To decrease portfolio risk for our covered-call writing and put-selling portfolios we must be well diversified and allocate a similar amount of cash per position, explains Alan Ellman of The Blue Collar Investor.

The allotment of cash per position will rarely be precise, but it is a goal we must incorporate into our methodology. In this article, I will describe the process for covered-call writing using the Premium Blue Chip Report (top-performing Dow 30 stocks) for the September 2020 contracts using a $250,00.00 cash balance. The process can be adjusted up or down depending on the cash available.

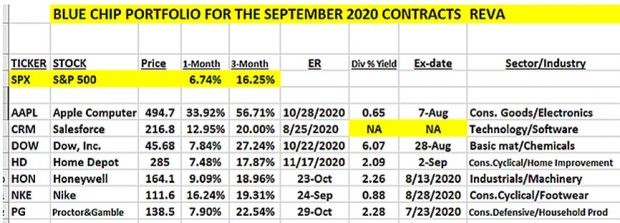

Blue Chip Report for September 2020 Contracts

Blue Chip Report for September 2020 Contracts

Structuring Our Strategy Requirements for a $250,000.00 Portfolio

- Diversify with 7 elite-performing Dow 30 stocks

- Allocate $36k per position ($250k/7)

- Divide the price-per-share into $36k and round to the nearest 100

- Are adjustments needed?

- Must leave a 2% – 4% case reserve for potential exit strategy opportunities

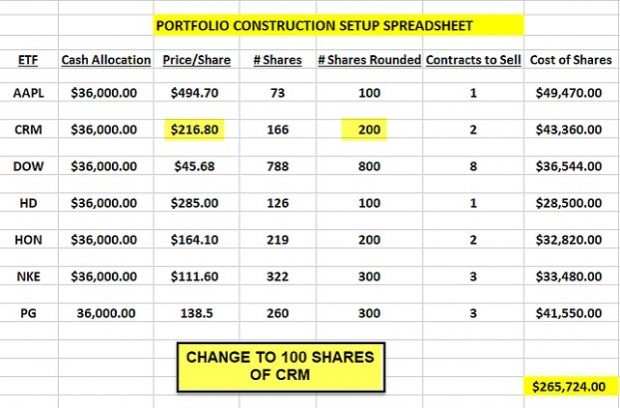

Portfolio Initial Setup Based on Initial Strategy Guidelines

Following the initial guidelines, the cost is $15,724.00 greater than the cash available plus there is no reserve for exit strategy. We need to make an adjustment of about $20,000.00. In this case, I decided to reduce my potential Salesforce.com (CRM) holding from 200 shares to 100 shares.

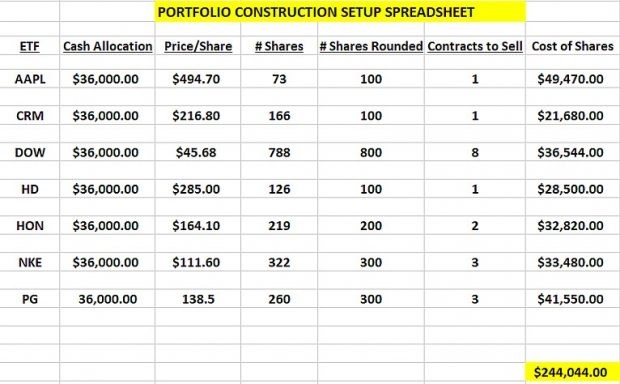

Portfolio Final Setup After the Adjustment

Covered Call Writing Final Portfolio Spreadsheet

We are now diversified with seven different Dow 30 top performers and have a reasonable, although not perfect, cash allocation per position. There is also a cash reserve of $5956.00 for potential exit strategy executions.

Next Steps

Once we have our portfolio selections, we turn to the option chains to select strikes that meet our system criteria and immediately enter our 20%/10% guidelines.

Discussion

Portfolio risk will be mitigated by diversifying the securities in our portfolios and allocating a like amount of cash per position. We must also factor in the need for a cash balance to execute potential exit-strategy opportunities.

Learn more about Alan Ellman on the Blue Collar Investor Website.