May Crude Oil WTI Futures traded down to -$40.32! How is that possible, asks Joe Perry.

A futures contract is a legal agreement to buy or sell a particular commodity or security at a predetermined price at a specified time in the future (Investopedia). Futures trade in contracts based on a specified time period. For example, May 2020 WTI Crude Futures expire today, April 21, 2020.

However, if someone wants to hold crude oil longer, they must roll the contract forward to a future month, which is usually at a premium to the expiring month. This is typically done a week or so before the expiring contract so that there is still plenty of liquidity. Otherwise, one could risk taking delivery of the product—where are you going to put 1,000 barrels of crude oil?

There has already been a glut of oil in the market beginning with the economy slowdown caused by the Coronavirus. This slowdown significantly decreased the demand side of the equation. In addition, in February, Russia refused to continue cut back production along with OPEC. Therefore, Saudi Arabia decided they would not cut back either, and turned the pumps on full throttle (the bear market in crude oil can be traced to a similar move by the Saudis on Thanksgiving of 2014). Oil is being stored on barges out at sea right now because there is nowhere else to store it. This increased the supply side. When demand is greater than supply, the price goes up. When demand is less than the supply side, the price goes down.

What Happened Monday?

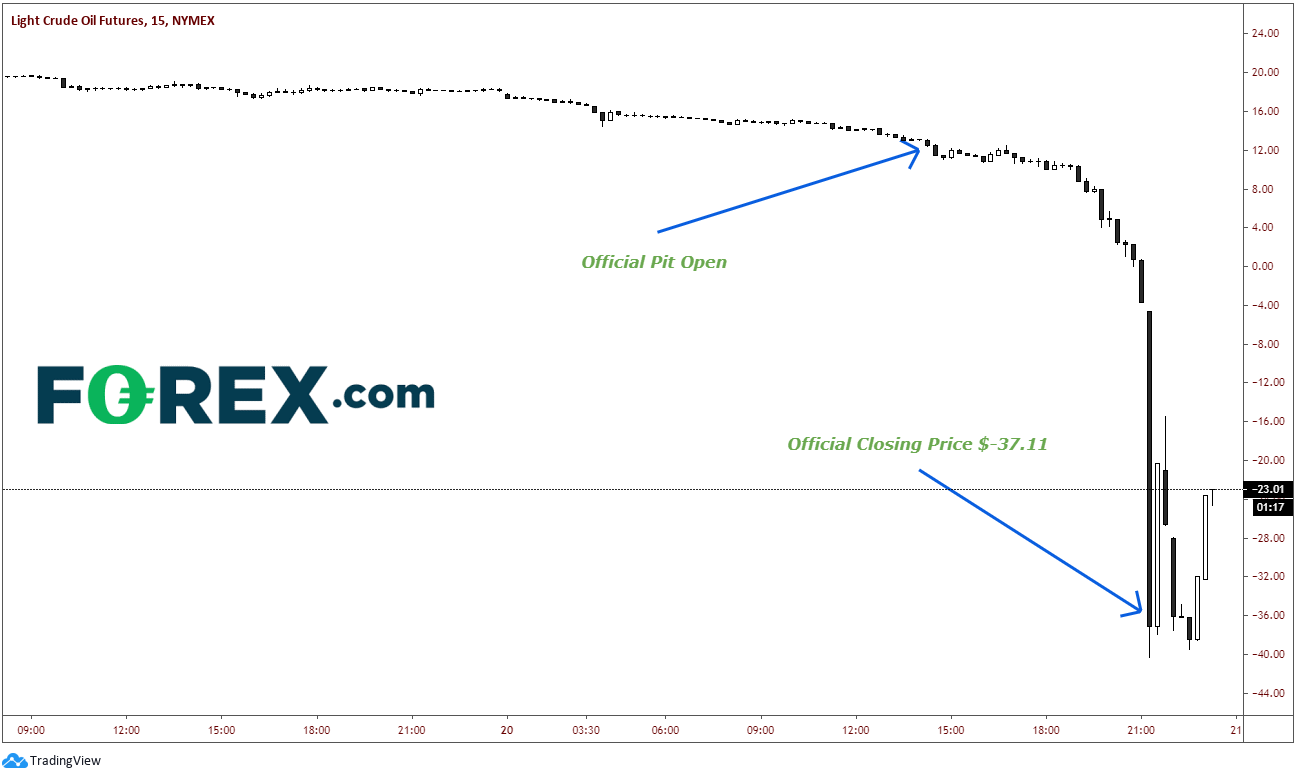

The May West Texas Intermediate (WTI) benchmark crude oil contract opened the day at $17.73. Most futures contracts to be rolled to June have already been done, so liquidity in the May contract was already thin. As the day wore on, there were still those who needed to get out, however the price of the June contract was relatively stable between $22 and $23. Therefore, as the price of the May contract moved lower, the premium you had to pay to roll to the June contract became more expensive. This led to eventual capitulation of the holders of the remaining May contracts and the “get me out at any price” mentality, so they would not have to take delivery.

Crude traded to a low of negative $40.32! This means that people who owned May WTI oil contracts were willing to pay someone $40.32 to take the oil from them or take delivery on the oil at expiration tomorrow. Price closed at -$37.11.

Source: Tradingview, NYMEX, FOREX.com

What Happens Now?

The price of the June Crude Oil WTI contract is currently trading above $21. Owners of May Crude Oil WTI futures contracts will take delivery if they don’t get out tomorrow. OPEC++ has agreed to cut back production on May 1. There is already a supply glut. The key will be on the demand side. Traders who own the June contract believe that demand will pick up, to the point where enough crude oil will be needed so that it will be worth $21 per barrel. However, if demand does not pick up, or if oil producing countries don’t abide by the supply cut, then price could move lower and the same thing may happen at expiration to those who haven’t rolled to the July contract. There is still one day left in the May contract. Perhaps it bounces back today, and owners of the May contract can get out at a positive price!

If you hear someone today say that crude closed below $0.00, just remember that it was the illiquid May futures contract, and not the underlying spot market contract. However, if the global economy does not pick up soon, one day it may be the spot market price!

Joe Perry holds the Chartered Market Technician (CMT) designation and has 20 years of experience in the FX and commodities arenas. Perry uses a combination of technical, macro, and fundamental analysis to provide market insights. He traded spot market FX and commodity futures for 17 years at SAC Capital Advisors and Point 72 Asset Management. Don’t forget that you can now follow Forex.com’s research team on Twitter: FOREXcom and you can find more of FOREX.com’s research.