Recent comments from Fed Chairman Jerome Powell — framing two quarter-point cuts for the Nov. 7 and Dec. 18 meetings — would put the federal funds rate at 4.25%-4.50% by year-end. In this scenario, I like the VanEck Preferred Securities Ex-Financials ETF (PFXF), writes Bryan Perry, editor of Cash Machine.

PFXF seeks to replicate the performance of the ICXE Exchange-Listed Non-Financial Preferred Securities Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark. It’s intended to track the overall performance of US exchange-listed hybrid debt, preferred stock, and convertible preferred stock issued by non-financial corporations.

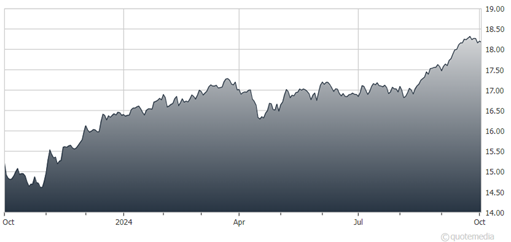

VanEck Preferred Securities Ex-Financials ETF (PFXF)

Total assets in PFXF are $1.9 billion spread over 101 holdings, and it had a recent yield of 6.9%. Utilities and telecommunications occupy the top spots within the fund’s holdings, and dividends are paid monthly. Total operating expenses are 0.40% per year.

This is an attractive way to add diversification to a fund invested in non-financial sectors with a heavy emphasis on US corporations.

Recommended Action: Buy PFXF.

Subscribe to Cash Machine here...