Many are wondering if the correction will resume. The best justification for a bull continuation is Amazon which hit new highs recently. Then we have the Dow Jones Transports which only retraced 62%, says Jeff Greenblatt, editor of The Fibonacci Forecaster Wednesday.

Here’s a test. Aside from the obvious difference what is the biggest difference between a bull and bear market?

Unlike many of my trading generation I did not get initiated in the old internet bubble go-go days. I learned the business in the bear market that followed. It was fascinating, I remember the Elliott people predicted a certain internet stock would drop from $85 to $15. Then it came true! As an important aside, this company did not disappear and is very successful today.

At one point in 2001 all one had to do was go short in the middle of the day and by the end of the day the market and most tech names were considerably lower. This condition materialized three times a week and continued for weeks, if not months.

But then it all changed. The market turned up in 2003 for good. What had worked during the bear no longer worked. This condition also rang true again in 2009 after the financial crisis.

The biggest difference other than the price destruction is when the bull comes to the ledge, it doesn’t jump. This was a very hard lesson for many traders who were conditioned to short every consolidation. No wonder W.D. Gann said a trader can’t become a true master until he has experienced two full bull and bear cycles.

As you know we had the biggest correction in recent memory in the beginning of the month. On average it was about 12%. It’s not so big but the biggest in two years.

On the bounce that followed many are wondering if the correction will resume. That’s not such an easy question given some areas will do better than others and certain stocks will hit new highs.

The best justification for a continuation of the bull is Amazon (AMZN) which hit new highs recently. On the other hand, we have the Dow Jones Transports (DJT) which only retraced 62% but the index is getting smashed. There are obvious divergences which is natural. When tops form, a key characteristic is the divergence which will mislead some.

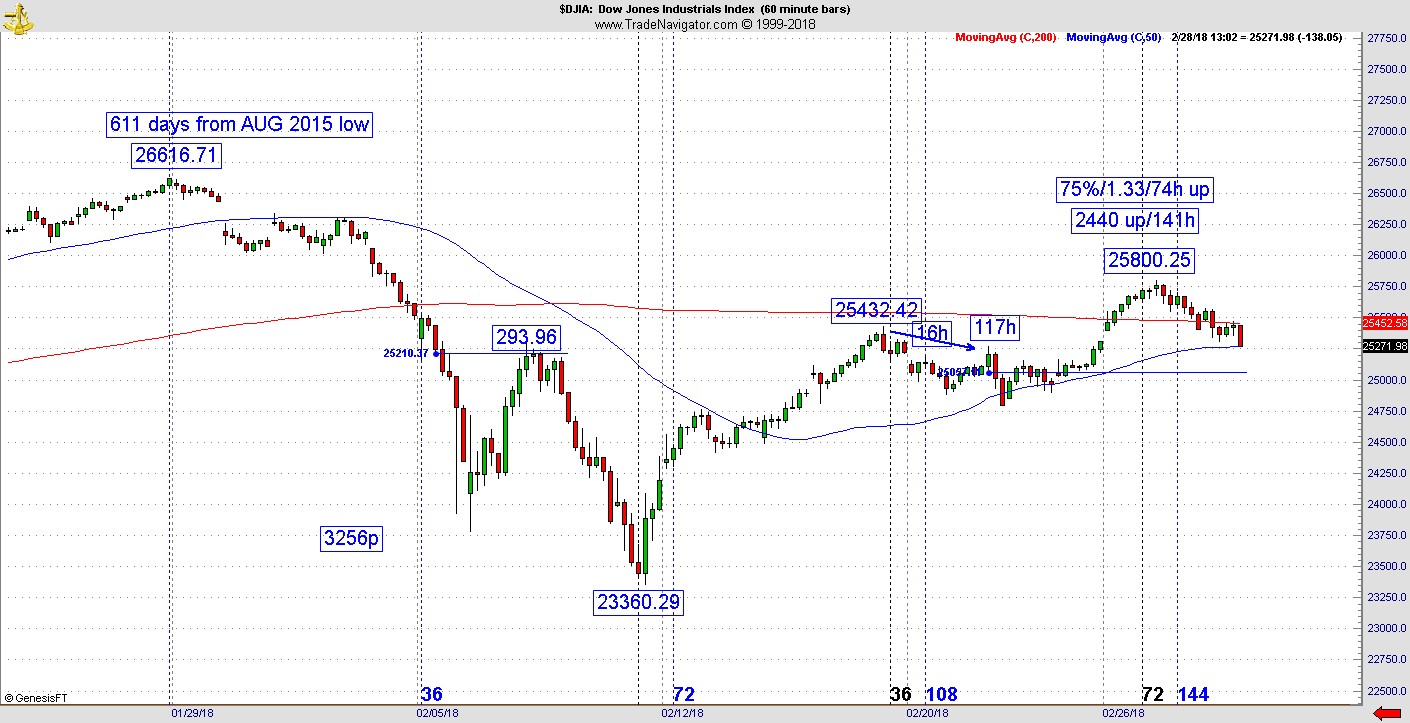

Let’s take a look at the Dow hourly. As you know it peaked at 26616 at 611 days from its August 2015 low. After the low was identified across all markets, the Dow retraced roughly 62% of the move down. What is important on this chart is the 117-hour mark from the 616-high last week which started rolling over.

Here is a chart that came to the ledge, and it even closed last Wednesday’s session with 2 red bars. Additionally, from the 432 high to the 117 hour point it was another 16 hours. If there ever was a chart set up to drop, it was this one.

Yet it did not. Having learned this lesson the hard way and the experience of two complete bull and bear cycles, I warned whoever was listening what the conditions were and how it didn’t necessarily have to drop. I’ve been there and done that too many times.

At the end of the week it stayed higher again. Now we come to another one of those forks in the road. There is another set of calculations this time at 2440 points up and 141 hours with a 75% retracement and 74 hours up. Analyzing square outs is part art and part science. I liked last week’s reading better, but this is still a setup that can do considerable damage.

What is the verdict this time? Part of my new work which I sampled here last week (How breakouts really materialize) is the balance bar. Part of the reason the breakouts I showed you worked is a result of a square out balance bar which is neither the high nor the low.

Right now, that 117 bar on the Dow is a square out vibration and could act as the balance bar. The territory of that bar could act as support and if it does not could lead to a considerable drop if it does not hold.

Right now, the area of the 116 bar should be a speed bump and quite possibly a barrier to any corrective phase once again picking up steam. By the end of the action right here, that sequence is being tested. This is what you should pay close attention to the rest of the week.