For conservative investors, water utility Essential Utilities Inc. (WTRG) has resolved water and natural gas rate cases favorably in its most important state, Pennsylvania. As a result, management has restored its robust long-term earnings and dividend growth guidance of five percent to seven percent a year, writes Roger Conrad, editor of Conrad’s Utility Investor.

Regulatory support is key for the utility’s $7.8 billion in planned utility capital spending through 2029. That would fuel annual rate base growth of 11 percent and 6 percent for its natural gas and water operations, respectively. And it’s in addition to Essential’s aggressive water utility acquisition strategy.

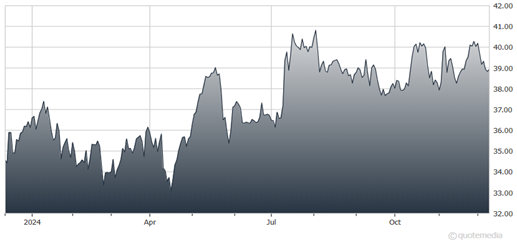

Essential Utilities Inc. (WTRG)

A bankruptcy court judge was recently holding up the pending $276.5 million purchase of the DELCORA wastewater system. But the company has other deals in the works that will add another 400,000 customers, easily ensuring the target of two percent to three percent annual growth.

Essential will release its Q4 results and update guidance on Feb. 21. In the meantime, it raised 2024 earnings guidance to “exceeding” the top of the previous range. My 12- to 18-month target for the stock is a return to the high $40s.