We're breaking down how low-priced stocks perform compared to high priced stocks, says Rocky White.

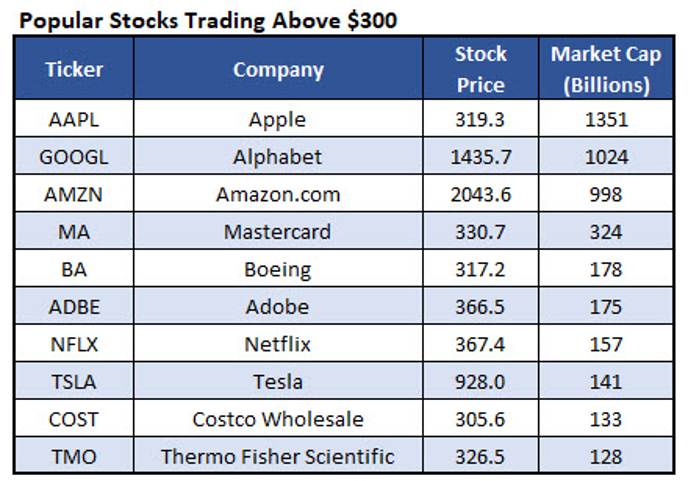

When looking at the most familiar publicly traded companies, nearly all of them are trading well over $100. Facebook (FB) is trading at $210, Amazon.com (AMZN) is at $2,030, Apple (AAPL) is at $320, Netflix (NFLX) is at $365, Tesla (TSLA) is at $895 and Alphabet (GOOGL) is at $1,430!

It didn’t used to be like this. Stock splits have declined extensively over the past several years, leading to a high proportion of stocks trading in the triple-digits. (When stock prices rose to very high valuations—over $100—often companies who do stock splits, increasing current stockholders’ holdings and allowing retail investors the ability to invest.)

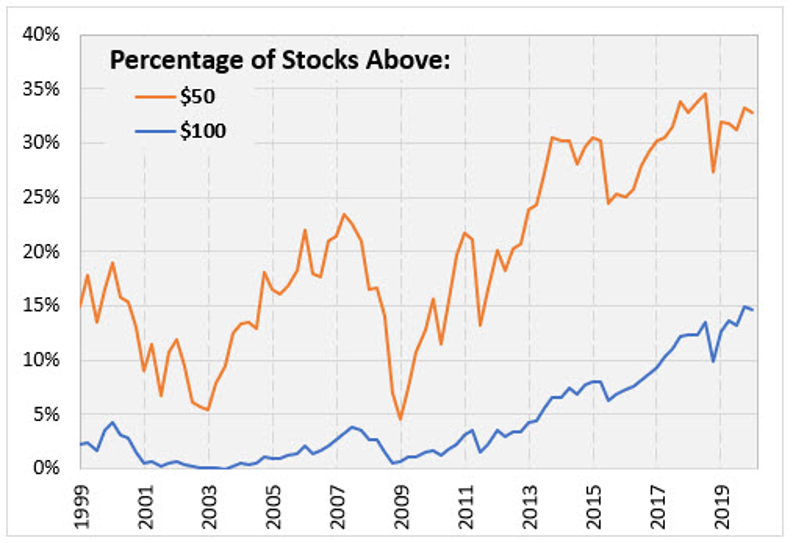

The chart below shows the percentage of optionable stocks that have prices above $50 and above $100. Currently, around 15% of U.S. stocks listed trade above $100. At the market top in 2007, that percentage was under 4%. Even further, take a look at the S&P 500 Index (SPX) — a whopping 45% of the stocks are above $100.

This week I’m doing a simple but interesting study. How have low-priced stocks performed compared to high priced stocks?

Measuring Returns by Stock Price

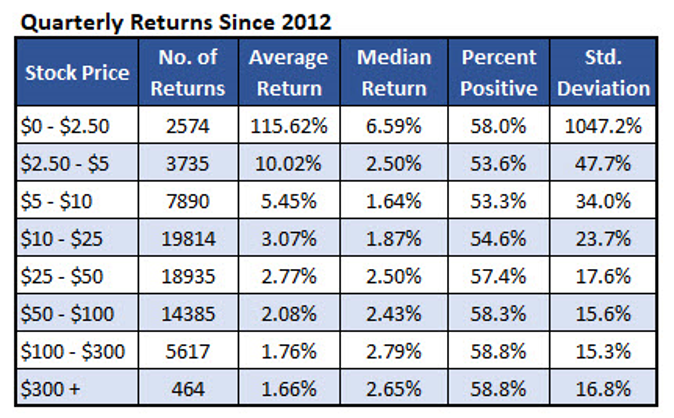

I went back to 2012 and found quarterly returns based on the price of the stock at the beginning of the quarter. The prices are not adjusted for splits, so it’s the actual price investors had to pay for that stock at the time. The left column shows the stock price range, followed by summarized quarterly return data.

The first thing you’ll notice is stocks in the lowest price range — less than $2.50 — average a 116% return per quarter (see table below). Do not believe that because there is a major flaw in this figure. The stock database that I’m using, unfortunately, only has data for actively trading stocks. The analysis demonstrates survivorship bias. That means it is only showing data for stocks that have survived. The data disregards stocks that went broke, which return a 100% loss. Naturally, stocks are very low priced just before going bankrupt, so in that low-dollar price range you’re essentially throwing out the worst performers. In other words, do not buy low-dollar stocks based on this analysis.

Based on this, investors would have been best off investing in lower dollar stocks. Stocks between $2.50 and $5 averaged a 10% quarterly return. As you move down the table, that average return declines to where the highest dollar stocks averaged a gain of less than 2% per quarter. The main reason for this is that the lower dollar stocks tend to be much more volatile. When you’re in a bull market, most stocks move higher and the most volatile stocks will move the most.

Let’s look at the volatility of the brackets. I’m measuring volatility by the standard deviation of returns. Stocks trading in the single digits showed a standard deviation well above 30%. Looking at the data at the bottom of the table (higher dollar stocks), those stocks have a standard deviation that’s about half that. Higher dollar stocks typically move less in magnitude. They tend to have bigger market caps which tend to be less volatile.

One last observation is that the higher-dollar stocks were slightly more likely to be positive. Disregarding the lowest-dollar stocks because of the survivorship bias I mentioned above, the lower-dollar stocks had a percent positive around 54%. As you move down the table, the percentage steadily increases until the highest dollar stocks were positive at a rate of about 59%.

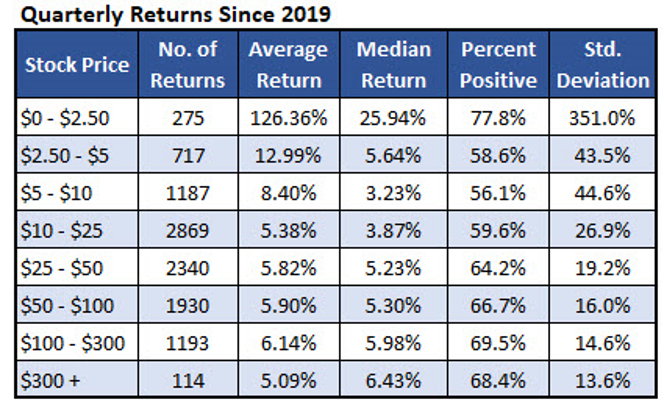

The table (below) shows the same data for 2019. Again, those low dollar stocks, less than $2.50, have an average return that seems too good to be true and that’s because it is. Disregard that group of stocks.

Lower priced stocks again had the highest average return at the expense of higher volatility. I could make the case, however, that the higher dollar stocks were much better stock plays. Once you get to about $25, stocks have significantly higher percent positive between 65%-70%. The standard deviations are lower and the median stock returns tended to be higher. Looking at the stocks priced above $300, there was a 50% chance that the stock return gained an impressive 6.4% return per quarter (see chart).

The high-dollar stocks seem to be a relatively reliable group of stocks. Below is a list of the more popular companies trading above $300.

Sign up here for the Schaeffer’s Research Edge weekly newsletter