I had the privilege to speak to investors at the TraderExpo Chicago last Tuesday and those conversations further confirmed that there is a growing group of people in this country taking back control of their investments, no longer satisfied with the status quo.

This group of investors are trying their best to sift through the 24-hour news and social media cycle to glean signal from all of the financial market noise.

Our job here is to apply our data-dependent, process driven framework in order to do the sifting and only deliver the golden nuggets each week. Our research is designed to help you limit how much your own humanness negatively impacts your investment decisions.

Last week, headlines were splashing everywhere and nothing is more human than to be drawn in by seductive headlines, especially when those headlines “move” markets.

The week started with news that the Peoples’ Bank of China announced changes to their policies designed to support the weakening economy and the inevitable drag from US tariffs. The policies are focused on improving domestic demand through tax cuts and accelerating plans to build new infrastructure. The news was seen as a shift away from the PBOC’s most recent deleveraging pledge, which prompted a two-day 4.6% rally in the iShares China Large Cap ETF (FXI).

Tuesday’s announcement was a big nothing burger, which is why we used the headline induced rally to short FXI in our Asset Allocation model.

In this two-part commentary, we are going to review our “Slowing Dragon” macro theme and discuss why absolutely nothing has changed and if the PBOC wants to arrest the downside trajectory of Chinese growth they’re going to need more than a pea shooter.

Fundamental Gravity Says What?

Whenever we evaluate a market opportunity, we always begin with the Fundamental Gravity. The reason for this approach is because the two chief variables impacting the risk and return of asset prices are: economic conditions and how central banks respond to those conditions. Together, these variables drive what we call an economy’s Fundamental Gravity.

Big Three

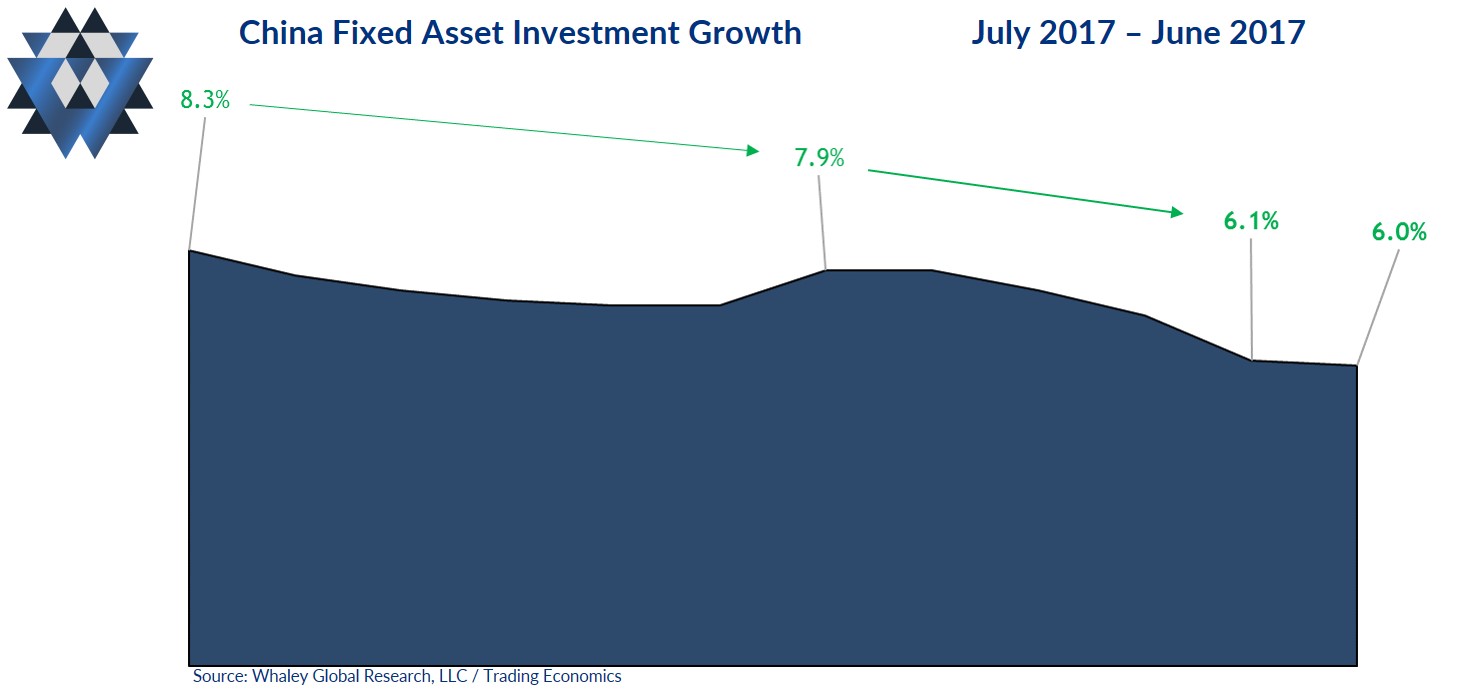

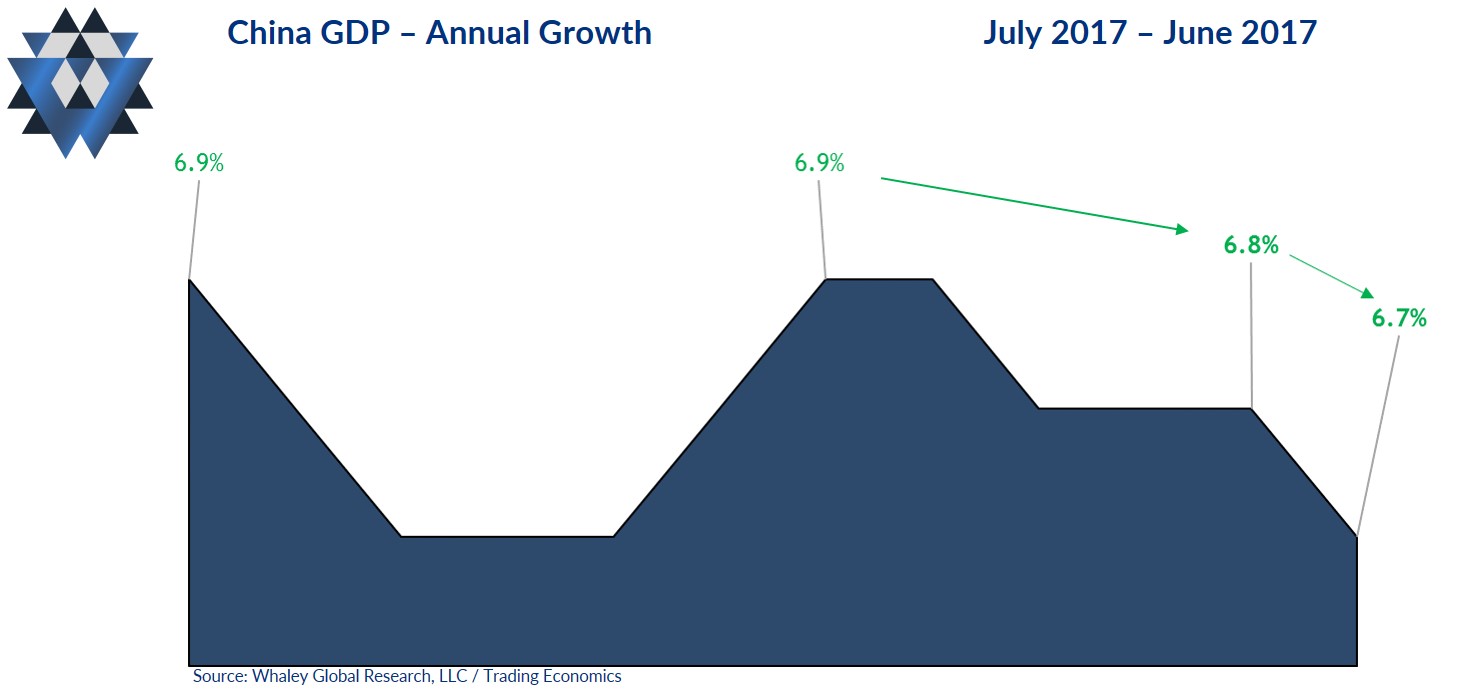

Let’s start this deep dive into China’s FG with “The Big Three”: retail sales, fixed asset investment, and industrial production. Both industrial production and fixed asset investment growth slowed to new year-to-date lows, each reporting a 6% annual growth rate. For industrial production, June marked the fourth monthly slowdown in the last five. For fixed asset investment, June marked the fourth consecutive month of slowing data. Bucking the downward trajectory was retail sales growth, which accelerated to a 9% annual growth rate. Before you China bulls fill up our inbox with nastygrams, June’s data followed two consecutive months of slowing sales growth and remains a long way from July 2017’s peak growth rate of 10.4%.

Even China’s goal-seeked GDP growth rate was allowed to slow to 6.7% after three consecutive quarters of exactly a 6.8% growth rate.

We aren’t cherry-picking data to support our view. Most of the critical Chinese data sets are painting a similar growth slowing picture, which is why Chinese officials have been using both monetary and fiscal policy levers to attempt to regain control.

Central Bank Says What?

Prior to last week, the PBOC had lowered the reserve requirement ratios three times this year. Then on Monday, a trifecta of policy actions sent Chinese equity markets ripping. First, the PBOC announced that capital requirements for some banks would be lowered to encourage lending. For context, the PBOC has been on a campaign to scale back leverage across the system without sending the economy into a tailspin, but the very real threat of a trade war is forcing their hand a bit now. Chinese policymakers aren’t just pushing monetary buttons, they’re pushing fiscal buttons as well. They announced the third tax cut since March and plan to accelerate the start of various infrastructure projects to boost domestic demand before any trade war fallout can be felt.

We used this PBOC-induced two-day rally in the iShares China Large Cap ETF (FXI) to initiate a new short position because the PBOC’s actions are not a 180-degree turn from their deleveraging campaign. These actions simply mean the PBOC is easing their foot off the deleveraging pedal in the hopes of kick-starting growth without having to flood the system with liquidity like it’s 2015.

As long as the PBOC’s policy is primarily driven by a desire to ring excesses out of their financial system, even if it’s not entirely driven by this mission, the direction of Chinese growth will remain southbound.

Fundamental Gravity Summary

The current Fundamental Gravity posture in China remains bearish for FXI. In this type of Fundamental Gravity, FXI averages a -1.2% quarterly decline with an average drawdown of -16.5% and posts positive three-month returns 53% of the time.

The Fundamental Gravity bottom line is that Chinese economic data continues to slow, and the PBOC has brought a policy pea shooter to a growth slowing gun fight. Unless—and until—the PBOC ups the liquidity and easing policy ante, the trajectory for Chinese growth is down from here.

This Friday, August 3, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting Chinese equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading FXI from the short side.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying short FXI trade details, please email us at ClientServices@WhaleyGlobalResearch.com with the subject line “Slowing Dragon.”

We will provide you with the complete “Slowing Dragon” macro theme breakdown as well as offer you the opportunity to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.