The Fed announced in addition to rate hikes for this year there will also be three next year as well. Markets were all over the map without conviction as they might be asking the same question you are, says Jeff Greenblatt, editor of The Fibonacci Forecaster.

Why are they bothering about next year when we are still in the first quarter of this year? After all, who knows what tomorrow will bring, let alone the next month or the next year?

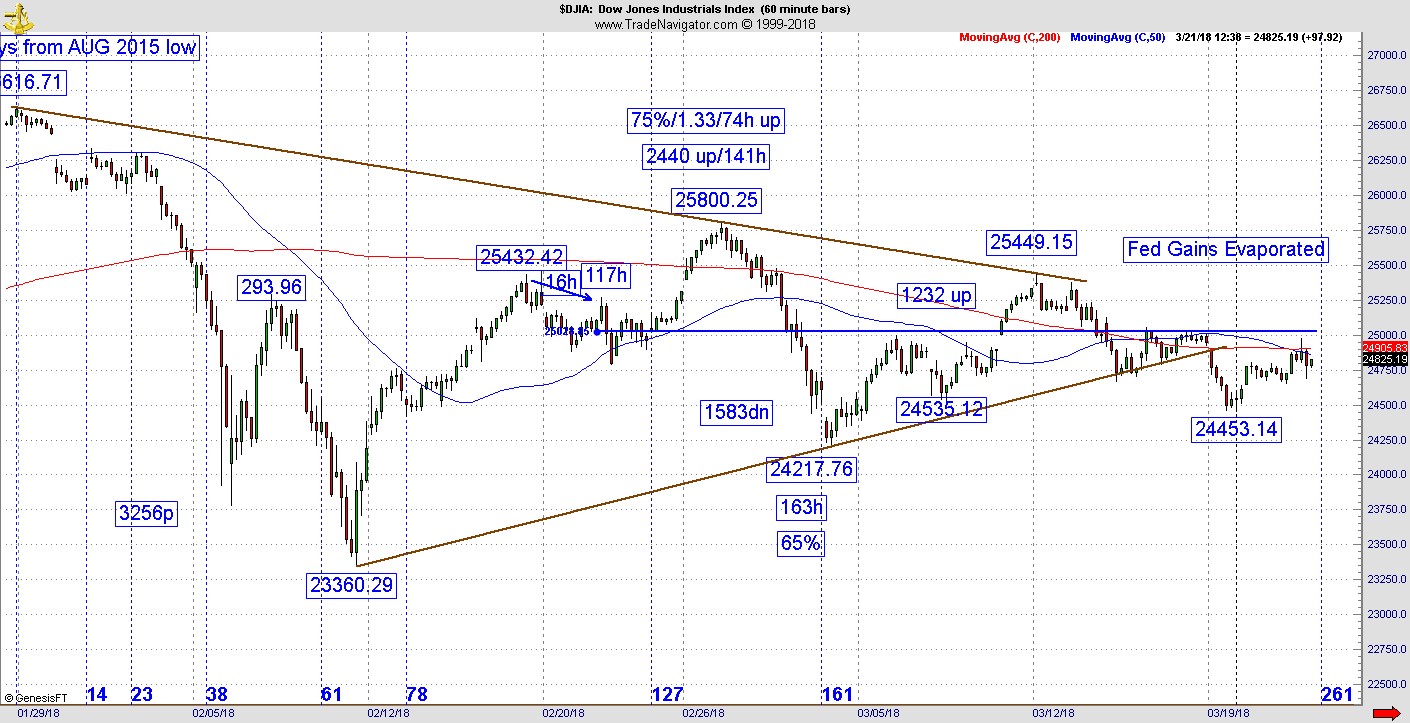

The one constant in all this has been the technical picture where the price action has held steady right below the balance line I’ve been discussing.

Keep in mind March 21 is the most important trading day of the entire calendar year for financial markets. Gann called it New Year’s Day for the market. He set his wheel where he calibrated market cycles on March 21 which is the change of season. The Dow Jones Industrials (DJI) has been choppy since February 21 when it hit 116 hours off the 26616 top and today was no different. Last week it hit 216 hours at basically the same latitude.

Last Friday the Dow wedged itself above the triangle line but along the balance line and on Monday it finally gapped through the triangle line to the downside. Since Monday they’ve been retesting this breakdown.

What I can tell you is we have two titanic forces colliding at the most important cycle point of the year. The good news is we are likely to get some relief and break out of this deadlock as early as Thursday. It is possible when the Dow hits 261 hours off the top it could finally loosen up. The question is whether it will be higher or lower?

Coming into the week, if the Dow played in the old NHL, it would have been considered a tie. That’s how close the technicals were.

Here are the issues. How many times over the past few years has the bull come to the ledge, looked into the abyss and didn’t jump? That’s the difference between a bull and bear market. Based on that alone, the bears must prove they deserve the benefit of the doubt. They haven’t done that yet. But there is always a first time.

A triangle at this stage of a pattern usually resolves to the upside and we do have room for one more wave to the 610-day window off the 2016 bottom which materializes in July.

On the other hand, the Elliott community will rightly tell you there is such a thing as a 5th wave truncation. A truncation can be a premature end to the last wave to the point it might not even materialize. From my experience, if a truncation where to happen, gravity would cause the next phase in the market to be severe. If a 5th wave of a bull doesn’t materialize, it usually means there is a severe underlying imbalance coming. You’ve heard about how the tide goes out prior to a tsunami? Same thing can happen in the financial markets.

Right now, the weight of the evidence started leaning bearish, but we need to get to the backend of this Gann window. Technically speaking, markets broke down prematurely on Monday, not a good sign. They didn’t give up to the point they could retest the breakdown, but markets were up a lot more during Powell’s press conference, not a good sign either.

It’s important to understand the unwinding of a bubble is a process. The Monday event was blamed on a new Facebook (FB) scandal.

If we lose that important FAANG stock leadership, it’s a bad sign for the market. So, while you can’t rule out the bull pulling back from the ledge, the weight of the evidence over time is getting bearish whether it breaks now or later in the year. Risk is very high because the future could be right now.

By the end of the session, the Dow gave back just about all the gains. Be sure to have stops in a strategic place as I’ve discussed in this column in recent weeks.