A lot of people use Facebook, Instagram, and WhatsApp daily. Almost 50% of all people use Meta Platforms Inc. (META) every single month. But is the stock an interesting investment? Let’s find out by going through part of my 15-step approach to analyzing companies, observes Pieter Slegers, editor of Compounding Quality.

1. Do I understand the business model? Facebook was created in 2004 in a Harvard dorm room by a 19-year-old student. His name? Mark Zuckerberg. Over the years, Meta has grown into a global technology company that owns big social media platforms like Facebook, Instagram, and WhatsApp.

97.7% of Meta’s revenue is made through advertising. Businesses pay Meta to show ads to users on their platforms. So, an advertiser pays Meta every time you click or even look at an ad.

2. Is management capable? Mark is the founder, chairman, and CEO of Meta Platforms. Together with his roommates Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes, they started “TheFacebook” on February 4, 2004.

It was meant as an online community where Harvard students could connect and share information. Today, almost 50% of the entire world population uses Meta Platforms.

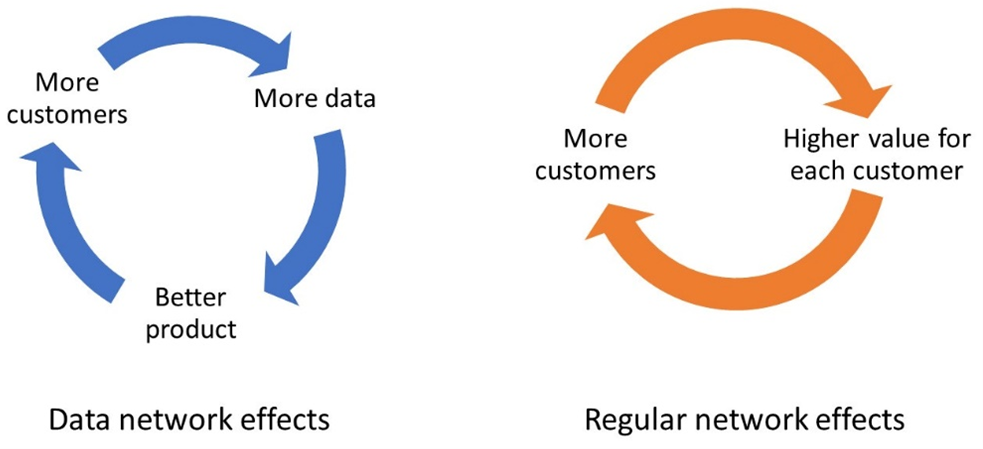

3. Does the company have a sustainable competitive advantage? Meta has a competitive advantage for sure. The company’s moat is based on network effects (our favorite competitive advantage).

4. Is the company active in an attractive end market? Social media is a very attractive end market. The social media app market is expected to grow significantly in the years ahead. Global adoption of 5G technology is the driving force behind this. According to Statista, Meta owns three out of the four biggest social media platforms by monthly active users (Facebook, Instagram, and WhatsApp).

This and the remainder of my analysis results in a Total Quality Score of 7.9/10 for Meta.