Warren Buffett, legendary investor and CEO of Berkshire Hathaway Inc. (BRK.A), wants everyone to know that he remains a long-term bull on US stocks. In his annual letter to Berkshire shareholders, he appeared to be responding to the many news headlines emphasizing Berkshire’s growing cash position, writes Sam Ro, editor of Tker.co.

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” Buffett said in his new annual letter to Berkshire Hathaway shareholders. “That preference won’t change.”

Berkshire’s cash pile grew to $334 billion in 2024, up from $167.6 billion the year prior. Buffett acknowledged that the value of marketable equities — companies that continue to trade publicly in the stock market — held by Berkshire declined last year.

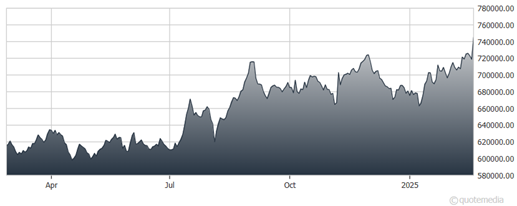

Berkshire Hathaway Inc. Class A (BRK.A)

But he also took a more holistic view of Berkshire’s portfolio, which includes 189 companies that Berkshire owns. These are companies that don’t trade on the stock market like GEICO, Precision Castparts, BNSF, Pilot Travel Centers, Clayton Homes, and Fruit of the Loom.

“While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio,” he wrote.

Commentators can read into Berkshire’s quarterly and annual tweaks however they like. However, Buffett’s long-term optimism for American business hasn’t changed, which is why he’d rather invest in stocks than bonds or cash.

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance,” Buffett wrote. “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.

None of this is to suggest stocks will only go up from here. Buffett would be the first to tell you he has “not been good at timing” the market.

In fact, one of his most bullish essays, a New York Times op-ed titled “Buy American. I Am,” came just before the S&P 500 fell another 26% before ultimately bottoming in March 2009. But the thesis of his piece ultimately held, and those who bought US equities at the time did extraordinarily well in the years to follow.

While investors should always brace for short-term volatility, they should also stay focused on the long game, which remains undefeated.