Our “Buy” rating on Morgan Stanley (MS) reflects expectations for strong revenues from capital markets businesses in 2025. We see a healthy environment for the company’s Wealth Management franchise, which is nearly 50% of revenues, as record equity market valuations and good inflows all lead to higher assets under management, notes Stephen Biggar, analyst at Argus Research.

Meanwhile, we look for at least a 20% rebound in investment banking activity. The change in US presidential administrations should result in a less-onerous regulatory environment for approvals of mergers and acquisitions, while elevated equity valuations lead to a release of pent-up demand for initial public offerings after three years of muted activity. Debt issuance should also benefit from lower interest rates.

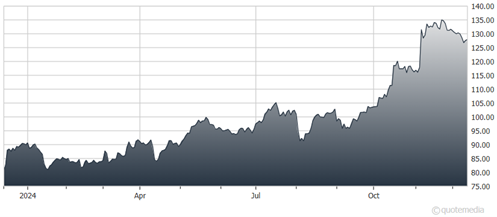

Morgan Stanley (MS)

The company has outlined several operating strategies, including gaining market share, expanding the client base and deepening relationships, realizing acquisition synergies, demonstrating operating leverage, and returning excess capital.

Long-term financial targets include a Wealth Management pretax margin of 30%-plus, a firm-wide efficiency ratio of less than 70%, and a return on tangible common equity of 20%, which would be best-in-class among industry peers.

We expect the stock's valuation to improve as investors recognize the greater earnings stability and cross-selling capabilities of the broader franchise. A more durable rebound in investment banking should further aid the valuation multiple.