If we are to get a January consolidation, it may very well depend on some combination of oil, transportation stocks and Facebook, says Jeff Greenblatt, editor of The Fibonacci Forecaster.

Is this a case of the “here we go again” market? It certainly seems that way.

Markets came back from the MLK break Tuesday with the Dow promptly up over 280 points. But they gave all of it back by the end of the day. It’s the first time we’ve seen anything like that.

The psychology seemed to match. There are serious concerns about a government shut down Friday night. Throw in a new scandal as the Democrats tried to tie their DACA deal as a condition to keep the government open and markets started getting nervous. The government shut down is tied to the debt ceiling which needs to be extended.

By Wednesday the GOP said they could still kick the can down the road on their own for a few more weeks so markets took a deep sigh of relief.

But we have a different issue which materialized last Friday. Did you see where Facebook (FB) gapped down? This may have been tied to reports that Mark Zuckerberg intends important changes in the way they prioritize news and political content on a user’s individual timeline. I saw the report on WSWS.org and this change could be a new push to censor online information. Some of you may have already seen the shocking Project Veritas videos of how Twitter (TWTR) censors content they don’t like.

Let’s look at the chart. In this sequence for Facebook off the September low the first retracement is a 51% retracement. From that secondary low the high is 51 days. What I did is draw two connect the dots trend lines. They’ve already violated one and would need to violate the next in order to confirm the top.

Why is this so important? In 2017 we spent a lot of time with the FAANG stocks which are the major market leaders. You’ll recall how badly they got hurt in the near term last June when Goldman released a report suggesting these names were safe havens just like the bond market.

If we were to lose one like Facebook it could become contagious. The good news for bulls is FB gave an intraday buy signal on Wednesday morning which contributed to the tail on the candle.

Now we have to see how much gas is left in the tank. Originally when I saw this drop on Friday I thought it would likely go sideways instead of filling the gap. The logic is we may finally be experiencing the political discourse impacting financial markets.

After Tuesday’s action it appeared we could finally get that correction but like the New England Patriots, it’s not easy to see the stock market lose two days in a row. By now many of you know I’m the ultimate golden spiral aficionado. Since the Dow hit 26,000 I’m watching with great interest to see what happens if and when the Dow hits 26,180. We could very well be there Thursday.

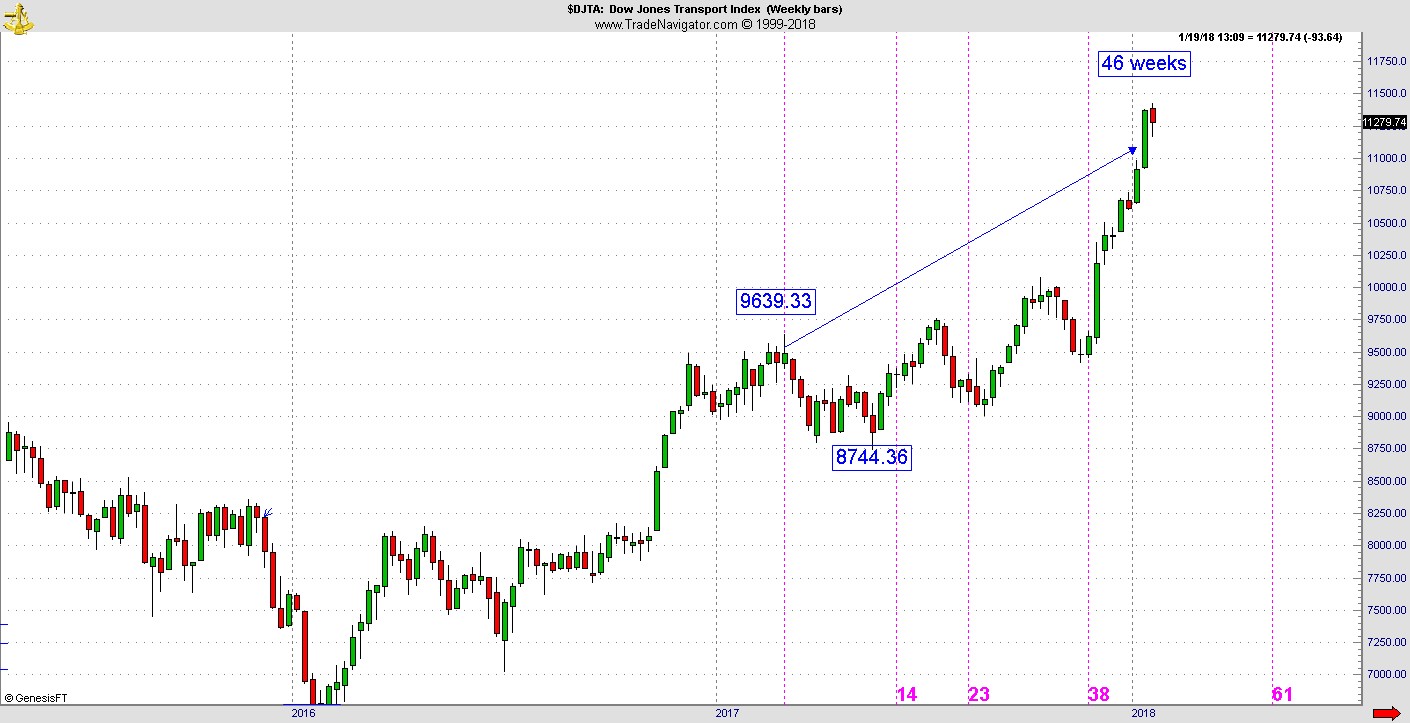

Two other conditions to be concerned about are the Dow Jones Transportation Average (DJT) and oil market. Oil has blown through its 261-day high to high cycle last week so that was negated.

But it is at the back end of the 144-day window and it did react yesterday. Transports has an interesting reading on the weekly chart with the 8744 low at 46 weeks high to high. This one has started to react but is stretching the rubber band. If we are to get a January consolidation, it may very well depend on some combination of oil, transportation stocks and Facebook.