The recent minor sell-off in stocks may have released pressure and allowed some opportunity to get back in, but traders should remain cautious, writes Marvin Appel.

January 2020 feels a lot like January 2018 to me. You may recall that after gaining more than 7% through Jan. 26, 2018, the S&P 500 SPDR (SPY) proceeded to fall 10% in just nine trading days, making a bottom on Feb. 8. The two-day loss of 2.5% on Jan. 24 and 27 this year—the worst such decline since October— felt like déjà vu. Fortunately, it may be different this time, and better, as stocks bounced on Jan. 28.

What’s the difference now versus 2018? I suspect the Federal Reserve is playing a big part. In 2018 the Fed had telegraphed its intention to raise interest rates and shrink its balance sheet. Now the Fed is reflating its balance sheet under the guise of injecting liquidity into the money markets, and of course there is no hint of a rate hike.

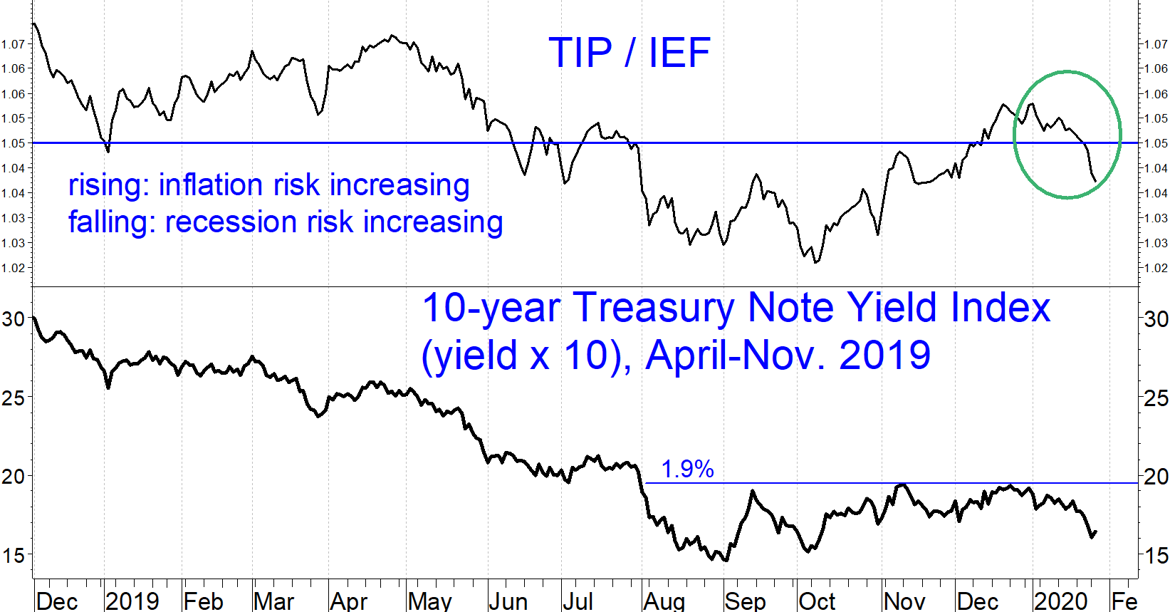

The dovish Fed notwithstanding, I continue to recommend cautious optimism rather than exuberance. Even before the Coronavirus outbreak that is the ostensible cause of the market’s skittishness, Treasury markets were flashing a warning sign. I like to follow the ratio between the inflation-indexed iShares TIPS Bond ETF (TIP) and the iShares 7-10 Year Treasury Bond ETF (IEF).

When the ratio is rising it means that the Treasury market is getting more optimistic about economic growth. The chart below shows that the TIP/IEF ratio has been pulling back since the start of the year (circled in green). That indicates that bond traders were expressing caution even before the Coronavirus hit the news. Ten-year Treasury note yields have remained stubbornly below 1.9% since August.

Low volatility equity ETFs such as the Consumer Staples Select Sector SPDR Fund (XLP) held up well during the recent dip. That observation led me to study whether overweighting XLP could be an effective longer-term diversification strategy for an S&P 500 index ETF such as SPY. I will go into detail on that in my next article, but the short answer is yes.

Bottom line: This is a time to be cautious about equity volatility. Take profits if the urge strikes, and don’t chase rallies.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.