Short-term WDC options have rarely priced in lower volatility expectations -- which means entry costs are also low, while the leverage potential is high, says Elizabeth Harrow, at Schaeffer's Investment Research.

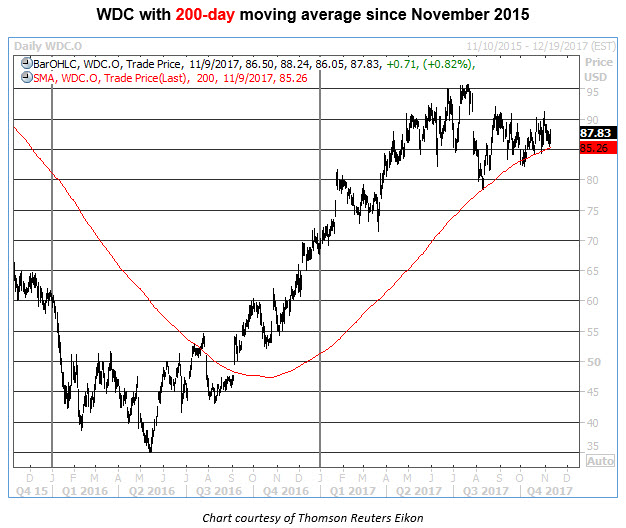

Data storage specialist Western Digital (WDC) has emerged as a force to be reckoned with in the red-hot tech sector, with the shares rallying about 30% year-to-date. Recently, the stock has undergone a period of consolidation -- but WDC's latest meet-up with its 200-day moving average provides a prime opportunity to take part in the security's next leg higher.

Schaeffer's Senior Quantitative Analyst Rocky White looked back at previous instances where WDC has traded consistently above its 200-day trendline, and found impressively bullish results. In fact, when WDC is trading less than one standard deviation from this moving average -- after having spent at least 60% of the last two months above the moving average, and closing at least eight of the last 10 sessions above it -- the stock's one-month returns fall into the "foolproof" category.

Looking back at the last four such signals for WDC, the stock sports an average five-day return of 1.2%, and is higher 75% of the time. And looking out one month (21 trading days) after a signal, WDC boasts an average return of 5.2%, with 100% of those returns positive.

And with Western Digital's quarterly earnings report in the rearview, now is a good time to buy premium on the stock's short-term options.

Schaeffer’s Volatility Index (SVI), a measure of front-month volatility premiums, currently stands at a tepid 33%, which ranks lower than 85% of comparable readings from the past 52 weeks. In other words, short-term WDC options have rarely priced in lower volatility expectations -- which means entry costs are also low, while the leverage potential is high.

Get Trading Insights, MoneyShow’s free trading newsletter »

There's some contrarian appeal to WDC, too, with palpable skepticism surrounding the outperforming stock. Short interest ramped up by 25.6% in the past two reporting periods, and is hovering near its highest point since February.

And during the past 10 days, speculative players on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 1.01 puts for every call on WDC. This ratio outranks 96% of others from the past year, as traders have rarely shown a stronger preference for bearish bets over bullish.

With the stock poised near historically powerful trendline support and plenty of room for new buyers to enter the market, now looks like an ideal time for a short-term bull play on WDC.