The 2019 class of IPOs are exhibiting interesting breakout patterns, reports Suri Duddella.

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors.

In 2019, the United States IPO market had a mixed year. While it wasn’t a stellar year, it appears many of these IPO stocks like Beyond Meat Inc. (BYND), Spotify Technology (SPOT), Zscaler Inc. (ZS), Uber Technologies Inc. (UBER), Lyft Inc. (LYFT) and Pinterest Inc. (PINS) may have plenty of room to grow.

Some of the recent IPO stocks are exhibiting Cup & Handle patterns.

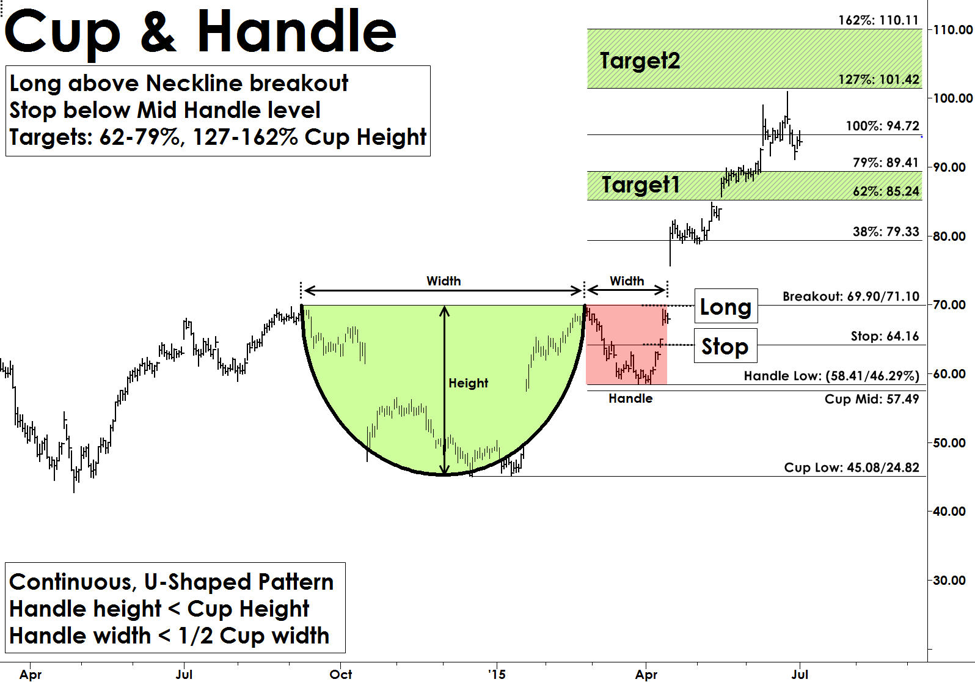

Cup and Handle patterns are continuation patterns, and they usually form in bullish trends. Most Cup and Handle patterns are very reliable and offer great trading opportunities. They also form in all markets and in all time-frames. The “Cup” formation is developed as consolidation phase during price rallies from the round bottom formation over multiple weeks to months. The “Handle” part forms due to a price correction after the cup formation and before a clear breakout to the upside.

Cup and Handle pattern structure show the momentum pause after reaching a new high in a U-Shaped form, followed by another attempt to breakout. When this breakout from the rim of the cup fails it starts to fall back to build the handle structure. Usually, the handle structures are small, and the handle depth should not exceed more than 50% of cup depth. This handle part of the pattern generates interest in buyers as they expect the pattern to breakout from these levels. The pattern is valid only if price convincingly breaks out with increased volume above the rim of the cup levels (see chart below).

Renaissance ETF Cup & Handle Pattern

The Renaissance IPO ETF (IPO) gives exposure to the most significant new public U.S. listed companies. IPO provides access investors for all recent notable IPOs.

IPO is trading in a Cup and Handle Pattern from July 2019 until January 2020 between $27.35 and $33.60. Cup and Handle Patterns are valid only when price closes above breakout levels after its handle formation. IPO's breakout level is $33.70, mid-cup Level is $30.48. A long trade may be entered on its breakout with the first target zone at 37.50 to 38.50 and the second target zone at $41.50 to $43.70 (see chart).

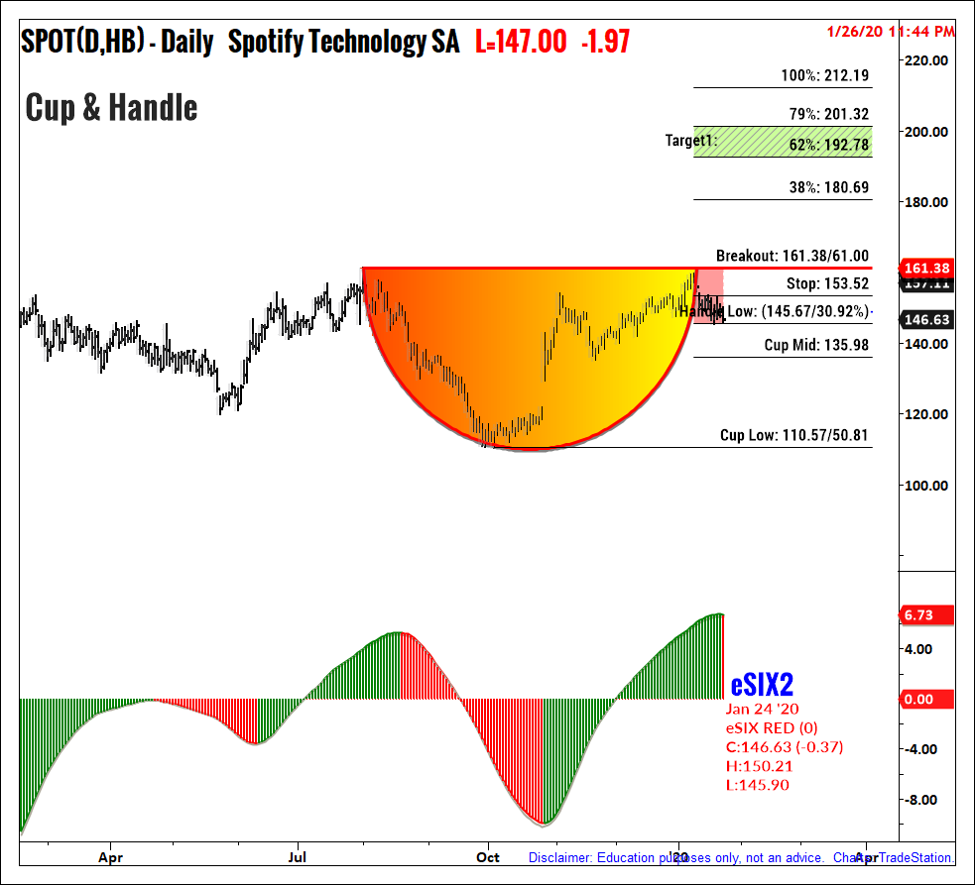

Spotify Technology Cup & Handle Pattern

The following daily chart shows SPOT with a Cup and Handle Pattern formation. This pattern is valid only when price closes above breakout levels. SPOT breakout level is $161.48 and the mid-cup Level is $135.98. Target zones: $192.8 to $201.3 and $212 (see chart).

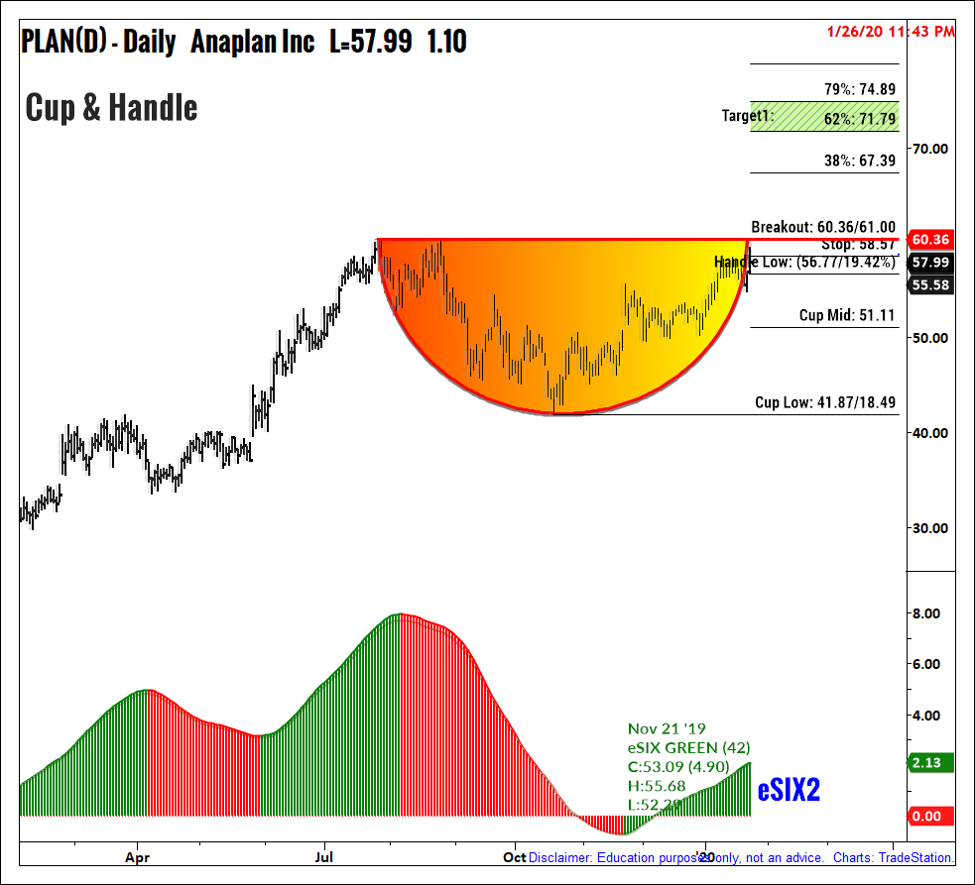

Anaplan Inc. Cup & Handle Pattern

The following chart shows a Cup and Handle pattern in Anaplan Inc. (PLAN) chart with Cup & Handle pattern (see chart). PLAN's breakout level is $60.46 and the mid-cup Level is $51.11. A long trade may be entered above the breakout level with target zones of $71.80 to $74.90 and $83.80 to $90.30.

Find more of Suri’s work at surinotes.com.