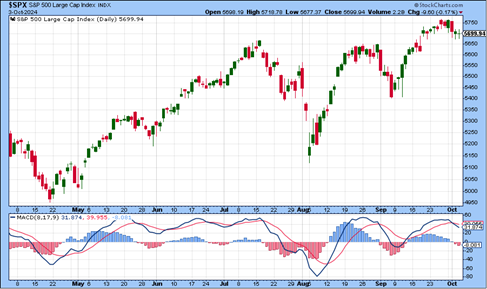

Thus far, this year’s “Worst Months” have been choppy – with declines in late-July/early-August, a second round at the start of September, and again here at the beginning of October. Current weakness appears to be setting up nicely for our annual Seasonal MACD “Buy” signal, highlights Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

The Dow Jones Industrial Average and S&P 500 have even closed at new all-time highs, but the Nasdaq and Russell 2000 have not. The market has proven resilient, quickly rebounding following each bout of weakness, and it is likely to do so one more time here in October.

(Editor’s Note: Jeff Hirsch is speaking at the 2024 MoneyShow Masters Symposium Sarasota, which runs Dec. 5-7. Click HERE to register)

As of last Thursday’s close, our Seasonal MACD Buy Signal was still on Hold. Faster moving 8-17-9 MACD indicators applied to DJIA, S&P 500, and Nasdaq were negative.

The criteria to issue our Seasonal MACD Buy Signal is:

1. A new buy signal crossover using our 8-17-9 MACD indicator AND

2. The crossover must occur on or after the first trading day of October AND

3. Dow, S&P 500, and Nasdaq MACD indicators must all agree.

Recently, it would take single-day gains of 748.55 Dow points (1.78%), 116.50 S&P 500 points (2.04%), and 440.15 Nasdaq points (2.46%) to turn all three MACD indicators positive. Continue to hold defensive, “Worst Months” positions. When all of the above criteria have been met, it will be time to act.