Micron Technology Inc. (MU) is bidding for leadership in high-bandwidth memory (HBM) technology with mass production of its 12-stack HBM3e. The chip will position Micron as a critical supplier to Nvidia Corp. (NVDA), and further its ambition to capture a larger share of the lucrative AI-driven memory market, suggests George Gilder, editor of Gilder’s Technology Report.

To cope with increasingly complex AI models, data centers require higher bandwidth throughout, from memory to processing, and more memory capacity. Micron’s 12-Hi HBM3E offers a significant performance uplift compared to existing 8-Hi HBM solutions, boosting power efficiency and processing speeds. The “3” in HBM3e indicates the third-generation standard. The “8” or “12” Hi indicates how many layers of memory are stacked on top of each other.

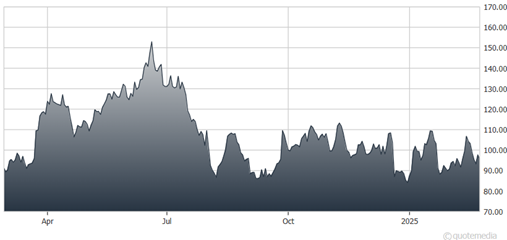

Micron Technology Inc. (MU)

Micron finalized the development of its 12-stack HBM3e in September and has already supplied samples to major AI chipmakers, including Nvidia. Speaking at a recent Wolfe Research event, Micron’s CFO Mark Murphy emphasized the product’s advantages, highlighting 20% lower power consumption and 50% greater capacity than a competitor’s 8-stack HBM product. These specifications are critical for AI workloads that demand higher memory bandwidth and power efficiency.

The HBM market, driven by the AI boom, is expected to grow exponentially for the next several years, with shipments increasing from just 1.2 billion gigabits in 2022 to an estimated 38 billion gigabits by 2027. This surge is driven in part by the more than four times greater capacity of 12Hi HBM3e compared to the HBM2 generation. HBM4 will double capacity again.

For investors, the takeaway is clear—HBM suppliers remain poised for strong revenue growth, with SK Hynix and Micron standing out as key players capitalizing on this AI-driven demand surge. Nvidia’s sustained leadership ensures a robust demand for HBM, while secondary players like Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), and Microsoft Corp. (MSFT) provide further upside potential.

Recommended Action: Buy MU.