One of the best-quality players in the gold arena is Agnico Eagle Mines Ltd. (AEM). Given what I see as an ongoing demand boom for the yellow metal in the coming year, AEM is my top pick for 2025, writes Clif Droke, editor of Cabot Turnaround Letter.

Canada-based Agnico is the world’s third-largest gold miner, with a pipeline of high-quality exploration and development projects in the US, Canada, Mexico, and Columbia. It also owns Canada’s top two biggest gold operations — the Canadian Malartic mine and the Detour Lake project.

A big part of Agnico’s long-term growth plans is the firm’s 100% owned Canadian Malartic mine, located in the heart of Québec's Abitibi Gold Belt. The mine is being transformed from Canada’s second-largest operating gold mine to its largest underground mine, with 15 million ounces of resources being added since 2019.

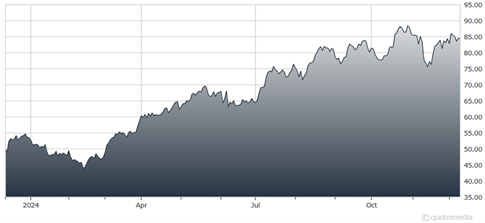

Agnico Eagle Mines Ltd. (AEM)

Meanwhile, the company recently unveiled plans to expand production at Detour Lake in Ontario to one million gold ounces annually over a 14-year period, starting in 2030. Management sees an opportunity to transform the asset into one of the top five gold mines in the world by output, with the development of an underground mine to complement Detour’s existing open pit mine.

Additionally, exploration trends at Agnico’s Odyssey and Hope Bay mines have been positive in recent quarters.

On the financial front, the past year’s significant increase in gold prices, along with solid production and cost control, has led to expanded profitability and cash flow for Agnico. That has allowed the firm to return approximately $700 million directly to shareholders through dividends and share buybacks in the first three quarters of 2024 (and $1 billion indirectly via a reduction of net debt).

For full-year 2025, Wall Street expects earnings to increase to $5.10 per share compared to last year’s $4.15 per share. I expect that will prove to be too conservative given the secular strength behind gold prices.