Hess Midstream LP (HESM) is an attractive income investment with intriguing upside at its recent $35.81 share price. This Master Limited Partnership (MLP) operates midstream – from the well pad to the gathering system, processing and storage, terminaling, and export facilities, notes Martin Fridson, editor of Forbes/Fridson Income Securities Investor.

Its integrated systems in crude oil, natural gas, and water services serve both its largest shareholder, Hess Corp. (HES), and third parties. HESM’s assets are located primarily in the Bakken and Three Forks shale plays in the Williston Basin area, which is one of North America’s most prolific crude oil basins.

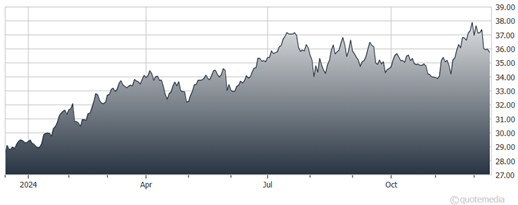

Hess Midstream LP (HESM)

The partnership is 37.8% owned by HES, 20.7% owned by Global Infrastructure Partners, and 41.5% by public shareholders. Hess is being acquired by Chevron Corp. (CVX) for $53 billion. The acquisition, which was scheduled to close during the first half of 2024, has been delayed. Boards of both companies and shareholders, however, approved the transaction in late 2023 and early 2024, respectively. The Federal Trade Commission approved the deal in September 2024.

A few hurdles remain, including arbitration issues with Exxon Mobil Corp. (XOM). The arbitration hearings concern preemptive rights in the Stabroek Block (Guyana Properties) joint operating agreement. Exxon Mobil claims the agreement gives it the right of first refusal on Hess’s Guyana properties. We expect that this issue will be resolved and not derail the transaction, which is now likely to be a 2025 event.

Assuming the deal closes, Chevron will acquire Hess’s 37.8% ownership of HESM. It remains to be seen, though, whether Chevron will seek to acquire the remainder of the outstanding HESM shares. We expect that CVX will try to acquire HESM’s outstanding public shares at a premium to the prevailing market price.

Even if that does not happen, HESM possesses favorable investment characteristics. Over the past seven years, its distribution has grown at an 11.95% compound annual growth rate, with no interim reductions. The MLP recently sported a 7.66% indicated yield. As for valuation, its P/E ratio, at 15.16x, is slightly below the Alerian MLP Index’s 15.76x.

Subscribe to Forbes/Fridson Income Securities Investor here…