How would you like to invest in one of the most-powerful storylines we’re watching at Stock Picker’s Corner, earn nearly 9% on your money, AND watch that payout march higher at an average annual pace of 6.3%? That’s what you get with Ares Capital Corp. (ARCC), highlights Bill Patalon, chief stock picker at Stock Picker’s Corner.

Ares is a Business Development Company (BDC) and a player in what I’ve nicknamed “The Private Equity Tidal Wave.” The Park Avenue-based firm has been around for 20 years and lends money to – and takes ownership stakes in – businesses. Those businesses are involved in technology, health care, media, power generation, and services in the financial, professional, consumer, and insurance arenas.

Its portfolio contains 535 companies (240 of them with private-equity backing) and has a fair value of roughly $26 billion. This is a big deal. Investing opportunities are changing. And investors need to change – or get left behind.

Ares Capital Corp. (ARCC)

When I talk about private equity, or PE, I’m referring to investment partnerships that controlled $8.2 trillion last year, says consultant McKinsey & Co. And it’s more than just dollars: I’m also talking about a true “paradigm shift” in how money is — and will be — invested.

Companies are staying “private” longer — and many aren’t going public at all. According to a recent report, the number of US companies trading on the key exchanges peaked at 7,300 back in 1996. That number has been cut by nearly half — to about 4,300. And it’ll be halved again in the 20 years to come. At the same time, the number of private firms has zoomed nearly sixfold — from 1,900 to 11,200.

BDCs like Ares Capital provide the financing “fuel.” Think of a BDC as a kind of closed-end investment firm that provides debt and equity to small- and mid-market companies. BDCs operate a lot like PE or venture capital (VC) firms. But while PE and VC firms accept investments only from wealthy folks, BDC shares are publicly traded, meaning anyone can invest if they want to.

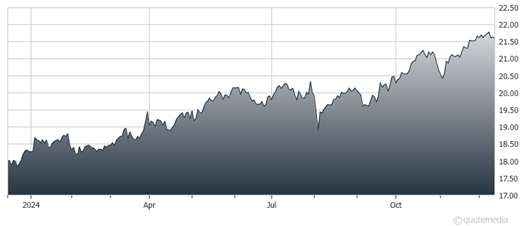

At a recent share price of $22, Ares Capital’s $1.92 annual payout equated to a yield of about 8.7%. That represents “real” income. And the company has regularly boosted its payouts – an average growth rate of 6.3% over the past three years.

Back in 2020, when it was trading at $18 with a $1.60 payout, the yield was a fairly similar 8.9%. But if you bought it back then, and still owned it today, your “yield on cost” ($1.92 current dividend on that $18 purchase price) would be a hefty 10.7%. Indeed, the average yield over the past five years was an alluring 9.27%.