Over the last few months I have suggested a potential bottom was in for the crypto market. Support levels that I called out did not hold, so I had to look lower. I have seen a very bullish pattern off the recent lows struck on April 1, writes Ryan Wilday.

Currently, most of the coins we track have the “impulsive five,” a pattern we look for to indicate a bottom. These patterns so far are more bullish in structure than previous patterns seen since January.

Furthermore, these structures, as measured in Fibonacci levels, are higher than before. This is promising.

Yet, as usual, we must watch supports and move them higher with the market to watch for indication of a false rally.

As of this writing, most of those coins are in consolidation off recent micro highs, and they appear to be setting up for continuation. Some coins are in the next degree wave 2 down. Some are in wave 4, needing to go one wave higher to complete the first-degree impulse.

I’m now providing biweekly commentary on the crypto market for the Korelin Report. Price action was bullish enough on April 30 for me to suggest a bottom was likely. I sounded a little excited that day and for good reason.

As is typical when we have a potential bullish reversal, I like to check in with our bellwethers: litecoin (LTC-USD), bitcoin (BTC-USD) and ethereum (ETH-USD).

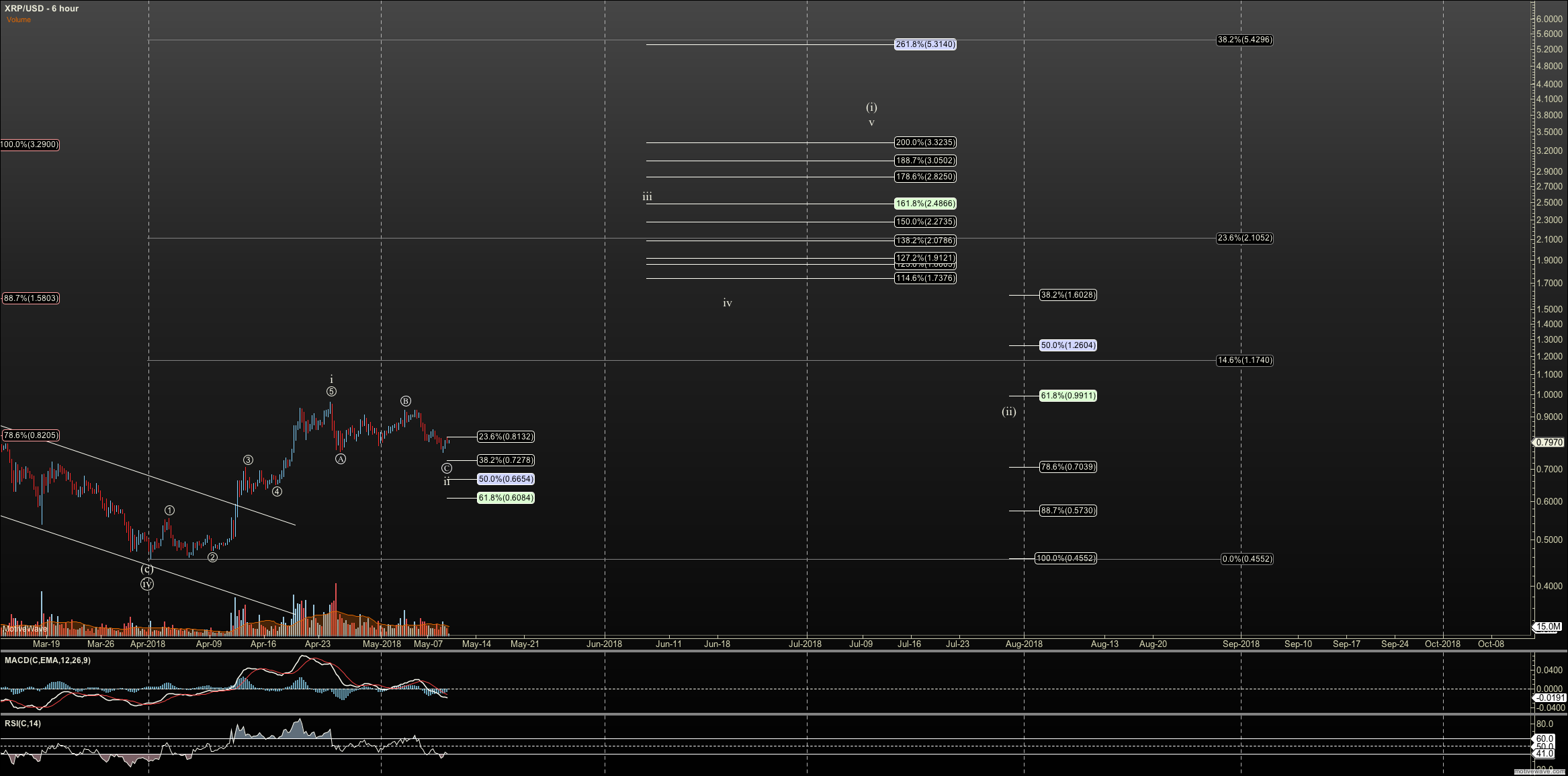

I also want to take a look at Ripple (XRP-USD). Previously, I had been looking for any high degree rally in Ripple to be a B wave rally, reserving a major bottom in wave 4 for after a large degree C wave down. However, we now have a five-wave impulse pattern in Ripple off the bottom, so it is reasonable to believe the major rally toward new all-time highs in Ripple has also started.

In fact, we have an impulse in quite a few coins for which I’ve expected B wave rallies. These include OMG, REP, and NXT, to name just a few. This is more promising evidence that a major low is in.

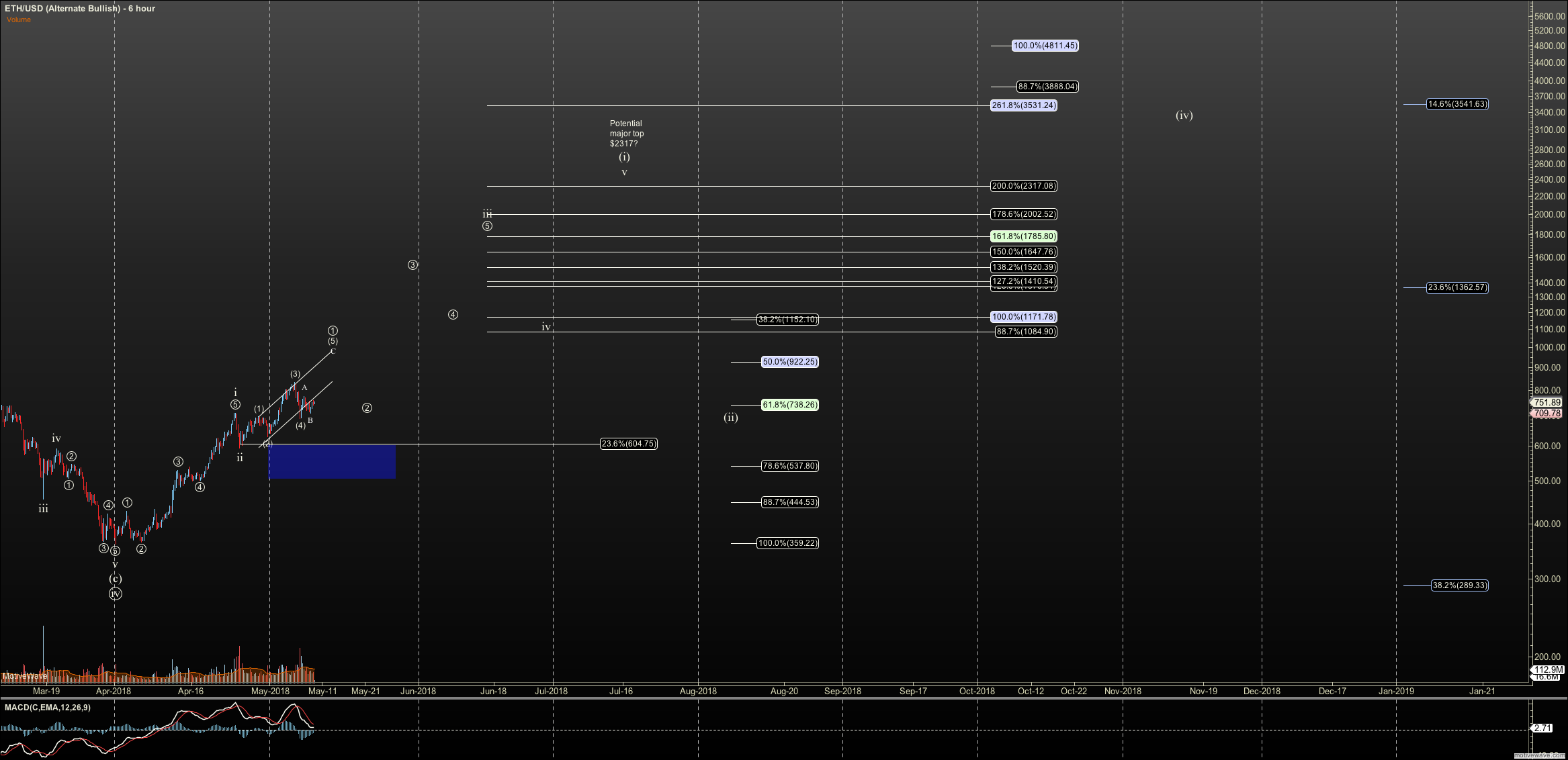

Ethereum is the most clearly bullish of our bellwethers. It put in a very deep correction that forced a review of my long-term count. This indicates that sentiment reached extreme negative levels. And now it has a very clear impulse off the bottom, retracing nearly .618 of the height of the correction.

Off the April 1 lows, we either have a five-wave impulse complete or need one more high as per the red count on my chart. White is my preference, and that means we had a very shallow wave 2, and are now in circle 1 of wave 3, targeting new highs. White is valid as long as $604 is not breached, and the pattern can be called bullish as long as $495 holds.

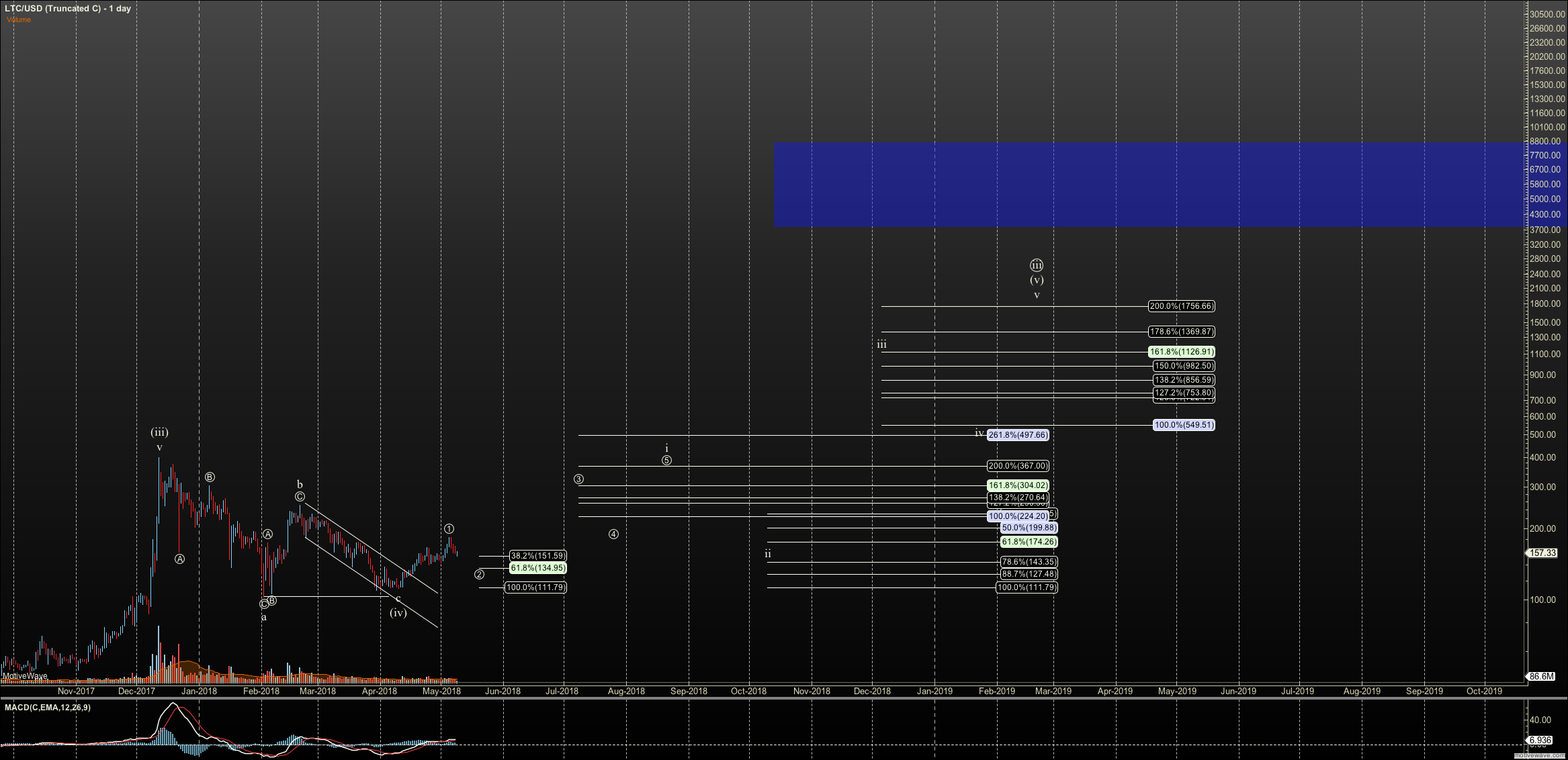

I view litecoin in two ways: I have been tracking a triangle pattern off the February lows, since we don’t have enough waves to really suggest that the C wave of the wave iv correction is completed. However, since we have five waves off the April 1 lows, which is not the structure we expect for a D wave, we may have something more bullish. This means the C wave could have been truncated and we are already in our expected climb to over $1000. I have posted both views below.

Litecoin Triangle:

Litecoin Truncated C wave:

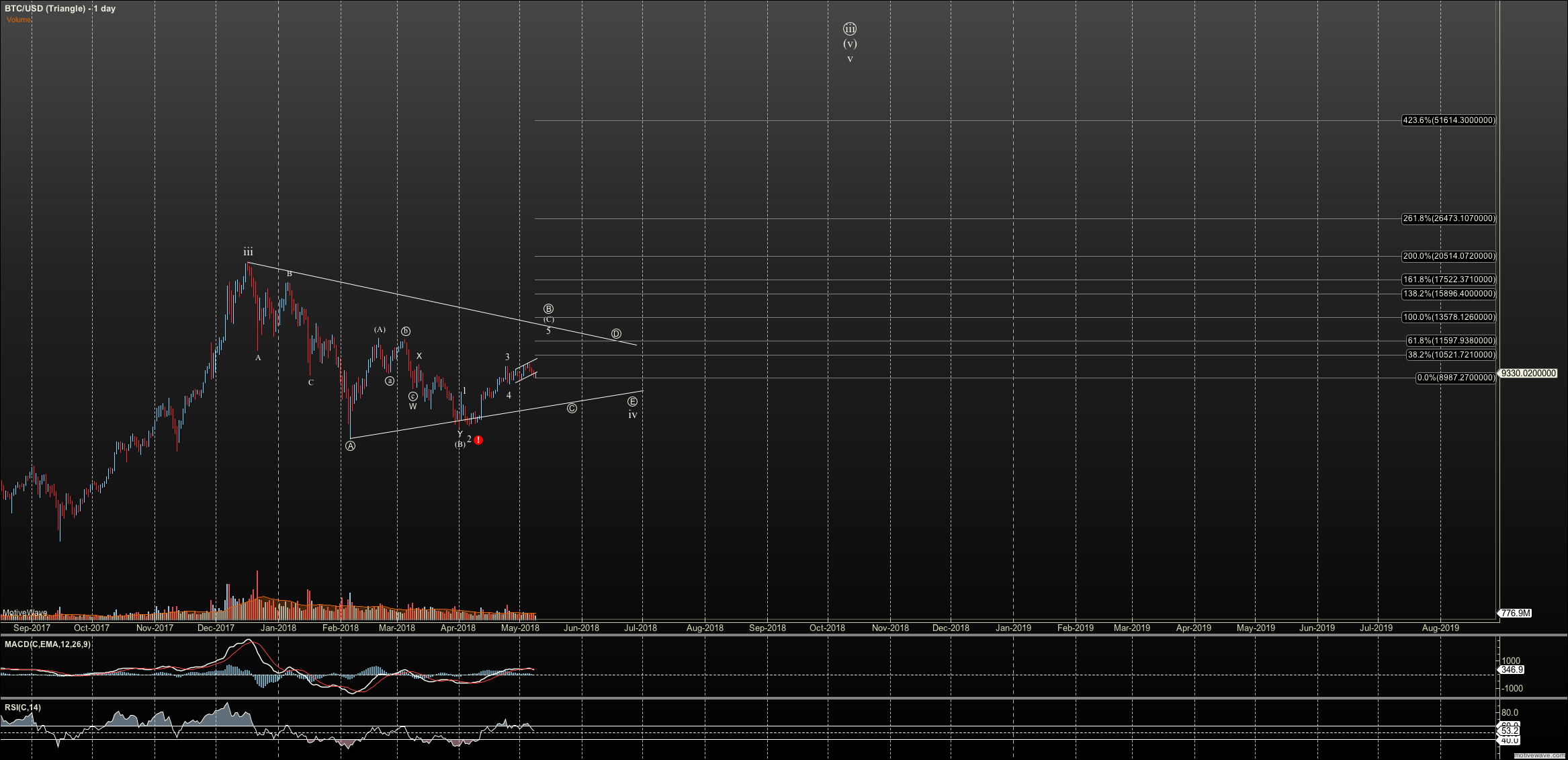

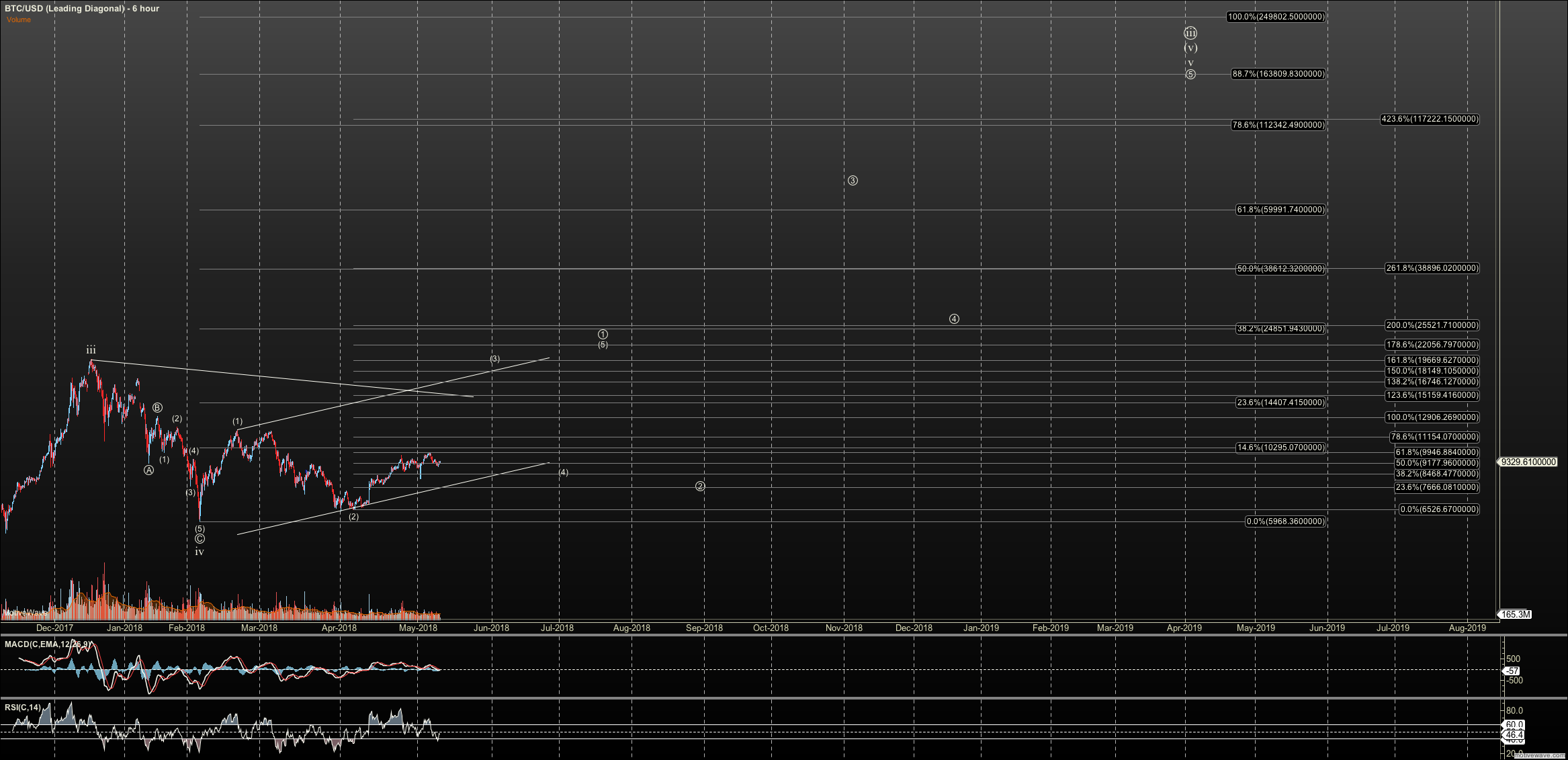

Bitcoin also has the potential to build a triangle. It has a five-wave pattern, but since I’m looking for this rally to be c of B, it still fits in Bitcoin’s triangle. Another pattern works well, and that is the leading diagonal I posted in a previous article. This will become my primary view if we breach $16,000 from here. Both views are posted below.

Bitcoin Triangle Count:

Bitcoin Leading Diagonal:

Now, let’s look at Ripple. If you recall from past articles, you know that I was looking for a B wave top. Yet, again, with a five-wave rally, I am looking higher. I’d like to see 60 cents to hold here, which gives me a target northward of $3.00 in the next degree. I’ll move supports as we go, and I see the potential for Ripple to continue a major rally over $10 before the next major correction.

Now, let’s look at Ripple. If you recall from past articles, you know that I was looking for a B wave top. Yet, again, with a five-wave rally, I am looking higher. I’d like to see 60 cents to hold here, which gives me a target northward of $3.00 in the next degree. I’ll move supports as we go, and I see the potential for Ripple to continue a major rally over $10 before the next major correction.

Subscribe to Elliott Wave Trader here

More articles on cryptocurrencies on MoneyShow.com

The CFTC and virtual currencies

CFTC warns about currency pump-and-dump schemes

Don't trust Buffett, Gates on bitcoin. CryptoCorner Index up 7% on the week

CryptoCorner Index shows consolidation. A dozen crypto trends you should know

Trading Lesson: Confessions of a crypto analyist who ignored sentiment

The risks and rewards of trading cryptocurrencies

Trading Lesson: Decrypting the cryptic cryptos

Trading Lesson: Decrypting the cryptic cryptos: Many questions, few answers

Trading Lesson: How I learned cryptos and became the Ethereum Whisperer

As regulators come for crypto criminals, invest in what is real