Here are four stocks that maintained above key technical levels in during volatility of the last two weeks, notes Kerry Given.

I enjoy roller coasters. It’s a thrill. Somehow, it isn’t quite as thrilling to have my money taking that wild ride. That phenomenon has become very common in recent market activity. After hitting a high of 2952 on May 1, the S&P 500 index dropped 7% in 23 trading sessions. But then the market turned and recovered all those losses in only 13 trading sessions. This is typical of the modern “V” shaped correction: a rapid, scary ride down followed by an incredibly rapid recovery.

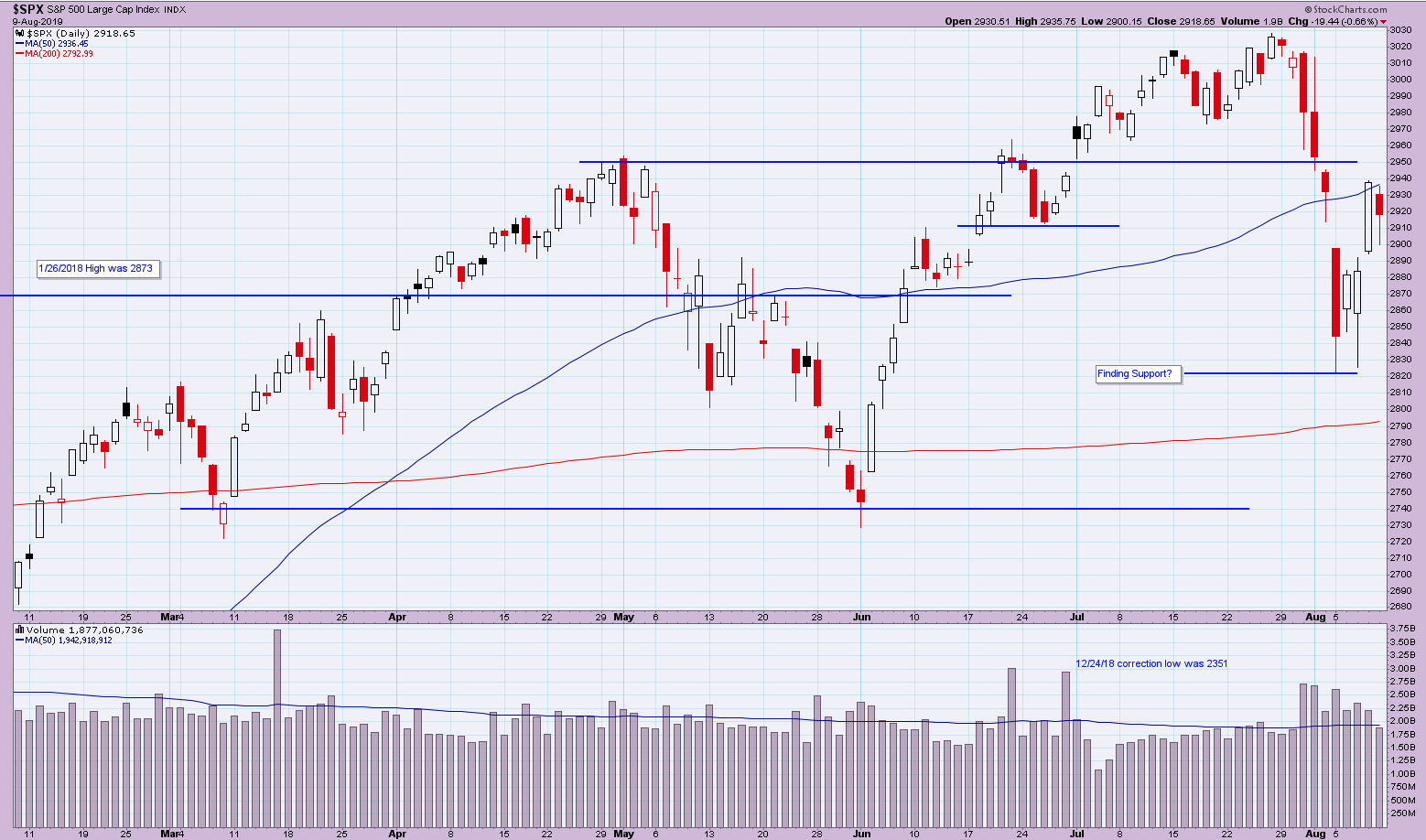

We witnessed part of that pattern again over the past two weeks. The S&P 500 Index (SPX) closed at 3026 on July 26 and then proceeded to lose 6% through the close on Aug. 5. Thursday’s close recovered half of that loss in only three days. SPX closed yesterday at 2919, down 19 on the day (see chart).

Standard and Poor’s 500 Index (SPX)

Chart courtesy of StockCharts.com

Trading volume has run below average since the July 4 holiday, but that changed with this correction. Trading volume in the S&P 500 companies spiked on July 31 and only dropped back close to the 50-day moving average on Aug, 9. It is significant that the only increases in trading volume are coming with market declines, not bullish runs higher. Money remains on the sideline as the market rises, but traders take profits quickly at the least sign of trouble.

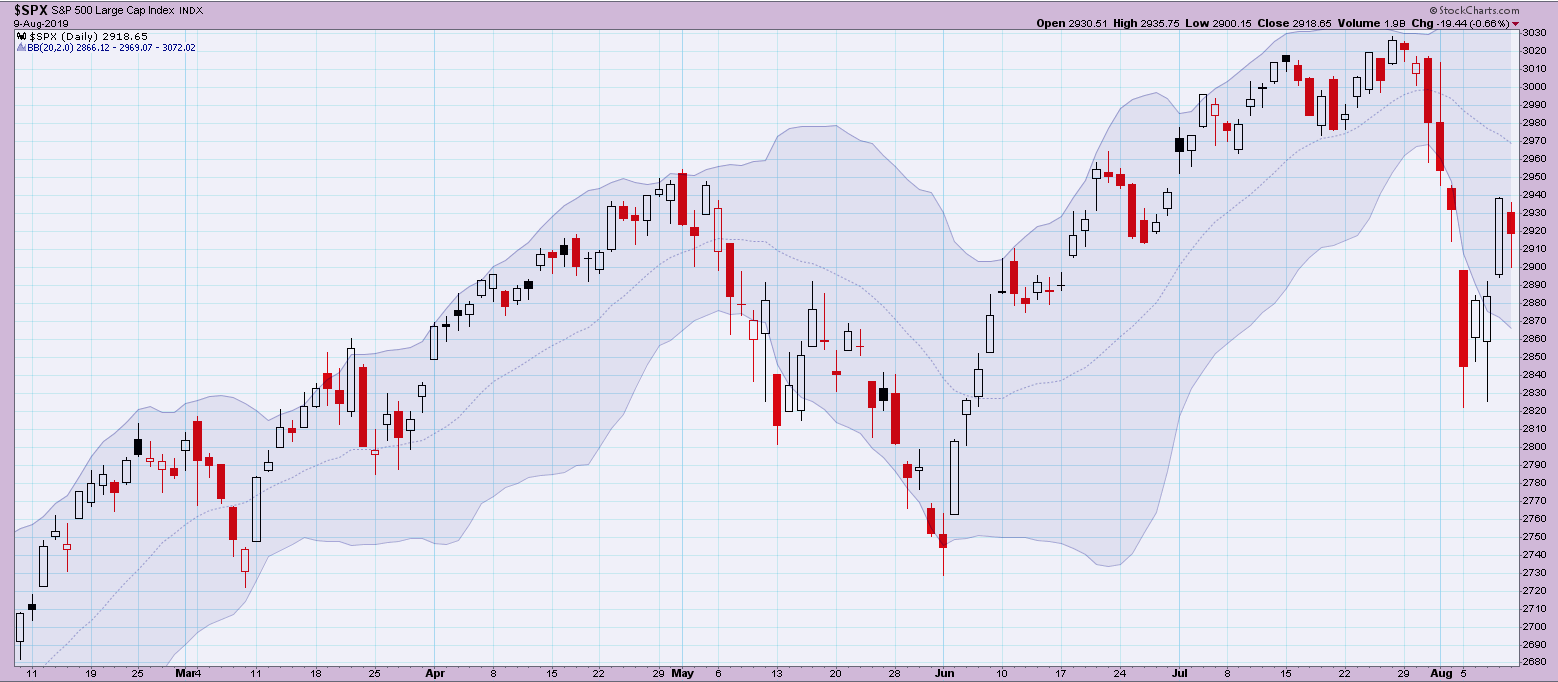

When we plot the Bollinger bands on the S&P 500 index, we see the seriousness of this last correction. SPX closed below the lower edge of the bands four times in succession. That lower edge is two standard deviations below the 20-day moving average (see chart). Statistically, we would expect that to occur less than5% of the time.

SPX with Bollinger Bands

Chart courtesy of StockCharts.com

The volatility index for the S&P 500 options as measured by the Cboe Volatility Index (VIX), spiked as high as 25 on the worst day of the correction and has declined since, closing Friday Aug. 9 at 18. That remains a relatively high level of volatility. All is not yet calm.

CBOE SPX Volatility Index (VIX)

Chart courtesy of StockCharts.com

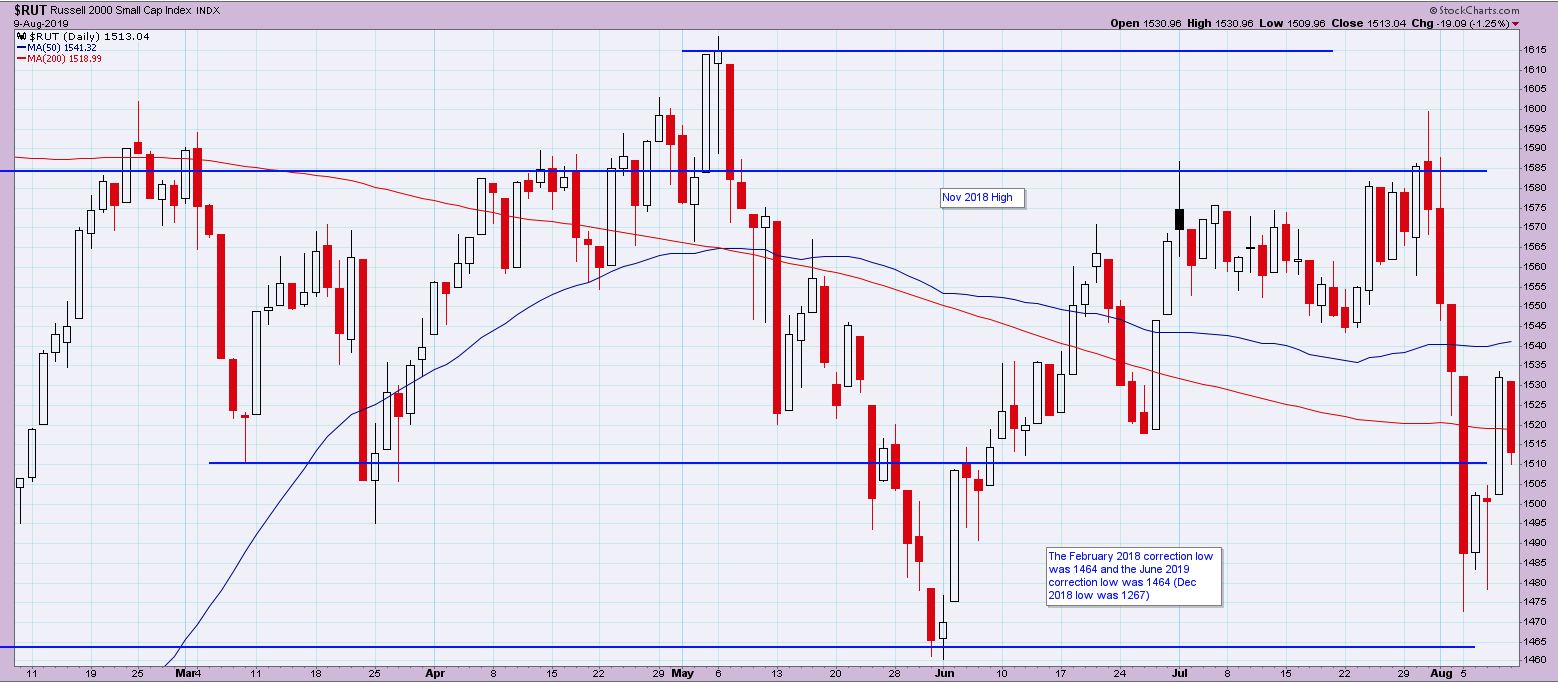

The Russell 2000 Index (RUT) continues to lag SPX and NASDAQ. Russell began the correction at 1587 on July 31 and closed down 6.3% at 1487 on Aug. 5. By Thursday, Russell had recovered almost half of that loss, but it gave much of it back yesterday, closing at 1513, down 19 points.

Russell never fully recovered from the December correction lows last year. Before this most recent correction, RUT had not yet even regained its high from early May of this year. Yesterday’s close remains more than 15% below RUT’s all-time high. The RUT chart (below) is a significant caution sign for the bulls.

Russell 2000 Index (RUT)

Chart courtesy of StockCharts.com

The NASDAQ Composite index set a new all-time high of 8330 on July 26 but lost more than 7.3% in this recent correction. NASDAQ recovered some of that loss late last week, closing Friday at 7959, down 80 points.

NASDAQ Composite Index

Chart courtesy of StockCharts.com

NASDAQ’s trading volume has trended even weaker than that of the S&P 500 index since the July 4 holiday, but volume rose above the 50-day moving average during this correction and has remained above average throughout this week.

Traders were buoyed by the prospects of a rate cut coming out of last week’s FOMC meeting and were somewhat disappointed by the quarter point cut (and lack of commitment to further cuts), but the markets remained positive. Then the China trade negotiations took center stage once again with President Trump’s tweet last Thursday. The markets have recovered since then but remain very fragile.

Conservative investors should remain largely on the sidelines, venturing only into conservative blue chips. Selling in-the-money calls is a good strategy for income and providing 3% to 4% of protection.

I have worked through many stock charts this week, focusing on stocks that have not broken their 50-day moving average during this correction. A finer screen would be those stocks that were trading sideways or higher on Friday.

The following stocks met both criteria — remaining above the 50-day moving average during the correction and trading higher on Friday: Chipotle Mexican Grill Inc. (CMG), Edwards Lifesciences Corp. (EW), Hershey Co. (HSY) and Starbucks (SBUX).

Be extremely diligent. Watch your positions carefully. In all cases, use relatively close stops and follow them. Don’t wait and hope in this market.

Parkwood Capital, LLC

Learn more about The No Hype Zone Newsletter

Kerry W. Given, Ph.D.

Parkwood Capital, LLC