Power Solutions International, Inc. (PSIX) designs, engineers, manufactures, and sells a broad range of advanced, emission-certified engines and power systems that are powered by a wide variety of clean, alternative fuels, including natural gas, propane, and biofuels, as well as gasoline and diesel options. It serves the power systems, industrial, and transportation end markets, says Nicholas Vardy, editor of Microcap Moonshots.

Power Solutions International Inc. (PSIX)

The company’s products are primarily used by global original equipment manufacturers (OEMs) and end user customers. Here are three bullish points to consider:

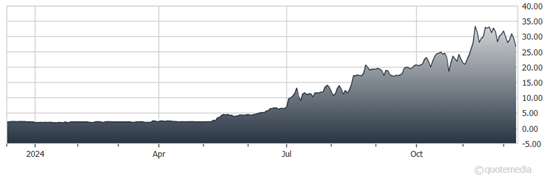

1. Exceptional Market Momentum: PSIX has a MomentumRank of 99, with a 1-year stock price increase of 966%, showcasing remarkable investor confidence and strong market performance. This meteoric rise reflects the company’s ability to capitalize on favorable market conditions and deliver substantial returns to shareholders.

2. High Profitability Metrics: The company boasts a Return on Equity (ROE) of 364.8% and an Operating Margin of 15.76%, demonstrating significant operational efficiency and profitability. These metrics underline the company’s ability to generate robust earnings from its core operations while maintaining tight control over costs.

3. Growth Potential with Undervaluation: PSIX has a forward P/E ratio of 9.4 and a PEG ratio of 0.8, indicating growth potential at an attractive valuation. This suggests that the stock is undervalued relative to its growth prospects, offering an appealing entry point for investors focused on long-term gains.