Retail stocks usually go on vacation during the summer months. The industry has historically reported the weakest performance May through September, as investors take their vacations and wait to focus on back-to-school trends. Will this be different? asks Lindsey Bell.

Advance Auto Parts (AAP) and Home Depot (HD) kick-off earnings season on Tuesday, August 14; followed by Macy’s (M) and L Brands (LB) on Wednesday, August 15; Gap (GPS) and Nordstrom (JWN) on Thursday, August 16 and Foot Locker (FL) on Friday, August 17.

This summer hasn’t exactly hasn’t gone by the script. Instead, the S&P 500 Retail Index (SPSIRE) has advanced 14.1% since the end of April, while the S&P 500 (SPX) is up only 7.9%, from the start of May. With retailer earnings slated to kick-off next week, can the rally continue through the remainder of summer?

Economic data certainly suggests the second quarter was a solid one for retailers. Consumer confidence remains near a 17-year high, unemployment is close to an 18-year low, wages are moving higher (even if slowly) and spending has ensued.

Retail sales, excluding motor vehicle sales, increased 7.0% year-over-year in June, an acceleration from the 6.8% increase recorded in May and the 4.9% average monthly growth in the first quarter. Personal consumption growth in the second quarter, used to calculate GDP, rebounded to a robust 4.0%, from 0.5% in the first quarter, according to the Bureau of Economic Analysis.

The back-to-school shopping period, which is currently underway, is expected to be a solid one for retailers, with the National Retail Federation (NRF) estimating total spending for K-12 schools and college to reach $82.8 billion. While that is slightly below the $83.6 billion recorded in 2017, NRF President and CEO Matthew Shay said, “College spending is expected to be at its highest level ever, and back-to-school will be one of the three highest years on record.”

Department stores have consistently topped the list of places to shop for the back-to-school period. An update on how sales are progressing will be a topic of discussion during earnings calls next week.

The S&P 500 retail index received a boost of momentum from solid first-quarter earnings in late May and June, where many retailers, including Macy’s, TJX Companies (TJX), Kohl’s (KSS) and Tiffany’s (TIF), raised full year guidance expectations on the back of improving same store sales.

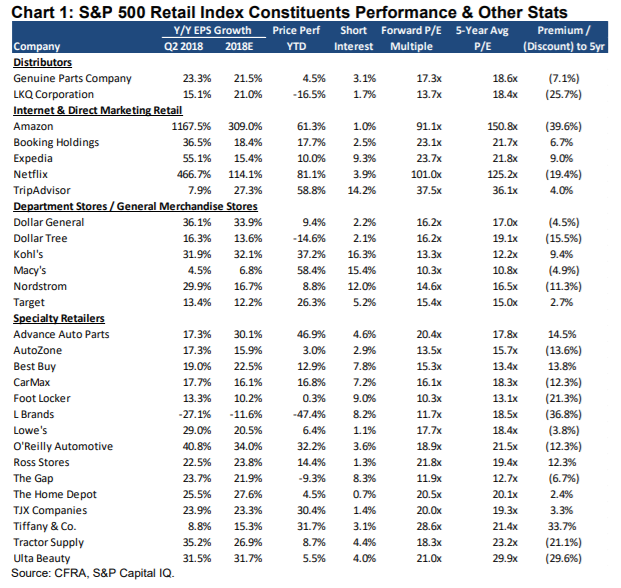

While Amazon (AMZN) and Netflix (NFLX) are key contributors to the index’s performance year-to-date, accounting for about 80% of the 33.1% advance (versus a 6.9% advance for the S&P 500), there are several other traditional retailers that have impressive stock runs, despite their less significant contribution to the index.

Several of the traditional retailers have jumped 30% or more in 2018.

Macy’s has been the come-back kid of the group, advancing 58.4% year-to-date through August 8. Advanced Auto Parts is 46.9% higher, Kohl’s is up 37.2%, Tiffany’s is 31.7% higher, and TJX is up 20.4%. If you expand outside of the S&P 500 Retail index, American Eagle, Abercrombie & Fitch and Dillard’s are 40-50% higher on the year.

To be sure, since the run up that followed first-quarter results, many of those stocks have underperformed both the S&P 500 and the S&P 500 Retail Index. That could mean investors haven’t gotten ahead of what could be another strong period following the release of second-quarter earnings next week.

Earnings estimates for the department stores and specialty retailers haven’t moved significantly since June 30. The small increases that have occurred are significantly less than the increases for the overall consumer discretionary sector.

Valuations are mostly reasonable for the department stores and many of the specialty retailers, despite the move higher in shares year-to-date. The department store price-to earnings (P/E) ratio of 12.0x is below the five-year average of 13.7x.

Macy’s seems to have some opportunity: trading at 10.3x, it is below the 10-year average of 11.3x. TJX and Home Depot are specialty retailers that trade in-line with historic averages, while the discounts on Ulta Beauty and L Brands have gotten quite large. But not all retailers are created equal. Dollar Tree, L Brands and the Gap have traded significantly lower year to date and are valued at a discount as they grapple with company-specific issues.

High levels of short interest remain at many of the department stores, which we think may not be warranted and could support a move to the upside if better-than-expected earnings are reported. In such case, the short sellers would get squeezed (they have to cover their short position by buying shares), helping to accelerate upside in those stocks. Macy’s and Kohl’s have 15.4% and 16.3% short interest, respectively, well ahead the sector average of 5.6%.

Even though August and September are typically weak months for retail stocks, CFRA forecasts earnings could be a catalyst for many retailer stocks, and for the sector to continue to grind higher.

The upside may not be as significant as after first-quarter results given an increase in valuations and year-to-date stock moves, but our analysis suggests the fundamental strength of the consumer and retail sales doesn’t appear to be fully baked in to the stocks.

Retail sales from clothing stores, department stores and online have been strong in the past three months and will be key in the success of retailers this quarter.

A summary of the retail index companies, along with key stats and valuation is on the chart.

Best,

Lindsey

Please consider joining me and an impressive list of investors and market observers at The MoneyShow in San Francisco on August 23-25. LindseyBell.SanFranciscoMoneyShow.com

A full schedule of events can be found here: https://conferences.moneyshow.com/moneyshow-san-francisco//schedule/full-schedule/