We’ve briefly touched on the topic of “alternate energy,” and it’s peeked more than a few Five-Star Traders interests. So I wanted to take a look at another alternate energy ticker that I made a quick 60% profit off of, explains Danielle Shay of Simpler Trading.

So let’s start at the beginning…

Around the time of the election, it became obvious that there was money flowing into a new area of the market. What was that new area? The alternate energy space.

In fact, during my Options Freedom Class, I made a new grid of all the alternate energy names. The ticker that we’re talking about today, First Solar (FSLR), was one of the companies on this list.

Take a look at the screenshot below which includes that new grid:

The reason I came across this ticker? The Phoenix Finder—which you can see depicted as the grid above.

I wouldn’t even have this new grid if it wasn’t for Phoenix. So I got into First Solar by using the Phoenix Finder when it also had a Turbo VZO buy, and a squeeze, and a buy signal on the Trend Strength Turbo Candles.

This trade was truly a combination trade…

How It Played Out:

Naturally, I got into this trade on a pullback.

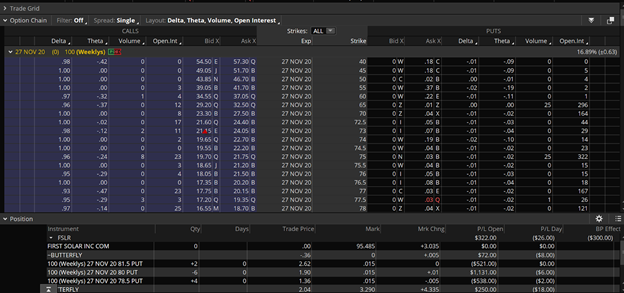

To start with, most conservative entry was first an unbalanced butterfly. However, once it started shifting to the upside, I added a regular butterfly too. (Then I actually also added a debit spread.) So as you can see, I had a stacked butterfly trade on this ticker, an unbalanced butterfly, and a regular butterfly.

The regular butterfly ended up making about 60% profit over the course of a few days. That trade was a little bit more of an aggressive trade because it was directional. Then like I said, I added an unbalanced butterfly at support, and with this one, I actually ended up taking in the initial credit received.

You can look at the profits in the screenshot below:

To learn more about Danielle Shay, visit SimplerTrading.com.