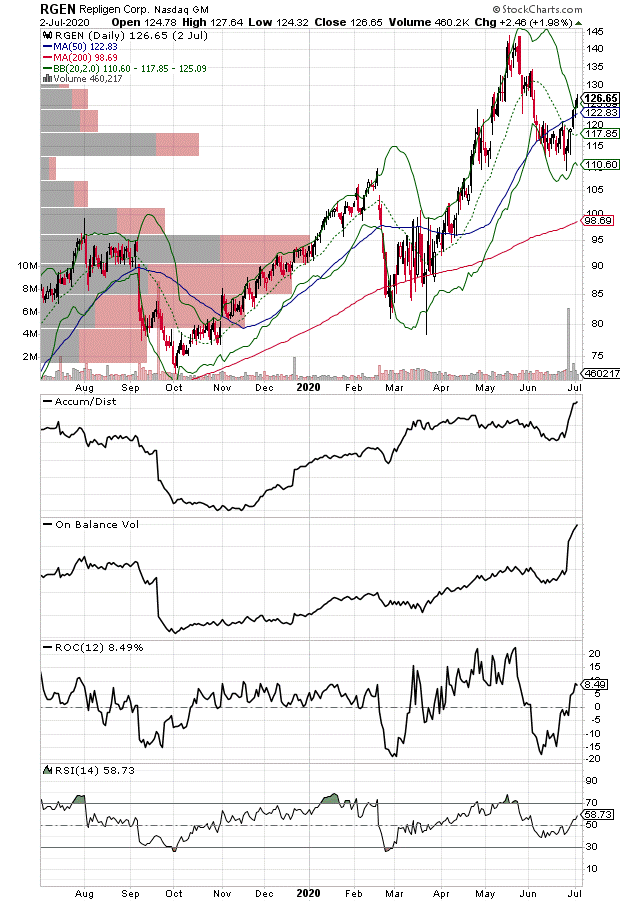

Such a company is the little known Repligen (RGEN), whose business focuses on the production of basic proteins and manufacturing systems used by biotech and pharmaceutical companies to make cancer treatments, gene therapy and other biologically derived treatments and drugs. Repligen beat earnings and revenue expectations last quarter, expanded its margins and made key acquisitions to expand its manufacturing base and meet the rising demand for all the resources needed to be a major biotechnology firm.

Moreover, its equipment and basic medication components will also likely play a role in the manufacturing of any successful Covid-19 related treatments. In other words, RGEN is a central company to biotech, which means that the odds of a continuation of its recent upward thrust are favorable as more investors catch on to what’s going on with the company.

Technically speaking, the stock is now under intense accumulation after a pullback to its 50-day moving average. Note the huge improvement in Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators while the Volume by Price indicator is telling us that there is little upward resistance to any price advancement. Therefore, if there are no extraordinary developments, I expect a test of the old highs near $145.

I recently recommended RGEN to subscribers of JoeDuarteintheMoneyOptions.com. To gain access to my latest picks consider a FREE trial. Click here for details.

For more details on the summer trading season catch my most recent Your Daily Five installment here. To subscribe for a FREE trial to Joe Duarte in the Money Options.com, click here. I have compiled a small list of companies whose stocks are showing relative strength and may be worth owning. The list can be accessed via a FREE trial to Joe Duarte in the Money Options.com To subscribe to my service, click here