The Federal Open Market Committee (FOMC), the decision-making committee of the Federal Reserve, cut the federal funds rate by 50 basis points in mid-September. This is a big deal because the funds rate serves as the benchmark for important interest rates in real life. But it’s important for investors not to be too complacent, says Scott Chan, editor at Investing Daily.

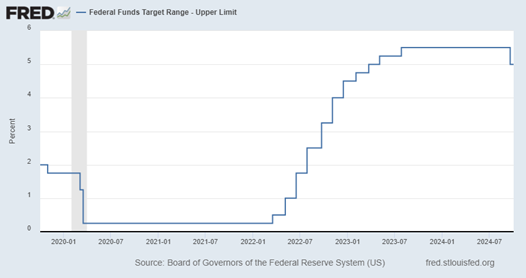

High inflation since the pandemic had caused the Fed to increase the rate from zero to more than 5% in recent years. This was the first cut since 2020. All things equal, lower interest rates are a positive for the stock market.

When interest rates are high, alternatives to equity, such as Treasury securities, pay a higher interest rate. Since US government debt is regarded as “riskless” (whether we agree or not is another story), this means that you could get a relatively high return for not taking on risk. In other words, if you hold the security to maturity, you know you will get back the face value of the bond. This makes stocks, which are considered riskier due to the high variability of returns, less attractive.

Additionally, higher interest rates mean the cost of debt and financing is more expensive. When businesses make investments, often they need to borrow money because either they don’t have the necessary cash on hand or they need to use cash elsewhere.

The same can be said for most individuals and families who have to spend on a big item. Imagine if you cannot take out a mortgage to buy a house. Very few Americans would be able to afford one. Thus, when financing costs go up, it tends to reduce business and household spending alike.

And when business activity is low, that usually means sales and earnings growth aren’t good either, and the economy could end up in a recession. That’s not good for the stock market.

In short, lower interest rates encourage spending and make stocks more appealing. But investors need to pay close attention to inflation trends.

High inflation puts pressure on Fed officials to raise rates. Recently, lower inflation readings have allowed the Fed to pull the trigger on rate cuts. However, if inflation picks up again, it could force Fed officials to go the other way again.

For example, the Middle East, important for its oil but always a hotbed for geopolitical tension, is inching closer to all-out war as the ongoing conflict between Israel and its Arab neighbors is escalating. We saw what supply disruption can mean for inflation when Russia invaded Ukraine.

If war expands to the point of disrupting the Middle East’s oil supply, it would likely bring about another bout of high inflation and force the Fed to reverse course. Therefore, it’s important not to be complacent just because the Fed cut rates last month. Stay vigilant.