Chinese stocks just notched their heftiest single-day gains in 16 years — apparent proof that Beijing hit the bullseye with its stimulus bazooka. Investors are scrambling to board the “China Stock Market Express.” One way to play it is the KraneShares CSI China Internet ETF (KWEB), advises Bill Patalon, chief stock picker at Stock Picker’s Corner.

The Shanghai Composite Index was recently up 21.4% since last Tuesday — the day China’s $114 billion stimulus package was unveiled. That’s the best five-day surge since 1996. Indeed, the Red Dragon’s CSI300 blue-chip index is now up almost 30% from its February lows — with more than 25% of that burst coming since Tuesday.

As part of the recent stimulus announcement, the People's Bank of China's (PBOC) unveiled two “tools” that can boost that country’s financial markets — including a “swap program” that’ll make it easier for insurers, institutional funds and brokers to access cash to buy stocks.

That won’t solve some of China’s other issues. But China isn’t going away, either. A “long” view — coupled with my “Accumulate” strategy — is the way to navigate that tug of war between long-term upside and near-term risk.

That brings me to KWEB. If you have some extra cash — and are truly willing to take the long ride — this is a way of profiting from a high-growth (but volatile) slice of the Greater China Economy. KWEB invests in China’s Internet counterparts to Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), Meta Platforms Inc. (META), and others.

Retail web sales in China came in at $2.1 trillion in 2023 – nearly double America’s $1.1 trillion, according to data from Statista.com and the US Commerce Department. China’s “Internet population” was 1.09 billion people last year – a penetration rate of 77%. In America, that population reached 311.3 million – with a penetration rate of 93%.

That means China’s “Internet economy” is already three times the size of its US counterpart — but still has plenty of room to expand. KWEB’s holdings include shares in such companies as Alibaba Group Holding Ltd (BABA) and JD.com Inc. (JD), as well as other companies like Baidu Inc. (BIDU) and PDD Holdings Inc. (PDD). As part of the recent stimulus announcement, the PBOC unveiled two “tools” that can boost that country’s financial markets — including a “swap program” that’ll make it easier for insurers, institutional funds and brokers to access cash to buy stocks.

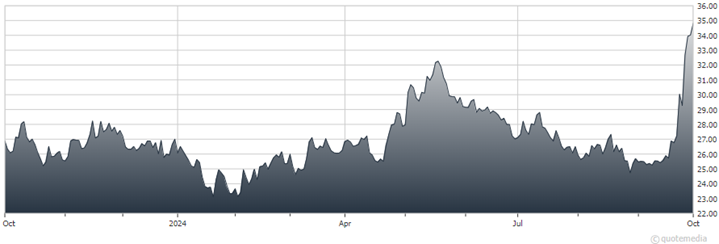

Before the most recent run, which took KWEB’s share price up 28%, analysts were projecting a one-year price increase of about 30%. Expect those forecasts to increase – perhaps even past the current “high” target of $40.67. View this as an investment to “put away for the long haul.”

Recommended Action: Buy KWEB.