Packaging giant International Paper (IP) was hit hard by the surging volatility that rocked stocks during the fourth quarter of 2018, writes Elizabeth Harrow of Schaeffer's Investment Research.

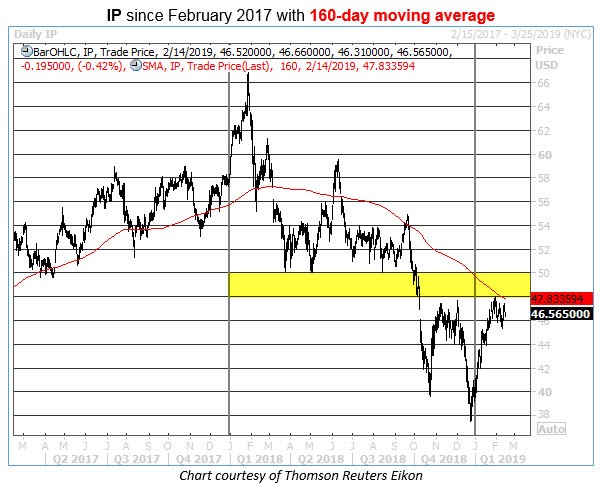

Packaging giant International Paper (IP) was hit hard by the surging volatility that rocked stocks during the fourth quarter of 2018, but the equity's downtrend started long before that. IP hit a high close of $65.08 back on Jan. 29 of last year, and then proceeded to rack up a decline of nearly 38% into year-end. The round $50 level provided a temporary floor for IP from March through late September, but the stock market's early October sell-off quickly smacked the shares south of this support (see chart).

Mimicking the action in the S&P 500 Index (SPX), IP hit its low close on Dec. 24, at $37.56. The shares have since rallied about24%, but have yet to make a meaningful push above their Dec. 3 high near $48. Meanwhile, a historically bearish trendline has descended into the region, which raises the odds that IP could be due for another leg lower in its longer-term decline.

Specifically, IP closed Tuesday within one standard deviation of its 160-day moving average, after having spent the majority of its time below this trendline since late September. Schaeffer's Senior Quantitative Analyst Rocky White reports that there have been three prior instances of IP testing resistance at its 160-day moving average in this manner over the past three years, and the short-term results going forward have been unequivocally bearish.

Five days after those three prior 160-day signals, IP was trading lower 100% of the time, with the average return amounting to a drop of 2.26%. And looking out 21 days after those signals, the average return widened to a loss of 12.07% — again, with 100% of the returns negative. Based on the equity's Tuesday close at $46.76, a drop of similar magnitude this time around would place IP around $41.12 by this time next month.

Given the stock's disappointing price action, a round of downgrades could help to hasten IP's pullback from technical resistance. Despite its long-term downtrend, IP still sports seven "buy" or better ratings from analysts, compared to five "holds" and just one "sell." Any negative notes from this group could spark fresh selling pressure.

Plus, with the company's fourth-quarter earnings report already in the rearview, speculative option plays on IP are attractively priced, from a volatility standpoint. The security's Schaeffer's Volatility Index (SVI) of 22% arrives in the 16th percentile of its annual range, which means short-term options have priced in lower volatility expectations only 16% of the time during the past year. In other words, it's an opportune time to buy put options in anticipation of additional downside in the stock during the weeks ahead.