Contract adjustments to the terms of our covered-call writing and put-selling options are due to corporate actions like mergers and acquisitions, special dividends, and stock splits, explains Alan Ellman of The Blue Collar Investor.

Stock splits fall into three categories:

- Even splits

- Odd splits

- Reverse splits: (1-for 5, as an example)

This article will highlight the contract alterations resulting from even and odd stock splits.

Even Stock Splits

Definition and Example

- Whole shares are issued for each share owned

- Example is a 2-for-1 stock split

Contract Adjustments for a 2-for-1 Stock Split

- Number of contracts is multiplied by two

- Deliverables (stock, cash that changes hands on exercise) is unchanged (100 split shares)

- Strike price is divided by two

- Multiplier (# to calculate total premium) is unchanged at 100

- Option symbol remains unchanged

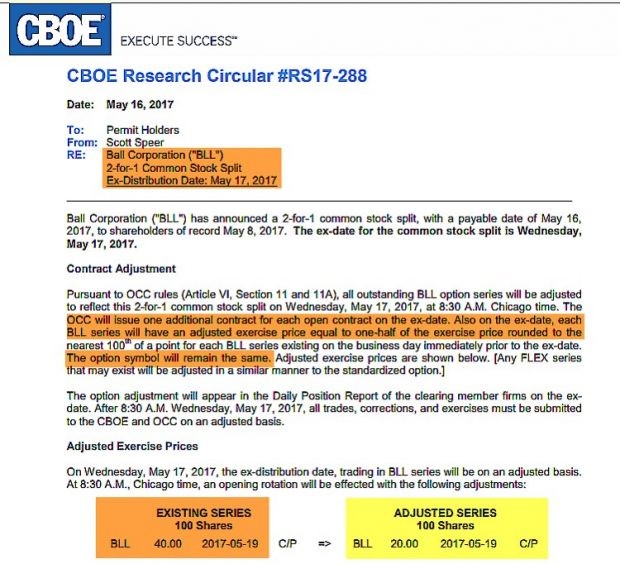

Real-Life Example with Ball Corporation (BLL)

BLL: OCC Notice of 2-for-1 Stock Split

The $40.00 strike becomes a $20.00 strike as the number of contracts double.

Odd Stock Splits

Definition and Example

- 1 Whole + fractional share are issued for each share owned

- Example is a 5-for-4 stock split

Contract Adjustments for a 5-for-4 Stock Split

- Number of contracts remains the same

- Deliverables (stock, cash that changes hands on exercise) is multiplied by 1.25

- Strike price is divided by 1.25

- Multiplier (# to calculate total premium) is adjusted to 1.25

- Option symbol is adjusted to reflect new contract terms

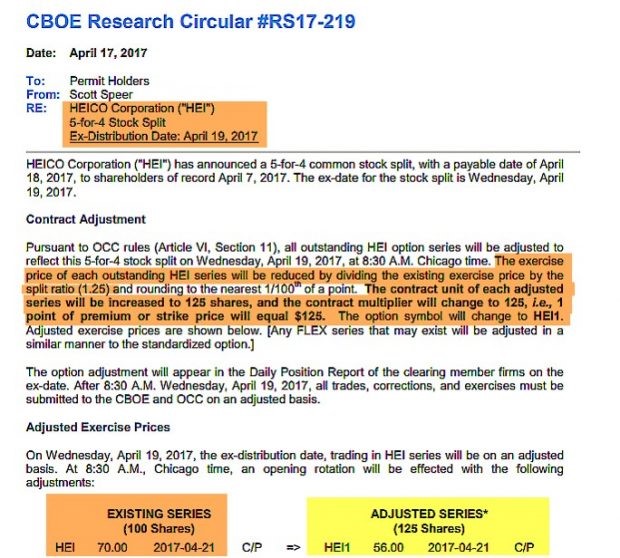

Real-Life Example with HEICO Corp. (HEI)

HEI: OCC Notice of 5-for-4 Stock Split

The $70.00 strike becomes a $56.00 strike as it is divided by the multiplier of 1.25.

Discussion

There is no single formula for all contract adjustments. However, they do fall into certain categories. This article highlights the basic contract adjustments for even and odd stock splits. When these events occur, we must understand the terms of the adjustment so we can make the most appropriate investment decisions.

Learn more about Alan Ellman on the Blue Collar Investor Website.