The GameChangers portfolio is so hot right now that it’s bending the “efficient frontier” that helps me compare our performance to the market as a whole. All it took was a little confidence from corporate leadership in the strength of their operations...matched with a little confidence from investors in what they’re hearing from corporate leadership. Five Below (FIVE) has finally turned around, too, notes Hilary Kramer, editor of GameChangers.

It’s a great change. Our companies have always had great quarterly numbers to brag about, or else they would never have found their way to the Buy List in the first place. Now, however, Wall Street is finally back in the mood to appreciate the growth those numbers really represent.

Growing companies normally deserve higher market capitalizations. At least that’s the long-term reality, even if it got a little forgotten in the last few years of Fed dread and economic anxiety. With the right business plan, you can defy interest rates, inflation, and even a recession.

The S&P 500 and NASDAQ are up about 1.5% to 2% in the past week. Our stocks have leaped 12.5% in the aggregate. Maybe you’re one of those investors who is always looking over your shoulder at the “Magnificent 7?” We’re beating them by five percentage points this earnings season.

In theory, we could liquidate everything now and walk away ahead of the game. If you feel like our stocks can’t justify their current levels and will never move higher, this is an opportunity to take a little money off the table. I won’t judge you. You’ve earned it.

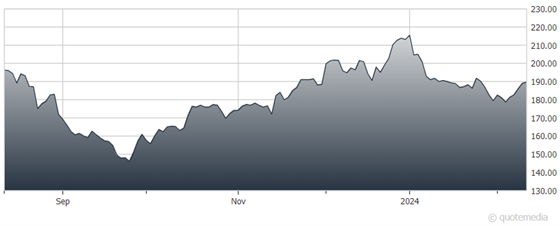

Five Below (FIVE)

But I’m hanging on for even better exits to come. For one thing, the market itself is back in record territory. The clouds of 2022 have lifted. One way or another, inflation and interest rates are going down. And our stocks in particular have proved that they can maintain healthy expansion through the economic storms.

In a gloomy world, companies like these wield disruption like a competitive weapon. If the economy falters, they’ve already defied the undertow. And if money starts flowing more freely, they’ll do even better.

As for FIVE, it’s in rally mode now. I’d be shocked if it doesn’t at least retest $195 in the near future. We refused to sell at $215 because I wanted more. As remarkable as it seems, we’ve only been here since October, so could theoretically give the position a couple more quarters to give us that “more.”

How much more? When we hit $215, we’ll have a better sense of the possibilities.

Recommended Action: Buy FIVE.