The Fed’s dramatic 50-basis-point cut still left Fed Funds above longer-term yields, reports Adam Button.

The Federal Reserved has delivered its first intermeeting rate cut since October 2008, one week after stocks posted its biggest weekly decline since October 2008. The global central banks failed to deliver a coordinated cut after a bland G7 statement but the Federal Reserve did with its 50 basis point move.

Monday we asked if central banks would come to the rescue, after today the question may be, will central bank interventions matter?

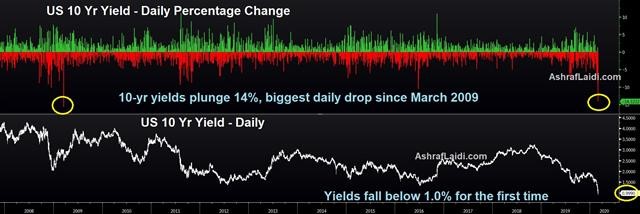

Yields on the U.S. 10-year Treasury note fell below 1.0% for the first time ever (see chart below). Crude oil and U.S. stocks initially spiked higher on the news but the reaction lasted only minutes as a 'sell the fact' trade hit hard.

A consistent reaction throughout the day was weakness in USD/JPY and jumps in bonds and gold.

The problem with the Fed surprise cut is that it was framed – unfairly or not – as an emergency measure and to companies and Main Street all that does is underscore that Coronavirus is an emergency. The S&P 500 jumped 80 points in seconds on the initial headlines but quickly gave it all back and closed down 86 points, or 2.8%.

Here are the levels in specific markets Ashraf Laidi said the bulls need to maintain, before the rate cut: SPX 3090, crude oil $49.33, AAPL $304, USDJPY 108.35-40. They all failed to do so.

As we warned yesterday, “Even if cuts are delivered the effect could be fleeting as investors continue to grapple with a seemingly endless stream of headlines about the virus.”

This isn't a financial crisis and it won't be solved by financial measures. Undoubtedly, lower rates will help in a rebound but that won't come until there is some visibility towards an end to the pandemic. Once again on Tuesday there was an endless stream of bad news about infections and deaths. The World Health Organization (WHO) revised its estimate of fatality rates higher to 3.4%, which is certainly a scary number to ponder with little chance now that the virus can be contained.

The Bank of Canada is the next central bank on deck with a decision coming Wednesday. A 25-basis-point cut is fully priced in and 50 bps is a 65% probability. The BOC has said recently that it doesn't want to fall behind the Fed so 50 bps is far more likely and 75 bps is a real possibility because Bank of Canada Governor Stephan Poloz may want to get ahead of a further March 18 Fed cut.

In any case, the bond market is way ahead of both of them. US two-year yields hit 0.62% at the lows Tuesday and 10-year yields hit a record low of 0.90%. In a world where the Fed's mandate is to get inflation to 2% that looks like an overreaction but it also seems reasonable in a world where the Fed will seemingly do whatever it can to keep equity valuations high.

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com. You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights. Ashraf's Tweet on indices here.