Over the past several days, China has unleashed several fiscal and monetary stimulus measures. China investor Jason Hu called these the "twin bazookas" policy of "[p]rint money and spend money." It's having an immediate effect, at least on stock prices. The question now is whether this rally is sustainable, writes Ed Yardeni, editor of Yardeni QuickTakes.

The Shanghai CSI 300 is up 27% since its low on September 17 (the day before the Fed's 50bps rate cut). The Shenzen Real Estate Stock index has surged 44%. The question now is whether this is just a short-term bounce after sentiment toward Chinese equities reached extreme pessimism. Investor David Tepper on Thursday, Sept. 26, said on CNBC to buy "everything" related to China.

(Editor’s Note: Ed Yardeni is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

Time will tell if these twin bazookas shoot the silver bullets needed to revive China's weak consumer demand and ailing property rubble. Speaking of silver bullets, it's the copper bullet that will likely signal how well the economy is taking to the stimulus. The nearby copper futures price is up 11% over the past month but fell by 1.3% Monday. Copper is highly correlated with the Chinese economy and stock market.

Not only was copper lower, but the iShares China Large-Cap ETF fell 1.1% even after Hong Kong's Hang Seng index rose 2.4% overnight. There are likely several contributors. The Caixin China M-PMI fell 1.1 points to 49.3 in September, its lowest level since July 2023. Meanwhile, China's official NM-PMI fell from 51.6 to 50.3, its lowest reading since September 2023.

Fed Chair Jerome Powell's speech Monday also suggested the Fed may not cut interest rates as aggressively as the financial markets expected. The 2-year US Treasury yield jumped nearly 10 basis points. Recall, China fired its monetary bazooka immediately after the Fed's 50 bps cut. Less Fed easing might mean less room for China to ease.

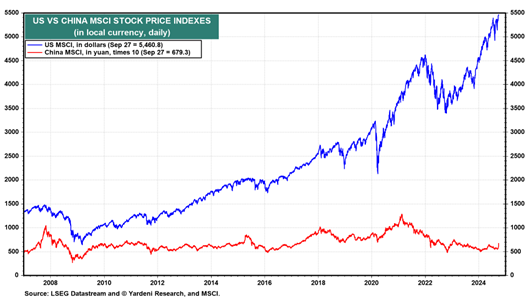

Seeing the forest for the bamboos, our recommendation to overweight US stocks and underweight Chinese stocks has been a good strategy for a long time, as the chart above shows. We aren't ready to change our position, for now. We continue to believe that Chinese consumer spending will remain structurally weak.