While Electric Vehicles (EVs) could potentially lose tax credits, Rivian Automotive Inc. (RIVN) Rivian has had a few blistering headlines in the last few years. We believe that lower ticket prices and the potential for higher gas prices will bring EVs back into favor regardless, advises Michele “Mish” Schneider, chief strategist at MarketGauge.

First, Rivian earned $6.6 billion in a loan from the Feds for a new manufacturing facility in Georgia. It will give them the capacity to increase annual production to 400,000 vehicles.

Second, Volkswagen and Rivian entered an agreement where VW is investing $5.8 billion as part of a 50% stake in developing vehicle software, including battery modules. Rivian can also now use Tesla Inc.’s (TSLA) superchargers.

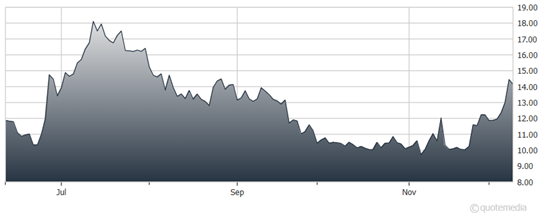

Rivian Automotive Inc. (RIVN)

This money will allow Rivian to launch the R2 SUV with a targeted $45,000 starting price.

Amazon.com Inc. (AMZN) also ordered 100,000 Rivian vans through 2030. Plus, it holds a 15% stake, making Amazon Rivian’s biggest shareholder. While Rivian has halted production of the Amazon electric vans because of a parts shortage, the plan is to make up for the missed production.

That Rivian is made in America puts the company in a better position given potentially higher tariffs on imported EVs. We would like to see the stock hold $11 per share. A breakout over $15 could take this stock to $21 and beyond.