Let’s talk about GameStop (GME) because the stock has gone absolutely crazy, explains Markus Heitkoetter of Rockwell Trading.

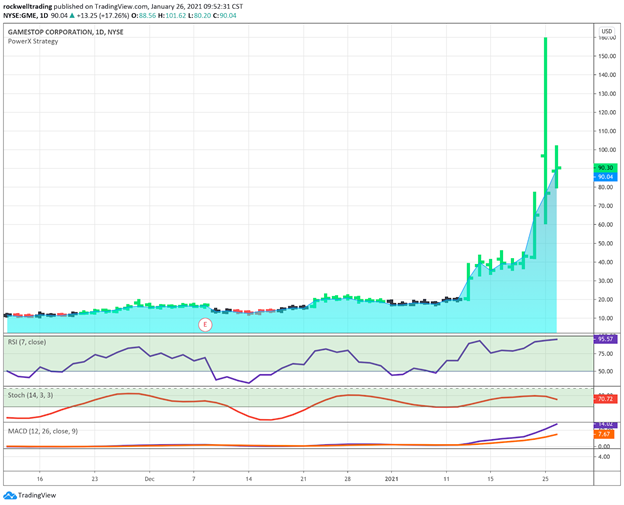

I mean, on January 25, it was up 144% before swinging into negative territory. Then it reversed again and closed up more than 18%. And today, it was up another 22% and traded at $93.50 yesterday. One month ago, it was trading around $20!

So, today, I want to look at exactly what’s happening with GME, and let you know if it looks like a good time to buy the stock.

What is Happening with GME?

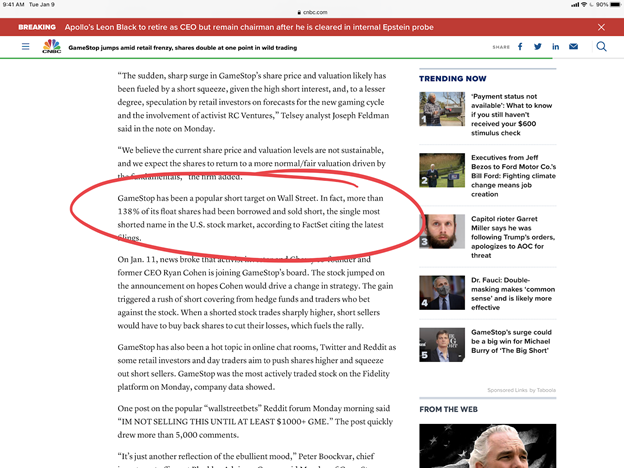

GME made its first big move in mid-January after adding Ryan Cohen to its board. This guy is the co-founder and former CEO of Chewy (CHWY)—the online pet supplies store—so he knows a lot about retail. The stock jumped from $20 to above $40 when that news hit, and this caught a lot of short-sellers off guard. In fact, according to one CNBC article I read, GME is the most heavily shorted US stock.

What’s a Short Squeeze?

For those that don’t know, short interest is when a trader bets against the stock, meaning they want it to go lower. To do this, they’ll borrow shares from their broker at one price. If the stock price falls, they can buy the shares back at a lower price to repay their broker and keep the difference as profit. But if the stock rallies, short sellers will have to buy back the shares at a higher price to limit losses.

For stocks that are heavily shorted, this can create a sort of ripple effect: Because how do you close a “short trade”? Well, you SOLD the stock earlier so now you have to BUY it back. So when more shorts start covering, i.e. BUYING, the stock climbs higher and higher.

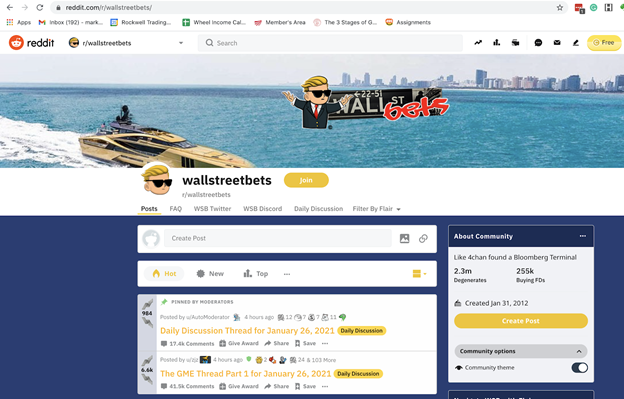

This is the short squeeze. And in GME’s situation, as the stock rallied on good fundamental news, shorts started to cover. Then the Reddit crowd got involved. There’s a forum on Reddit called “WallStreetBets,” and their purpose is to “make money and being amused while doing it.”—their words, not mine.

As GME was rallying, online traders on Reddit began posting about the stock and buying it to manipulate the shorts. Take a look at some of these posts:

And as they bought the stock, the price soared, forcing more shorts to cover their positions, and again, this means that more people are BUYING.

It’s not surprising there are a lot of traders upset about this manipulation. Famous short-seller Citron Research is one of them, and said it would no longer comment on GME because of the “angry mob” on Reddit.

Is GME a Buy or a Sell?

Now, you could make an argument for GME stock to keep going higher. There are probably some shorts still hanging on. And fundamentally, the company did report solid holiday same-store sales and digital sales growth a few weeks back. But in reality, it’s dangerous to trade GME right now.

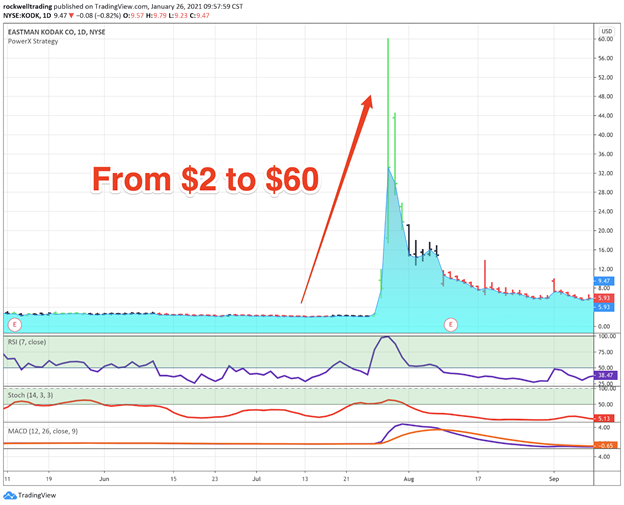

For starters, look how overbought this stock is. A lot of times, when these stocks fall, they fall fast. Remember last summer when Eastman Kodak (KODK) went from $2 to $60 in two days, and then back down to $6 a month later?

And implied volatility is all over the place. This means options premiums are crazy high right now for options buyers. It’s not a good time to sell options, either, because it’s hard to pinpoint levels of support or resistance.

So, yes, you could have made a lot of money trying to trade GME stock, but you could’ve lost a lot of money, too. Whenever I see a parabolic move as we’ve seen in GME, I leave it alone. The risk is simply not worth it. At some point, the Reddit traders might lose interest in this stock. So they would just sell it and move on to the next stock, and that could make the stock crash. After all, there are 2.3MM people in this group!

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

More Stocks to Watch

Before we go, I just want to check out some more of these “short squeeze” stocks that have been volatile this week.

The first is Palantir (PLTR), which ran from $26 to almost $40 in two days. Yesterday, the stock was down 3% at $35.12.

Another is BlackBerry (BB). BB stock ran from $7.50 in mid-January to above $20 Monday—its highest level since 2011. Yesterday, the stock was up 3.6% at $18.60.

And there’s Bed Bath & Beyond (BBBY), which was trading around $18 earlier this month, but hit a three-year high near $48 Monday. Yesterday, BBBY was up 0.1% at $30.68.

Finally, there’s AMC (AMC). It was trading below $2 at the start of the month and hit a high of $5.19 earlier Tuesday.

While I’m not going to be trading these stocks because of the risk involved, I’ll certainly be keeping my eye on them.

Learn more about Markus Heitkoetter at Rockwell Trading.