Oliver Sloup breaks down recent price action in the grain complex.

Corn (ZCU)

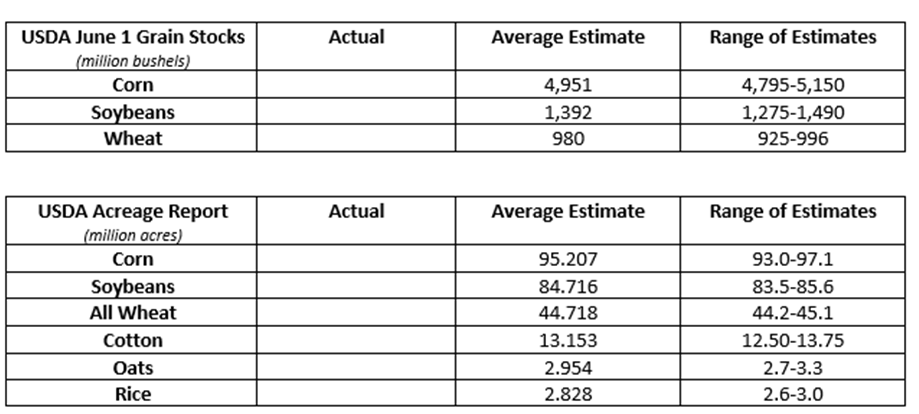

Fundamentals: Corn futures rallied hard Monday, erasing losses from the back half of last week’s trade, that momentum has carried over into the early morning trade. This momentum comes on the back of short covering ahead of Tuesday’s USDA report. Keep in mind that it is also the end of the month and quarter, which could be encouraging additional position squaring. You can find the estimates at the bottom of this report. Export inspections yesterday morning came in at 1.2 million metric tons, this was at the top end of trade estimates. There were also rumors that China was in the market for U.S. corn, this could just be analysts looking for an after the fact reason for the pop. Yesterday’s crop progress report showed good/excellent conditions at 73%, 1% higher than last week and inline with expectations.

Technicals: September corn futures have clawed back some of the recent losses, taking us back to the breakdown point and our resistance pocket near $3.30 ½. If the bulls can achieve a close above this pocket today, we could see additional short covering propel the market back towards the recent highs, something that seemed nearly out of the question just a few days ago. A failure at this pocket keeps the bears in control. Our bias remains Neutral ahead of today’s report.

Bias: Neutral

Previous Session Bias: Neutral

Resistance: 338 ¼-339***

Pivot: 328-330 ½

Support: 314 ¼-317 ½****

Soybeans (ZSX)

Fundamentals: November soybean futures made new lows for the move yesterday but managed to finish the day near unchanged. The market is moving higher in the early morning trade as some traders see value at these prices into yesterday’s USDA report. You can find the estimates at the bottom of this report. Export inspections yesterday morning came in at 325 metric tons, nothing to write home about. Yesterday’s Crop Progress report showed good/excellent conditions at 71%, 1% higher than last week.

Techncials: Soybean futures broke below the low end of the most recent range last week, accelerating the selling pressure down to our four-star pivot pocket, which we defined as $8.55 to $8.60 in yesterday’s report. We believe this area represents value from a risk/reward perspective, but the bulls must defend it on a closing basis. A failure to defend this area could open the door for another leg lower, $8.38 to $8.40 being the next meaningful support pocket.

Bias: Neutral/Bullish

Previous Session Bias: Neutral/Bullish

Resistance: 877 ½-882 ¼***, 902***

Pivot: 855-860****

Support: 836 ¾-840 ¾****, 830-831**

Chicago Wheat (ZWU)

Fundamentals: Chicago wheat futures snapped back yesterday, erasing much of Friday’s loss. Export inspections came in at 515tmt, within the range of expectations. Crop Progress showed winter wheat harvest is 41% complete and the crop has a good/excellent rating of 52%. Good/excellent conditions for spring wheat came in at 69%, a 6% drop from last week. Today’s USDA report will be out at 11:00am CT.

Technicals: The wheat chart has been controlled by the bears for the better part of the last three-months, and there is nothing over the last week that has changed that. Our bias remains Neutral as we see the risk of a relief rally offsetting potential downward movement. Previous support became minor resistance at $4.81, this will act as a pivot pocket going forward. The more significant resistance pocket will come in from $4.97-$5.02 ¼. Consecutive closes above this pocket would neutralize the technical landscape.

Bias: Neutral

Previous Session Bias: Neutral

Resistance: 497-502 ¼****

Pivot: 481

Support: 471-475***

Bill Baruch provides technical levels on all markets throughout the week at BlueLineFutures.com. Please sign up at Blue Line Futures to have our entire technical outlook, actionable bias and proprietary levels emailed to you each day. Email us at info@bluelinefutures.com to start the conversation and set up a phone call with our experts.