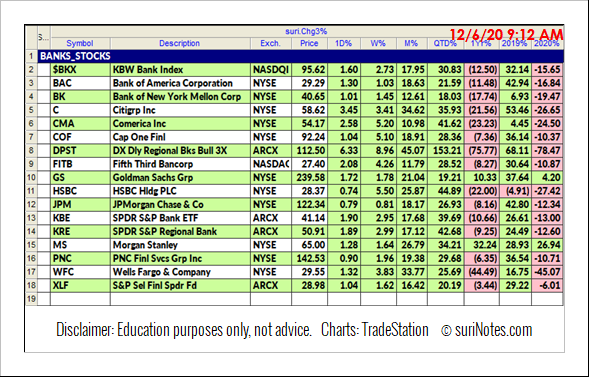

After performing well in 2019, banks have underperformed the S&P's key sectors in 2020 due to the coronavirus and weakened economy, states Suri Duddella of suriNotes.com.

Some of the banking-sector stocks that seem to be on the rebound are currently forming potential cup-&-handle chart patterns and could present great trading opportunities. This article discusses some of the chart patterns and how to trade them.

Bank Stocks and Their Performances in 2019 and 2020:

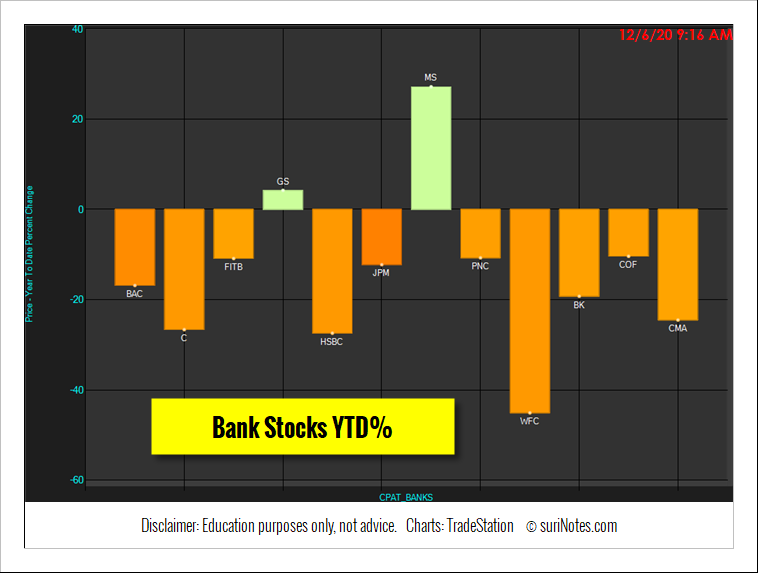

Bank Stocks Year to Date% Performance Chart:

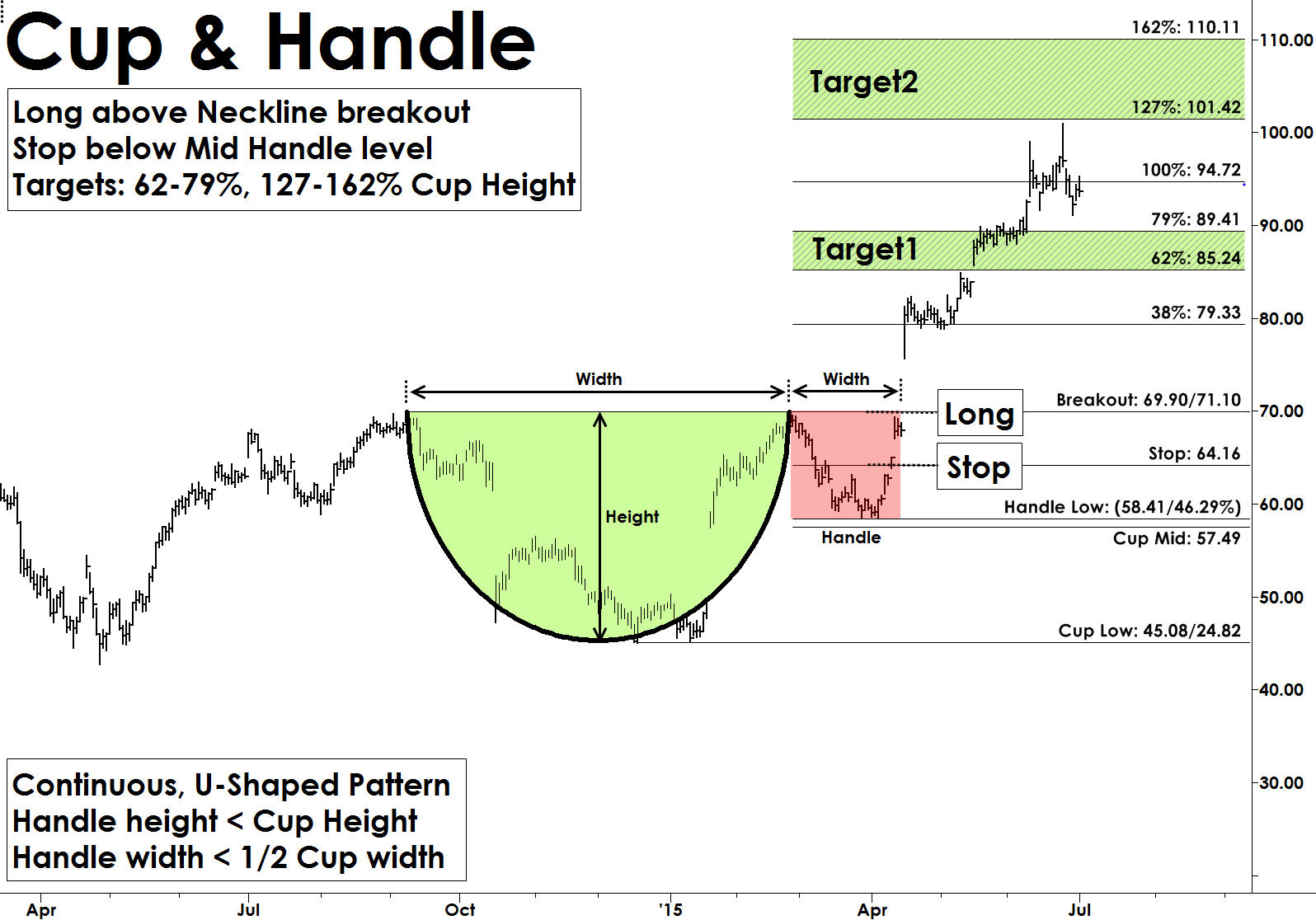

Cup-&-Handle Patterns

The cup-&-handle chart pattern was developed and popularized by William J. O’Neil in the 1980s through his CANSLIM methodology, Investor’s Business Daily articles and his book How to Make Money in Stocks.

The cup-&-handle pattern resembles a cup with a handle and are continuation patterns that usually form in bullish trends. Most cup-&-handle patterns are reliable and offer great trading opportunities. They also form in all markets and in all timeframes. The “cup” formation is developed as consolidation phase during price rallies from the round bottom formation over multiple weeks to months. The “handle” part forms due to a price correction after “cup” formation and before a clear breakout to the upside.

Cup-&-Handle pattern structures show the momentum pause after reaching a new high in a U-Shape form, followed by another attempt to breakout. When this breakout from the rim of the cup fails, it starts to fall back to build the "handle" structure. Usually, the handle structures are small, and the handle depth should not exceed more than 50% of cup depth. The handle part of the pattern generates interest in buyers as they expect the pattern to break out from these levels. The pattern is valid only if price convincingly breaks out with increased volume above the rim of the cup levels (see chart below).

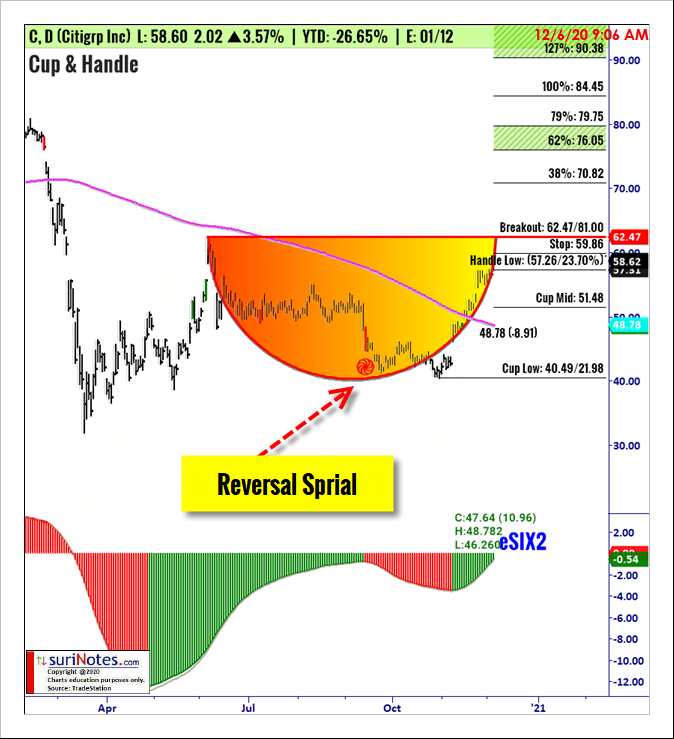

Citigroup Inc. Cup-&-Handle Pattern:

Citigroup Inc. (C) chart forms a cup-&-handle pattern on its daily chart and trades below the breakout level of $62.57. C&H patterns are valid only when the price closes above the breakout level. A long trade is entered above the breakout level with a stop placed below the lowest low of the mid-cup $51.48, and the handle low $57.26. Targets are placed at $70.82, $76.1 to $79.7.

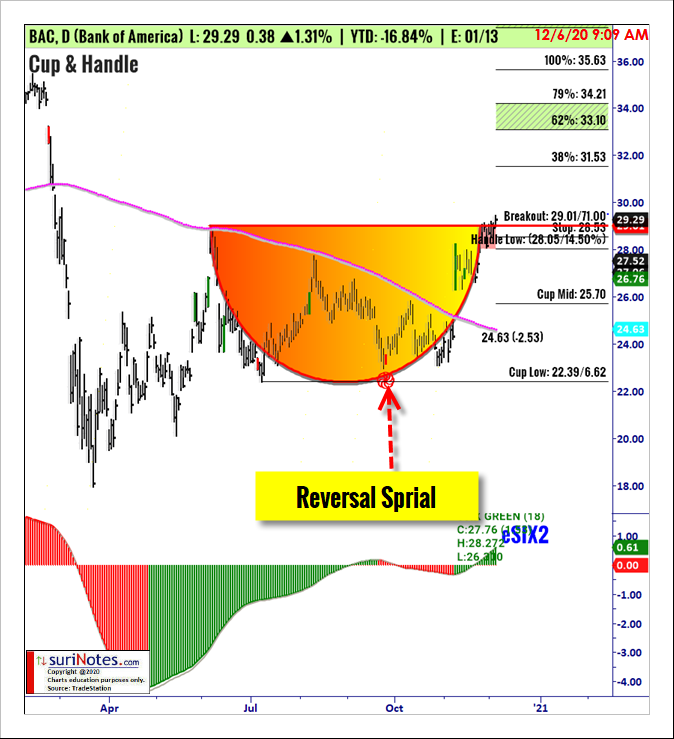

Bank of America Cup-&-Handle Pattern:

Bank of America Corporation (BAC) chart forms a cup-&-handle pattern on its daily chart and trading near the breakout level of $29.11. C&H patterns are valid only when the price closes above the breakout level. A long trade is entered above the breakout level with a stop placed below the lowest low of the mid-cup $25.70. Targets are placed at $31.53, $33.1 to $34.2.

To learn more about Suri Duddella, please visit SuriNotes.com.