The summer months are traditionally a weak time of the year for stocks, cautions growth and income expert Bryan Perry, editor of Dividend Investing Weekly.

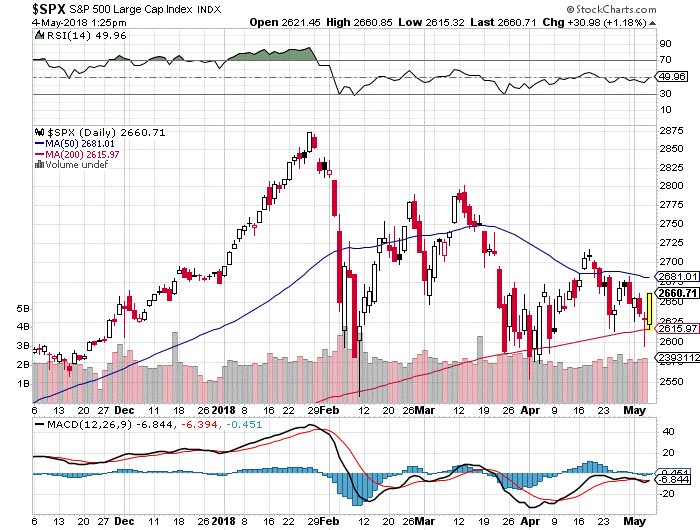

When one looks at the market from a purely technical standpoint, the S&P 500 is running the risk of a material breakdown if its 200-day moving average suffers a protracted breach.

Because program trading dominates more than 70% of all daily activity on both the NYSE and NASDAQ, any high-volume, downside penetration of the 2,600 mark for the S&P will invite a 100-200 point sell-off for that benchmark index. Such an event could happen very quickly because of how these computer-generated sell programs can feed on themselves.

The current 200-day moving average sits at 2,615, with the next near-term level at 2,585, after enduring a February low of 2,550. However, those second and third levels are soft and will only act as speed bumps to lower levels.

The problem I see is that, after three short breaches of this key line, a fourth breach could be a watershed event. Each rally attempt off this level has resulted in what chartists call a lower high.

The latest rally came just in the nick of time, but the market is a long way from being out of the woods. Since late February, volatility has been very elevated, and I don’t see that diminishing any time soon. So, an action plan should be considered if the market takes a turn for the worse.

For many investors, a go-to-cash exit strategy can create a nightmare of a tax situation. Instead, I recommend utilizing a sound hedging strategy to protect portfolios of all sizes.

This is a good way to mitigate downside risk in the event of a trapdoor sell-off where stocks drop like they are going over a waterfall. We all know the old saying, “if you fail to plan, you plan to fail.” Nothing could be truer than when it applies to our money in a frothy market.

Seeing how headline risk has played havoc with the major averages on so many trading days these past couple of months, I find it incredibly naïve of investors to not have a plan for portfolio insurance in place.

As to what most investors can lay on in the form of portfolio insurance, I would look to a few potential instruments. They are the ProShares Short S&P 500 ETF (SH) and the iPath S&P 500 VIX Short-Term Futures ETN (VXX).

This two-part portfolio hedge lets investors short the S&P 500 in an unleveraged exchange-traded fund (ETF), while playing the upside spike in market volatility if the S&P 500 tops its key 200-day moving average in a material way.

This approach is a very simple way to insulate a certain measure of downside risk. Everyone has portfolios with varying degrees of risk and, therefore, has to determine what percentage of a portfolio should be weighted in hedging instruments versus long exposure and cash.