The poor man’s covered call is a very specific type of spread. As you know, we’ve been covering option spreads for several Coffee with Markus Sessions, states Markus Heitkoetter of Rockwell Trading.

In this article, we’re discussing the difference between trading stocks, covered calls, and the poor man’s covered call.

Trading Stocks

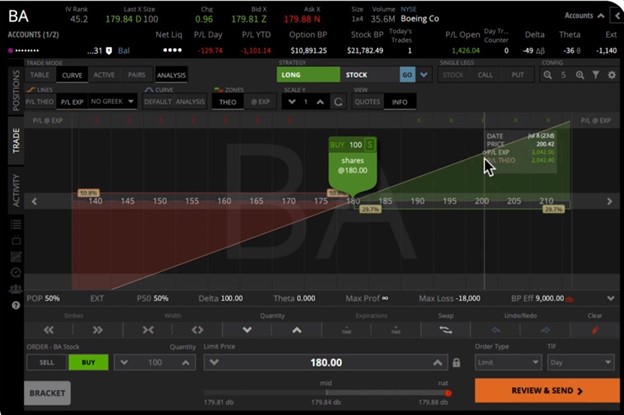

Let’s take a look at trading stocks first. Let’s say that you’re bullish on a stock like Boeing (BA). If you were bullish on this stock, you might purchase a decent amount of stock, let’s say 100 shares.

At the time of the original writing of this article, this stock’s strike price was $180. If you purchased 100 shares of Boeing, at $180 dollars each, this would require $18,000 in purchasing power.

If the stock’s price increases by $10, to $190, you stand to earn $1,000 in net profit. So, you’ve risked $18,000 to earn $1,000. If the stock price increases to $200, you’ll earn $2,000 and so on. This is pretty basic, and you probably understand this concept.

Profit Picture for Movement of Stocks

As you can see in this image, the sliding scale moves to the right as the stock price increases. This scale is called a profit picture. It is a visual representation of your profits, or losses depending on the movement of the stock. In this example, the price of the stock is increasing so the scale is moving to the right.

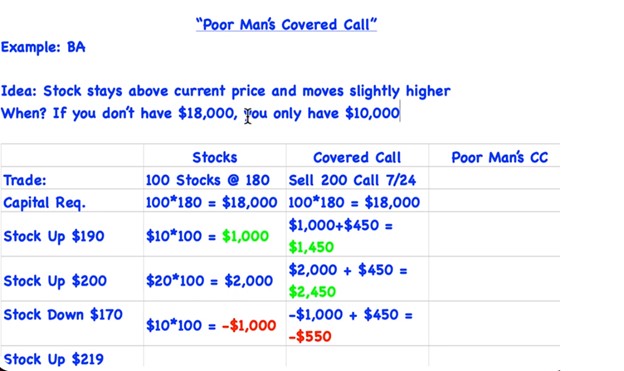

Selling Covered Calls

In this example, let’s say that you’re still bullish on Boeing, and in the short term, you expect an upward movement in price. Since you already own the 100 shares of Boeing stock, you can sell a $200 call option against these shares (again, this is based on the price of Boeing at the time of writing this article).

If the stock price increases to $190 like you expect, you’ll earn an additional $450 on top of the $1,000 you’ve already earned. If we see a decrease in stock price, the covered call acts as a hedge.

In this example, if we saw a downward movement to $170, you would lose $1,000. But because you sold a $200 call option contract and received a premium of $450, your net loss would only be $550.

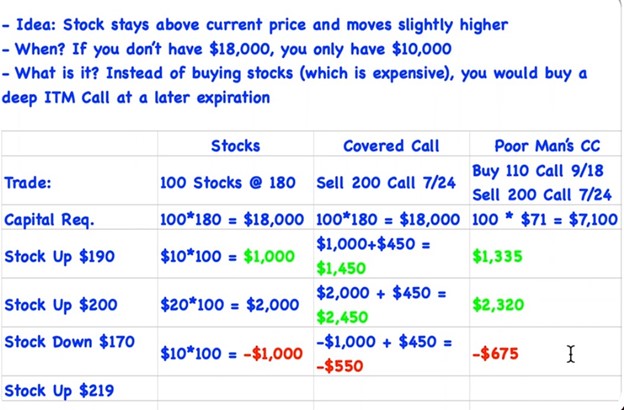

Covered Calls vs Poor Man’s Covered Call

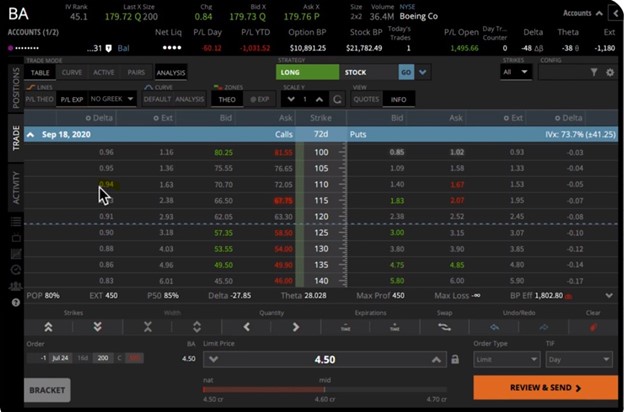

When would you trade a poor man’s covered call? That’s easy! When you don’t have the $18,000 to buy 100 Boeing shares! And when do you trade a covered call? When you expect the stock to stay above the current price and move slightly higher. Instead of buying a stock, you would purchase a deep in the money call option at a later expiration. When looking for a call option deeper in the money, we’re trying to find one with a Delta of 0.95. This means for every dollar the stock moves; the call option is gaining .95 cents in value. Delta of .95

In this image, we can see the options chain on the Boeing options contracts. This window is where we find the Delta and ensure that we’re choosing the right contract for the poor man’s covered call strategy.

Deep “In-The-Money” Calls

For this example, we’re buying a deep ITM call at $71 which means the capital required to take this position is only $7,100. As you can see this is a fraction of the price to purchase the stock outright. At the same time, we will sell the $200 call option.

Instead of owning the stock at a price of $18,000, we purchased the ITM call option and sold a $200 call option. If the underlying stock price moves from $180 to $190 you would make $1335 because the Delta is 0.95, which means it’s only increasing 95% of the value.

The profit on this type of position isn’t as high as a covered call, but it’s much more than owning the stock outright, with much less risk and less capital.

Limited Risk and Losses Associated with the Poor Man’s Covered Call Strategy

This sounds too good to be true right? The perfect strategy! BUT…there’s a downside associated with this strategy. Your profit is limited.

If you see a huge movement in the underlying stock, you’ll only benefit from a portion of the total gains. In this example, if the underlying strike price gained $40, the stockholder would earn $4,000. The covered call would earn $2450, and the poor man’s covered call would earn $2,320.

Many traders use this strategy because of the limited capital involved with taking on a position, and the limited risk associated with a potential downward movement of this stock.

Learn more about Markus Heitkoetter at Rockwell Trading.