While the Federal Reserve left rates unchanged, Chair Powell did mention the Coronavirus could have an effect on global growth.

We are barely one month into 2020 and we’ve had enough news materialize for an entire year. My prediction this will be a year like none other is already coming true.

Last week markets wrestled with Coronavirus fears for the first time. However, last Thursday (Jan 23) there was a mild Kairos reading as markets reversed course on news from WHO the virus wasn’t going to be the emergency some people think it is.

I knew right there the Thursday low was the equivalent of a boxer’s glass jaw. It was a soft low and would be taken out. I didn’t think it would happen the next day. When good readings are taken out, it means something larger is going on. Now we are bouncing again and the low we had last Thursday had better calculations then the one we have now.

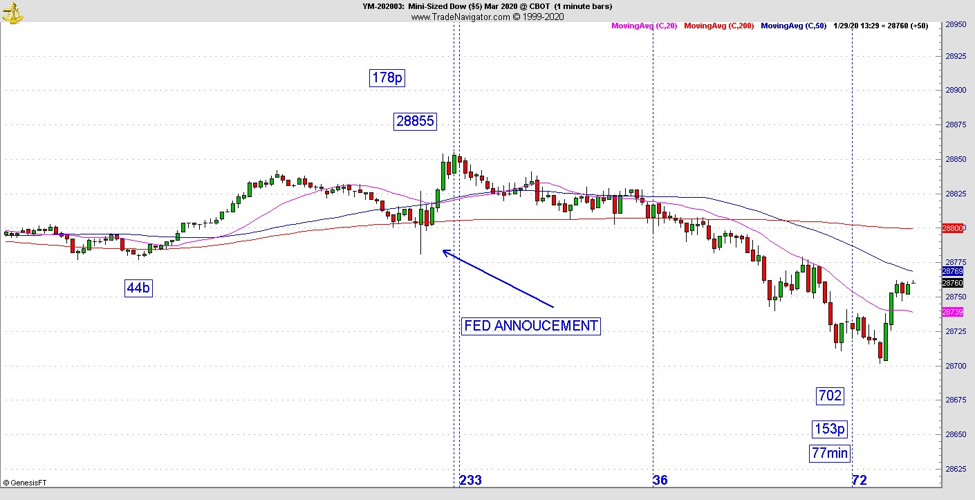

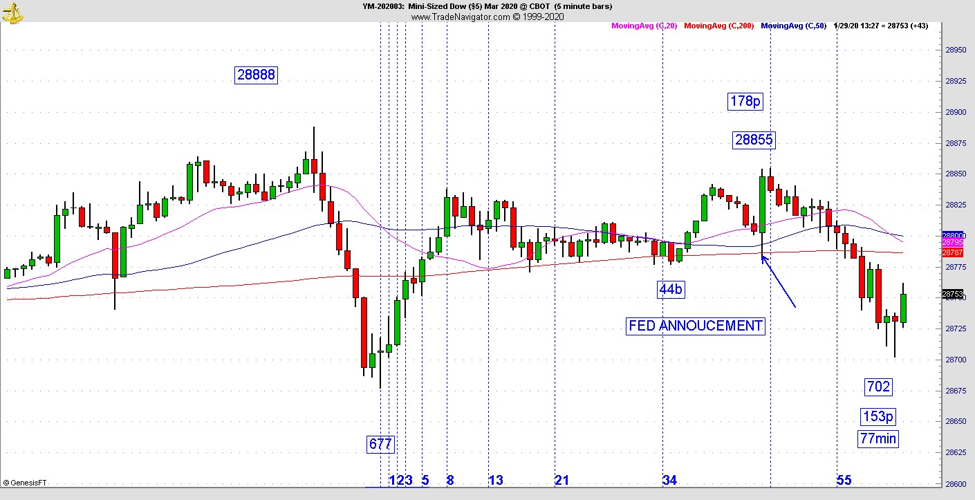

Yet it’s going apparently based on good Apple (AAPL) earnings. Its also going up because people do not believe the virus will go viral in the United States. What else could it be? The Federal Reserve is in an easier money rate policy yet they did not lower rates on Wednesday. This was a very interesting call since they had an excuse to lower rates. Then again, when did we ever know the Fed to get in front of the curve? To his credit, Fed Chair Powell mentioned a possible global slowdown as a result of the Coronavirus during his press conference and markets declined (see chart below). But that isn’t the same thing as lowering rates because of the global slowdown he might be anticipating. Remember, when the Fed cut rates in 2019 without much domestic economic justification, Powell mentioned global economic weakness.

I believe part of the reason the Fed didn’t lower rates this time is because it might have caused the opposing effect. Think about it. The Fed has lowered rates and will do so again. But to lower now, with no economic metric to justify it, could signal they know something about the virus the public doesn’t know. That could’ve caused a panic and instead of markets going up on lower rates, this time markets very well could have dropped. To that effect, we don’t see the President or anyone else in high office giving too much credit to the virus because they don’t want to cause a panic.

Earlier in the week President Trump tweeted appreciation to Chinese President Xi for doing a good job of controlling the virus. He tweeted, “The United States greatly appreciates their efforts and transparency. It will all work out well. In particular, on behalf of the American people, I want to thank President Xi!”

On Tuesday market participants anxiously awaited Tim Cook’s comments on the virus given Apple has so many workers and stores in China. They wanted to know how the virus is impacting his company. The bottom line he said only one store closed and as far as his projections are concerned, he doesn’t know what will happen.

That’s the point. We don’t know what is going to happen. Is Coronavirus going to be the pandemic like the Spanish influenza virus of 1918? Here’s the challenge. What is stopping us from buying into a panic is normalcy bias. Can we rule out the 1918 scenario? Of course not. But should we be complacent to the possibility? Same answer. Here’s what stops us from considering the 1918 scenario. We don’t believe the worst-case scenario because we haven’t experienced it. For the very reason we haven’t experienced it is the reason we don’t think its going to happen. Compounding the problem is the incubation period for this virus which is 10 days to two weeks. There are many people who may be carrying the virus at this point and they don’t even know it.

I saw a video of a conference last week at Davos where the CEO of Huawei Ren Zhengfei was part of an Artificial Intelligence discussion with Israeli professor Harari as he suffered a coughing fit right on the stage. The room was heavily populated by important CEOs from all over the world. Did he just have a cold? Let’s hope that’s all it was.

The charts of the day are the intraday Dow Jones Futures (YM) at the Fed announcement. It was one of the tamest sequences for any Fed announcement in the past few years (see chart below). In terms of the Kairos, there was a 44% retracement of the move up from Monday’s low. There was a mild breakout at 44 bars on a 5-minute chart from the high. It didn’t last as the 178 point move off the 28,677-low stalled at 28,855. You guessed correctly, it stalled at 56 bars. It proceeded to break below that ridge but was only mildly bearish. The last part of the sequence was a low at 77 minutes. Kairos precision works both ways. If you were long, there is a statistical condition called variable change. If you saw the movie 21, the protagonist Ben Campbell stated his nonlinear professor Micky Rosa told him to always account for variable change. In trading that means to understand what could be coming against you. Coronavirus may very well be the variable change coming against the market.

How should you view the Coronavirus? That’s entirely up to you. People are buying masks and storable food in record numbers these days. Isn’t it prudent to look after your finances the same way? Nobody should hide under the bed, but realize on any given day the Dow could and probably will be down 400 points.

It’s very important to have trusted strategies that keep your risk/reward ratios down. You never know what tomorrow brings, all you can do is have control over what you do. Don’t enter any moves that are late stage or where you get emotional. In trading it’s important to note the person who gets in early has the most staying power. Those who get in late end up becoming like a deer in the headlights. As you can see, the way this YM chart was analyzed, there is pinpoint precision. If you get caught on a day of pandemic fears, your losses should be very small. If you’ve entered correctly, that’s the worst that should happen.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.