Auto stocks jolted higher to start this week, with sector heavyweights like Ford (F) and General Motors (GM) rallying on Monday as the White House touted its “United States-Mexico Trade Agreement,” writes Elizabeth Harrow. Here’s a short trade idea on Fiat Chrysler.

Ford shares advanced 3.2% on the day, while GM and Fiat Chrysler (FCAU) both jumped 4.8%. However, that trade-induced pop could actually present an opportunity to short shares of Fiat Chrysler, which just encountered a trendline that has previously sent the stock reeling.

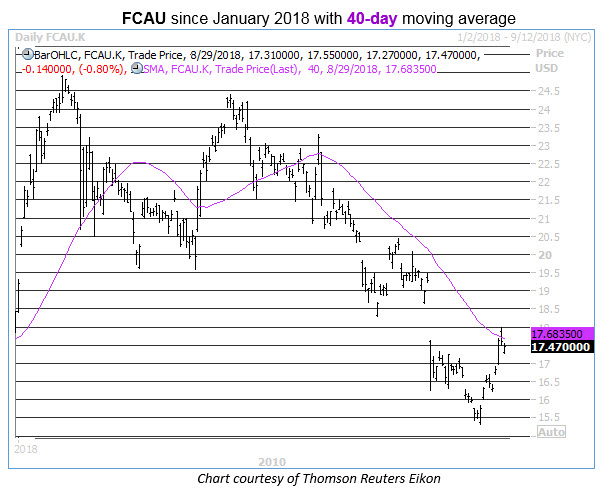

Specifically, FCAU is fresh off an unsuccessful test of its descending 40-day moving average, which has been looming overhead for quite some time now. Over the past three years, there has been just one prior instance of FCAU rallying up to test its 40-day trendline after spending an extended period of time below it (defined as 60% of the time over the past two months, and at least eight of the last 10 trading days) -- and the results going forward were ugly.

Five days after that prior 40-day sell signal, FCAU was down 2.91%, according to Schaeffer’s Senior Quantitative Analyst Rocky White. And 21 days later, the stock had dropped an eye-popping 16.58%. Based on FCAU’s current price of $17.47, another drop of this magnitude would place the shares around $14.57 by this time next month.

A sample size of one admittedly isn’t that compelling, but the fact that FCAU’s recent rally was stopped cold near the site of its late-July post-earnings bear gap strengthens the case for another leg lower in the weeks ahead. In fact, the overhead $18 level was previously a staunch technical ceiling throughout the fourth quarter of 2017 and shows no signs of giving way -- and this area also coincides with FCAU’s year-to-date breakeven point of $17.84, creating a formidable resistance cluster for the stock.

Meanwhile, there’s very little pessimism priced into this underperforming auto name, which leaves it vulnerable to more downside in the short term. FCAU currently has zero Sell ratings from analysts, leaving the door wide open for downgrades. Plus, less than 1% of its float is dedicated to short interest -- an all-time low for the metric, suggesting the timing could be ripe for shorts to move back in and ramp up selling pressure on the stock.

As for options traders, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows 17,369 calls bought to open on FCAU over the past 10 days, compared to just 601 puts. The resulting 10-day call/put volume ratio of 28.90 registers in the 94th annual percentile, as speculative players have rarely shown a greater appetite for bullish bets over bearish in the past year.

With the stock set to back down from stiff resistance, an unwinding of optimism could accelerate FCAU’s pullback.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here