If past is prologue, the Dow and S&P could extend their quarterly winning streaks in 2018, writes Andrea Kramer, managing editor at Schaeffer's Investment Research.

It's no secret that 2017 has been a banner year for stocks. While the major market benchmarks have cooled off amid light holiday-week volume and a recent dip for Apple (AAPL) stock, they're still set to put a big, bullish bow on 2017 this Friday.

In fact, the Dow Jones Industrial Average (DJIA) is still just one record close from making history, and both the Dow and S&P 500 Index (SPX) are pacing for their longest monthly win streaks since 1958 and 1983, respectively. In addition, the DJIA and SPX are eyeing their best quarterly win streaks in years. Below, we take a look at what this rare feat could mean for stocks in 2018.

DOW, SPX eye rare 9-quarter win streak

The Dow and S&P are set for a ninth straight quarterly gain -- a feat accomplished just a handful of times ever. What’s more, the Dow and SPX are up 10.5% and 6.5%, respectively, so far in the fourth quarter, pacing for their best quarter in four years.

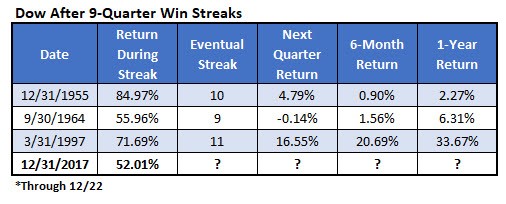

Looking back, the DJIA has recorded just three nine-quarter win streaks: in 1955, 1964, and the last in 1997, during the tech boom. In fact, that last quarterly win streak was the Dow's longest ever, ending after 11 straight quarters higher.

The S&P 500 has enjoyed four other nine-quarter win streaks, the last wrapping up in early 2015. Prior to that, the SPX recorded similar streaks the same years as the Dow: 1955, 1964, and 1997. Again, the tech-boom streak was the longest on record, lasting for 14 quarters.

What to expect in early 2018

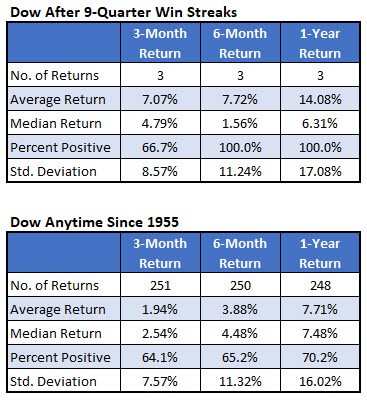

If history is any indicator, strength could beget strength for the Dow and S&P. After previous nine-quarter win streaks, the DJIA averaged a three-month gain of 7.07% -- more than three times its average anytime three-month gain of 1.94%, since 1955, according to data from Schaeffer's Senior Quantitative Analyst Rocky White.

Furthermore, the Dow was higher 100% of the time six months and a year after previous streaks, and the average one-year return of 14.08% is almost twice its average anytime return.

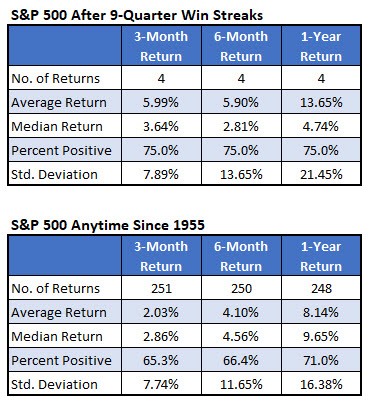

Likewise, the S&P 500 Index was in the black three, six, and 12 months after all but its last nine-quarter win streak, in 2015. That 75% win rate is higher than usual across the board.

Further, the index was up an average of 5.99% three months after all four streaks -- roughly three times its average anytime three-month return of just 2.03%, looking at data since 1955. Returns were also much bigger than usual six months and one year out, with the SPX higher 13.65%, on average, 12 months after nine-quarter win streaks, compared to 8.14%, on average, anytime.

However, it should be noted that the above numbers are highly inflated by the returns after the 1997 win streaks, wherein stocks skyrocketed over the next year as the dot-com bubble grew. Still, if past is prologue, the Dow and S&P could extend their quarterly winning streaks in 2018.