The debt ceiling agreement was approved, despite high-decibel dissentions. With this debate now sidelined until 2025, investors can redirect their attention to the upcoming June 13-14 FOMC meeting, notes Sam Stovall, chief investment strategist at CFRA Research.

After last month’s meeting, it seemed certain the Federal Reserve signaled that it would pause its rate tightening program. Friday’s Fed funds futures still pointed to a 67% probability that the FOMC will not raise interest rates at its upcoming meeting, yet the May employment report showed an unexpected jump in payrolls, despite a rise in the unemployment rate.

However, due also to stronger-than-expected economic reports, stickier-than-anticipated inflation readings, and increasingly hawkish Fedspeak, we think there remains a good chance that the FOMC will raise rates one final time by 25 bps at the June meeting. What’s more, we don’t see the Fed cutting rates until Q2 2024.

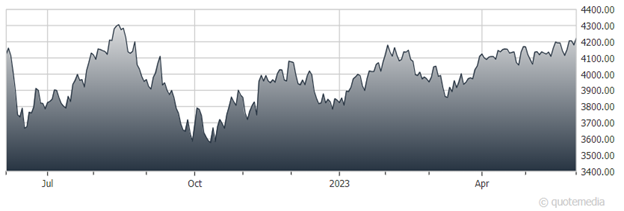

S&P 500 Index

Week to date (WTD) through June 1, in response to improved sentiment toward Congress and the Fed, large-cap growth and value stocks posted price gains, while mid- and small-caps slipped. In addition, such growth sectors as communication services, consumer discretionary, and technology were leaders, while consumer staples, energy, and materials were laggards.

Finally, 41% of the 153 sub-industries in the S&P 1500 gained in price, led by automobile manufacturers, data center REITs, and gold, while apparel, accessories & luxury goods; housewares & specialties; and tires & rubber recorded the deepest declines.

Should the FOMC decide to put its rate-tightening policy on hold, we see the stock market rallying, with the S&P 500 above the 4,292.44 level, which is 20% higher than the October 12, 2022 low, thereby signaling the start of a new bull market.