Not long ago, Heliostar Metals Ltd. (HSTR.CA) was a highly regarded gold exploration company. In a seeming flash, however, it evolved into project development and now gold production, observes Brien Lundin, executive editor of Gold Newsletter.

Consider that, over just the last 18 months, the company has added 3.5 million gold ounces in the measured and indicated categories, two producing mines, and two new planned production centers — all for a total cost of just $15 million. It’s all part of Heliostar’s plan to become a mid-tier, 500,000-ounce annual gold producer by 2030.

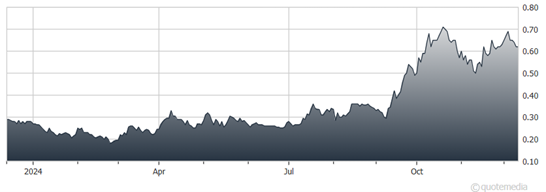

Heliostar Metals Ltd. (HSTR.CA)

That plan got a huge boost in July 2024 when the company struck a deal to buy former Argonaut Gold mines in Mexico for just $5 million. The deal gave Heliostar two active gold mines in Mexico, La Colorada and San Agustin. Both are small-scale producers near the end of their mine lives, but both have some potential for further work to extend their productivity.

Totaling it all up, the company’s production and development portfolio now boasts 580,000 ounces of gold in mineral reserves, 3.5 million ounces in measured and indicated resources, and one million ounces in inferred resources. Heliostar paid less than $1.80/ounce of gold all-in for the acquisition of those resources and reserves.

While the production assets are providing key revenues and have significant potential to grow production, the jewel in Heliostar’s crown is the high-grade Ana Paula project. Ana Paula boasts over 700,000 ounces of measured and indicated gold resources at an average grade of 6.60 g/t gold, plus another 447,000 ounces of inferred resource at 4.24 g/t.

But it’s getting even bigger, with drilling expanding not only the known High-Grade Panel zone, but also outlining the recently discovered Parallel zone. Recent drill results were highlighted by an amazing intersection of 87.8 meters of 16.0 g/t gold, including 16.1 meters of 71.8 g/t gold.

The possibility that drilling will expand the high-grade resources, combined with the producing assets that are about to come online elsewhere in Mexico, makes Heliostar Metals not only a powerful lever on rising gold prices, but also a bet on a steep resource and production growth curve.

Much of that growth is set to come over the coming months, making Heliostar one of my top picks for 2025.