When high end mall operator Macerich Co. (MAC) reported earnings in November the news was all good. Funds from operations (FFO) — the preferred metric in evaluating REITs — came in above estimate; so did revenues, which were up 14.2% versus 2020, notes Paul Price, editor of TheStreet's Real Money Pro.

Few industries were as battered by Covid-19 than shopping malls after government imposed shut-downs and then strict covid-protocols kept customer visits restrained.

After sitting at home during that stretch people were more than ready to go back to the malls. My own trips to local shopping malls saw very few available parking spaces and crowds that were similar, or better, than were seen before March of 2020.

Macerich — a REIT — was hit especially hard as it was forced to issue equity at less than favorable prices last year to ensure balance sheet stability when cash flow dried up. Business is much improved since then and the shares had recovered from an absurdly low $4.80 panic bottom to about $17 on Dec. 13, 2021.

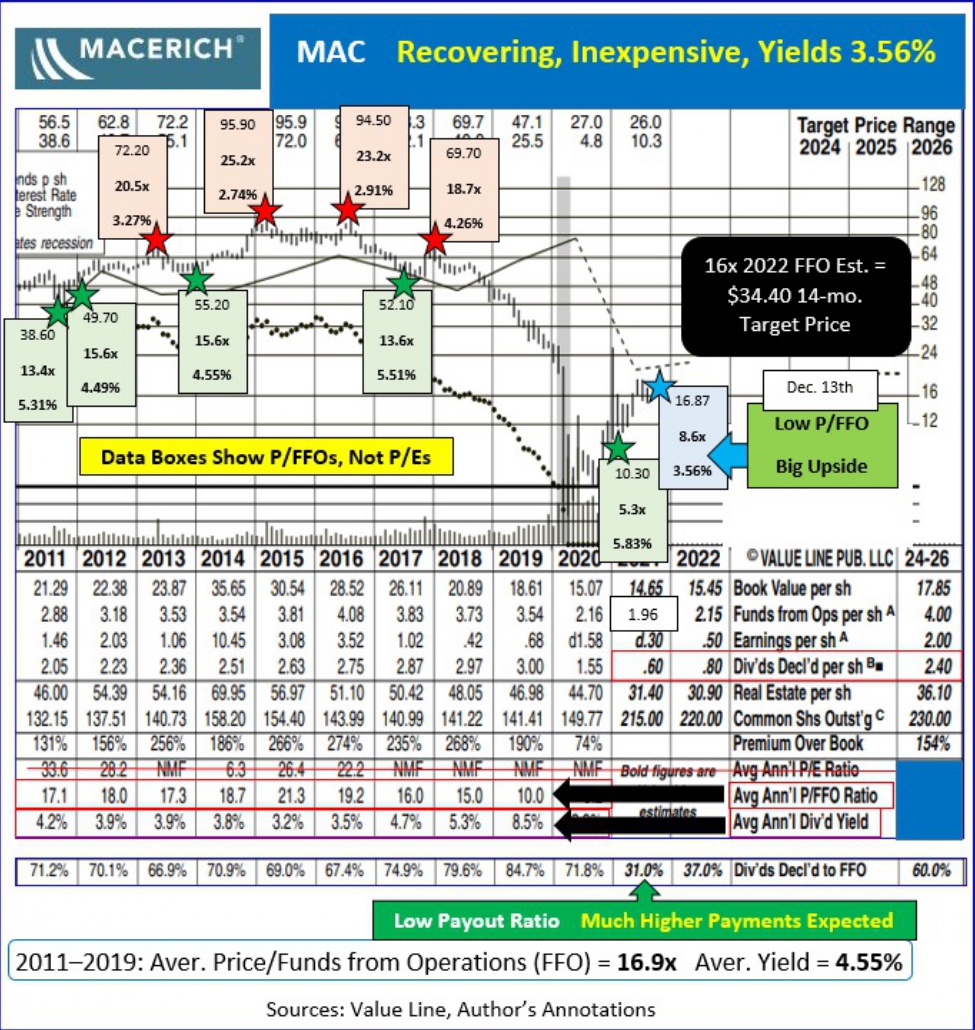

What is MAC really worth? In the nine pre-covid years from 2013 through 2019 MAC’s average P/FFO ran about 16.9x. Its typical yield was around 4.55% during those years.

MAC’s average payout ratio (dividends as a percentage of FFO) revolved around 70%. Management prudently cut the dividend during the shutdown period to 15-cents quarterly from 50-cents. That rate is now likely to start climbing again as 2021’s payout ratio is now just 30.6% of 2021’s FFO.

Value Line thinks it will rise to 80-cents annually next year and to $2.40 per share not later than 2026. That factor alone should entice a lot of buying in our currently low interest world. Assume just a 16 P/FFO on next year’s estimated FFO and a $34.40 goal by early 2023 seems quite possible. Add in dividend payments and there’s a great chance of garnering well over 100% in total return over the coming 14-months or so.

Yahoo Finance is not (yet) as bullish on MAC as I am. Even so, its year-ahead price target of $21.02 would deliver 28% in total return without an implied dividend increase. Their goal is ultra conservative in my book as it assumes MAC will only command 9.8-times projected 2022 FFO, rather than its typical 16.9x.

Independent research from Morningstar is much more in harmony with my view. They rate MAC as a 4-star, BUY. Morningstar deigns to provide 12-month target prices. It does, however, let us know what they think is present-day fair value for each stock they cover. For Macerich, that figure is $30.

Simply rebounding back to the modest target would deliver 77.5% upside plus dividends. Note, too MAC traded as high as $26 last January and was $22.88 only five weeks ago.

Improvement in fundamentals, a bump in the dividend rate and just a bit of better investor sentiment could make this high-yielding stock a big winner before too long. Option savvy traders with long time horizons can pocket outstanding put premiums on MAC’s Jan. 19, 2024 puts. My recommendation is to buy some MAC shares, sell some LEAP puts or consider doing both.

(Disclosure: Paul Price is long MAC shares, and short MAC options.)