Exit strategies are critical to our overall success whether using traditional covered call writing or the Poor Man’s Covered Call (PMCC), explains Alan Ellman of The Blue Collar Investor.

In this article, we will evaluate scenarios when share price both declines and accelerates creating rolling-down and rolling-up opportunities in the current contract month. The BCI PMCC Calculator will assist with the computations.

What is the poor man’s covered call?

This is a covered call writing-like strategy where a deep in-the-money LEAPS option is purchased instead of a stock or ETF (exchange-traded fund). The technical term is a long call diagonal debit spread.

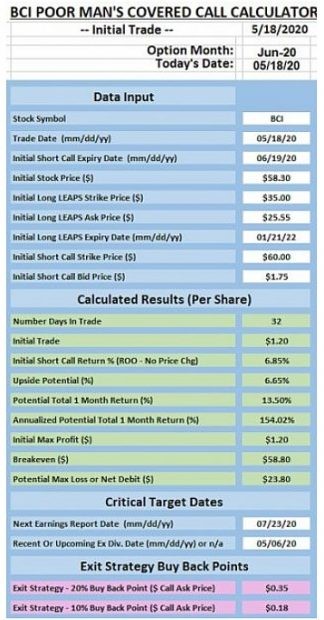

Hypothetical initial trade

- 5/18/2020: BCI trading at $58.30

- 5/18/2020: Buy 1 x 1/21/22 $35.00 LEAPS for $25.55

- 5/18/20: Sell 1 x 6/19/20 $60.00 call for $1.75

Initial trade calculations with the BCI PMCC Calculator

PMCC: Initial Calculations

- The initial trade meets our system requirement with a credit of $1.20 per share

- This results in an initial one-month time-value return of 6.85% with additional upside potential of 6.65% for a total one-month potential return of 13.50%

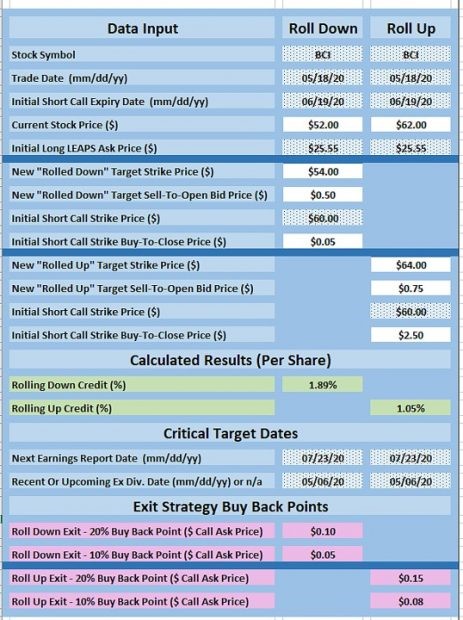

Rolling calculations if share price declines to $52.00 or accelerates to $62.00 in the current contract month

PMCC: Rolling Options in the Current Contract Month

- Rolling-down to the $54.00 (now out-of-the-money) strike results in a net option credit of 1.89%

- Rolling-up to the $64.00 (still out-of-the-money) strike results in a net option credit of 1.05%

- Both choices allow for additional share appreciation

Discussion

After entering a PMCC trade that meets our system requirements, we immediately go into position management mode. Rolling option opportunities in the current contract month may present and, if that’s the case, we must be prepared to take advantage.

Learn more about Alan Ellman on the Blue Collar Investor Website.