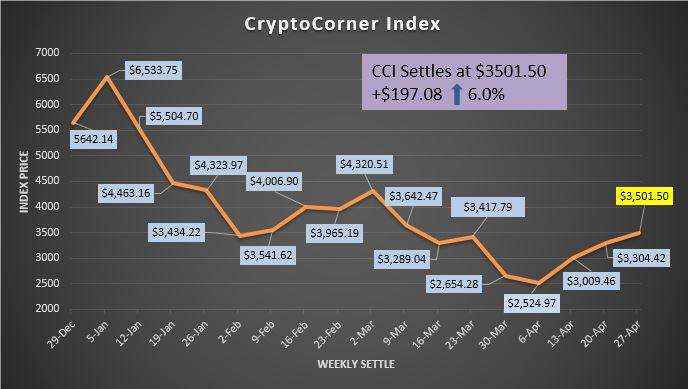

We can see that our CryptoCorner Index is up again this past week settling at $3501.50 +$197.08 some 6% on the week, we would like to see a push above the $4300 area for confirmation of further upside bias, writes Nell Sloane of Capital Trading Group, with a dozen things you should know about cryptos today.

Nasdaq Inc. and Gemini (GKX), the bitcoin exchange founded by Cameron and Tyler Winklevoss, have agreed to team up to fight fraud and manipulation in the crypto exchange venue world.

Gemini will use Nasdaq’s “SMARTS” surveillance software to monitor activity on its exchange. This is further solidifying the merger between established players and those at the forefront of the crypto revolution. (WSJ)

**

Michael Oved, founder of Airswap and co-founder of the HFT group Virtu Financial Inc., finally opened its doors last week for business.

Airswap is a decentralized cryptocurrency market that brings together “execution, settlement and custody” directly to the user and away from any middleman interference, a Bloomberg article noted.

**

Dutch multinational banking giant ING (ING) is getting into the blockchain space and they said they have come up with a modified version for “zero-knowledge range proofs.” This was deemed an improvement in part because it uses less computational power and therefore runs faster on a blockchain. (CoinDesk)

**

Traders remember ING: On a side note, some of our other more veteran traders may remember ING when they took over Barings Bank for $1£.

Back in 1995 Barings and their infamous “rogue trader” Nick Leeson hid a bunch of terrible bets on the Nikkei in what is now famously known as the legendary 88888 error account, saddling the bank with $1 billion in losses.

Nick led authorities on a wild goose chase around the globe, eventually turning himself in. Ewen McGregor played Nick in the movie named after the “Rogue Trader.”

**

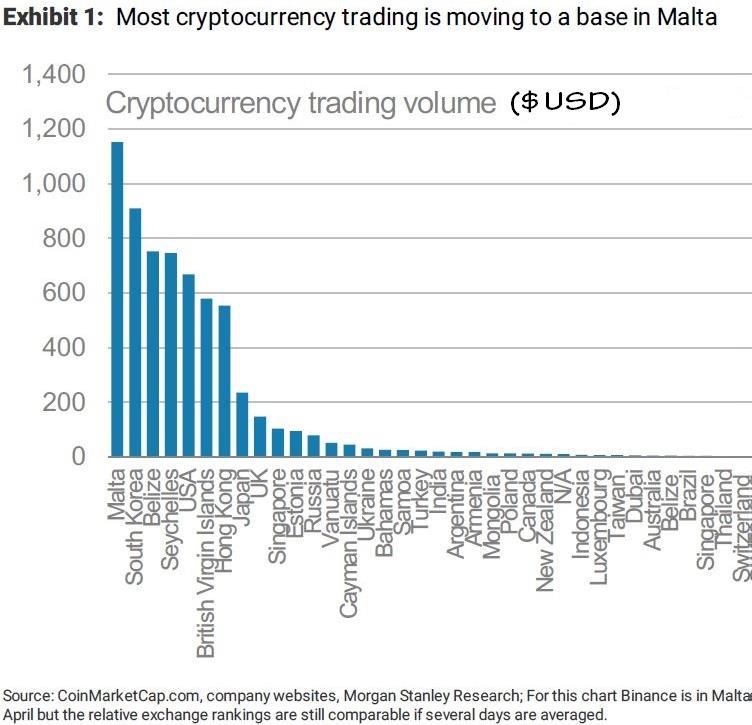

Crypto exchanges favor Malta: Bloomberg reports that most of the cryptocurrency trading occurs on exchanges based in Malta. This has regulators concerned but veterans of the crypto space are certainly more open to the most hospitable jurisdictions. And as most blockchain enthusiasts know, those that adopt it will flourish, those that don’t will be left behind!

Anyway, here is a chart they posted:

**

EOS supernodes: In other news and adding to all the hype around EOS this week is that there are over 50 candidates vying for the 21 supernodes that will support the new mainnet.

EOS is scheduled to migrate from the Ethereum (ETHUSD) network on June 2. BitcoinMagazine reports the candidate pool is a mix of big and little fish. Traders should read it.

**

CFTC Chairman Christopher Giancarlo was out again with positive comments about bitcoin (BTCUSD) last week, stating that bitcoin has “elements of all of the different asset classes and that bitcoin might best be suited for a long-term buy and hold strategy rather than a form of payment.” (CNBC) CFTC's Dan Rutherford on demystifying virtual currencies.

**

You know what we think: he is gearing up for a cushy crypto space private sector job. Makes sense, right?

**

Russian hack a security reminder: It seems as if Russian hackers are responsible for the DNS attack on Amazon Web Services servers which hosts the Myetherwallet website. The rerouting of user traffic to Myetherwallet led to $150k of cryptocurrency being taken from customer wallets.

The hackers were able to gain access via the BGP or Border Gateway Protocol redirecting traffic to a dummy site on their own servers.

Now, this wasn’t the biggest heist but it is just another example of the ongoing security concern, not just for cryptocurrency, but the entire viability of the internet itself.

We can’t stress enough the usage of paid-for premium security suites, not that they catch everything, but at least they offer the possibility of avoiding a malicious website, which is basically what this was.

**

IBM patent for blockchain security: Cointelegraph reported this week that IBM filed a patent for a “Proof-Of-Work Protocol” tailored to IoT networks. The patent configuration will address potential security issues in IoT networks in an application published on April 26.

IBM (IBM) has certainly seen the light and realized the huge potential they can add to the growth of the blockchain ecosystem.

**

Top cryptocurrency exchanges: Coincentral.com compiled a great list of the top cryptocurrency exchanges, we won’t list them all but it’s a good resource for those readers looking for a home, you can find the link here.

**

Mt. Gox cold storage wallets: Also of note this week as highlighted by a few accounts on Twitter as well as the site cryptoground.com which shows the Mt. Gox cold storage wallets, that $165 million worth of BTC and BCH were moved out of cold storage.

For those who remember a few months back the Mt.Gox trustee sold around $400 million worth of BTC and Kobayashi, the man in charge, was blamed for the steep selloff. So some are speculating they are gearing up to dump the $165 million, so just be aware of this when trading.

**

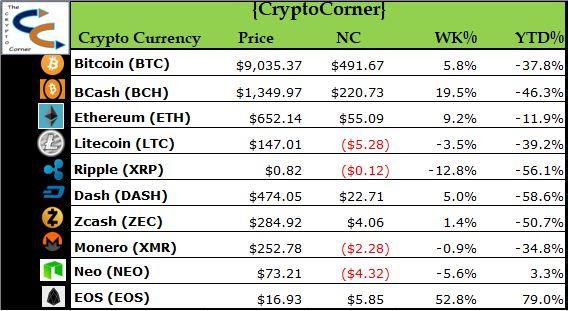

OK, let’s move to the settlements for the week ending April 27, 2018:

As you can see most of the coins we follow were up with EOS the very large standout up nearly 53% on the week!

Now we don’t expect a runaway freight train, but optimism is high and centered around the June 2 move date, so we would be better buyers on any move toward $11.

We feel the overall tone across the complex is that heavy buyers have lifted us off the lows and that we are in a more consolidated mode, which is a good sign for the overall marketplace.

We can see that our CryptoCorner Index is up again this past week settling at $3501.50 +$197.08 some 6% on the week, we would like to see a push above the $4300 area for confirmation of further upside bias:

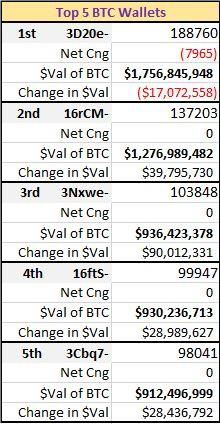

Looking at the top 5 wallets we can see that out of the top 5 spots only the largest wallet changed, dropping some 7965 BTC on the week putting their total wallet size at 188760.

This is on the heels of nearly touching 200k BTC last week ending April 27.

Rounding out the top spots, all other wallets were unchanged and have seemingly gone quiet over the last few weeks, perhaps suggesting some long-term hold bias.

We will move toward the technical side of things and this week we will cover bitcoin and BCH.

As our readers know we have been hard on Bitcoin Cash, but it seems as if some adopters are taking it under their wing, so we will continue to monitor its progress.

Anyway, let’s start out with a technical chart of bitcoin, we see large support coming in around the $8190 area and would like to see the $9555 price overtaken for a renewed upside bull bias:

Ok, that’s it folks, we hope you enjoyed this week’s letter.

We hope you learned something new, were inspired to learn even more and we hope that this helps you analyze the space a bit more constructively. We thank you for joining us on our journey down this great blockchain and cryptocurrency path and we hope you continue reading and learning alongside us.

We know you have many choices and we hope we remain one of them! Cheers and best of luck this week trading and as always, follow your own guidelines, keep risk well within your reach and realize that there is always opportunity, so don’t rush it!

Feel free to send this to your friends, family, colleagues and have them sign up for it as well. We aren’t sure how long we can offer the free service, as you know we are working on both a global macro futures and options fund as well as a crypto centric based fund. So exciting times indeed.

We are committed though, to continue to bring you quality coverage and despite not knowing what the future holds, we will always keep the lines of communication open. Peace out!

Nell

Subscribe to the Capital Trading Group newsletter here

More articles on cryptocurrencies on MoneyShow.com

The CFTC and virtual currencies

The risks and rewards of trading cryptocurrencies

Trading Lesson: Decrypting the cryptic cryptos

Trading Lesson: Decrypting the cryptic cryptos: Many questions, few answers

Trading Lesson: How I learned cryptos and became the Ethereum Whisperer

As regulators come for crypto criminals, invest in what is real