Expect the coming year to be about refocus. In the ever-evolving tech landscape, today's laggards could be tomorrow's leaders. Executives at Intel Corp. (INTC) will adapt to the corporate hurdles faced in 2024, advises Joe Markman, editor at Digital Creators & Consumers.

As 2025 begins, we are looking beyond last year’s behemoths for the next big opportunity: The overlooked powerhouses of the semiconductor world.

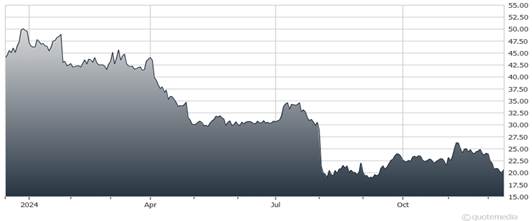

Intel Corp. (INTC)

Intel lacks the management credibility of companies like Monolithic Power System Inc. (MPWR), and its product is no longer best-in-class, like at ASML Holding NV (ASML). However, the opportunity is nonetheless compelling.

Intel is undergoing an aggressive restructuring, and renewing its focus on AI and edge computing, after several years of poor corporate performance. The company is honestly too important to fail.

Semiconductors, and their production, are now important components of national security. Too much production is concentrated in Asia. The US needs a strong national player, and that company is necessarily Intel.

At a recent share price of $21, the stock was trading at 21 times forward earnings and only 1.6 times sales. The stock could easily double in 2025.