As part of an upcoming spinoff, Safehold, Inc. (SAFE) will become the only publicly traded entity to focus purely on ground lease (“GL”) investments, an attractive business in this environment, writes Jim Osman, a leading specialist in spinoffs and the editor of The Edge Spinoff Report Lite.

The main advantage of the ground lease business is that it generates attractive risk-adjusted returns with safe, inflation-protected income, and offers the potential for significant capital appreciation of land plus properties built on that land.

Star Holdings (STHO) will spinoff into a new publicly traded entity STHO that will own all its remaining non-ground lease assets (including real estate finance, operating properties, and land and development) and $400 million of SAFE shares.

With the significant sale of STAR’s 5.4m shares of SAFE to MSD Partners (Michael Dell’s family office), STAR’s own holding in the STHO spinoff will be reduced to 51% (37% directly and 14% indirectly). SAFE’s free float is also expected to be more than double (~2.5x to free float), which will drive higher trading volumes on the market.

In the long term, land has lower risk than commercial real estate, making SAFE (ex-transaction) a long-term land play. STHO, the spinoff, is fairly valued considering its non-ground lease assets and 50% of its portfolio is in SAFE’s stock. We see upside potential for SAFE post-spin of 53% in our base case.

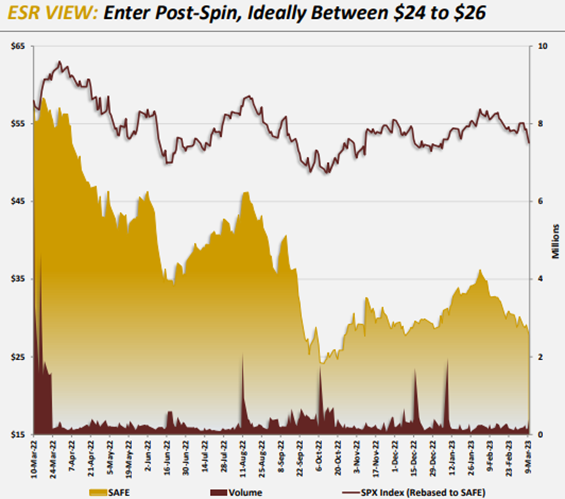

Recommended Action: Buy SAFE.