The first day of the new month has started positively for equities and risk-sensitive yen pairs, writes Fawad Razaqzada, Market Analyst, Forex.com.

The first day of the new month has started positively for equities and risk-sensitive yen pairs, while commodity dollars have also shown relative strength so far in the session. At the time of writing, the German DAX index, for example, was up a solid 1.1% while the UK’s FTSE 100 was up 0.5%. U.S. index futures were all trading higher ahead of the open.

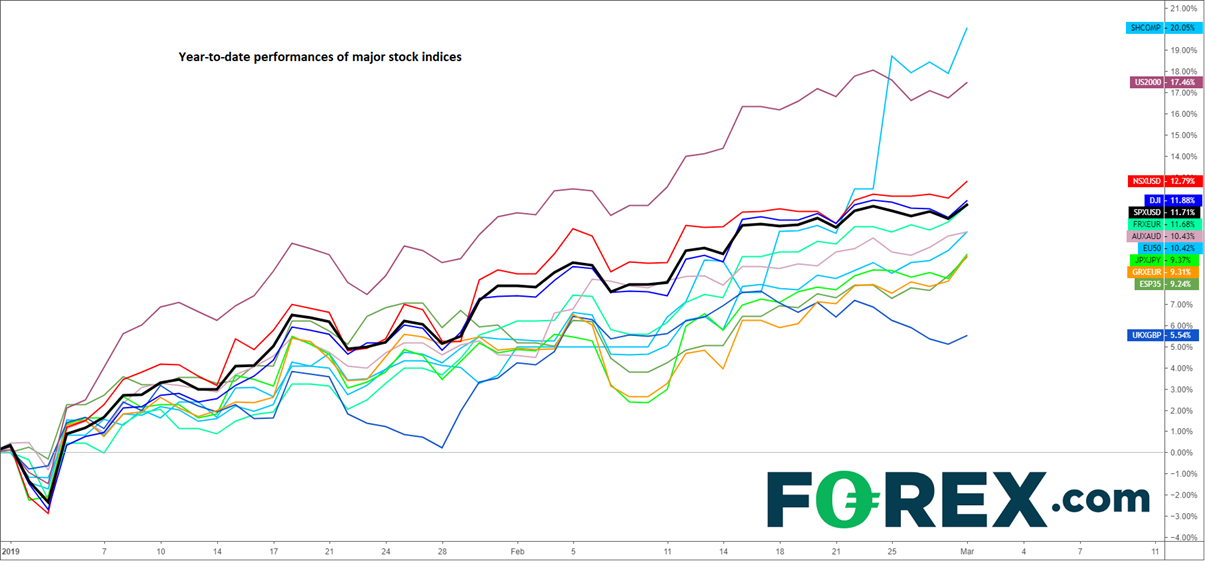

Thursday marked the last day of February, a month which saw the major global equity indices extend their gains for the second consecutive month after they had tumbled at the end of last year. Sentiment improved on the back of positive US-China trade talks and as major central banks have re-iterated the need for interest rates to remain low for longer. For these reasons, we have seen the Shanghai Composite outperform her peers on a year-to-date basis, while ongoing Brexit uncertainty has held back the UK’s FTSE 100 (see chart).

Source: TradingView and FOREX.com

The key risk now is if no trade deal is achieved at the end of it all, although that looks increasingly unlikely. For now, therefore, momentum appears to be on the upside. But sooner or later, stock market investors will start focusing on something else.

Today's data releases have been overall positive, aiding the ongoing risk-rally.

Data recap (mostly better-than-expected numbers):

- Caixin China Manufacturing Purchasing Managers Index 49.9 vs. 48.5 expected and 48.3 last

- German Retail Sales +3.3% vs. 1.9% expected (previous moth revised to -3.1% from -4.3%) and Unemployment Change -21K vs. -5K expected

- Swiss retail sales -0.4% vs. +0.3% expected

- Eurozone CPI 1.5% as expected, up from 1.4% last; Core CPI 1.0% vs. 1.1% expected and last; unemployment rate 7.8% vs. 7.9% expected (previous revised to 7.8% from 7.9%), and Final Manufacturing PMI 49.3 vs. 49.2 last

- UK Manufacturing PMI 52.0, in line with expectations; Mortgage Approvals 67K vs 63K expected

Coming up during North American session:

- Canadian GDP +0.0% expected

- U.S. Core PCE Price Index +0.2% expected

- U.S. Personal Spending -0.2% expected

- U.S. ISM Manufacturing PMI 55.6 expected

Today’s other not-so-important U.S. data include: Personal Income, Revised University of Michigan Consumer Sentiment, Revised University of Michigan Inflation Expectations and Total Vehicle Sales

Currencies

With commodity dollars outperforming and the safe-haven Japanese yen being out of favor, the AUD/JPY could be the next yen crosspair to break higher. It has consolidated bullishly since making a quick recovery in early January following a mini flash crash. Now tie has broken above a short-term bullish trend line. If it goes on to take out its 2019 high at 79.85 next, then this could pave the way for a rally towards the 200-day moving average next, at 80.70ish.

Source: TradingView and FOREX.com.